Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. (2 pts.) Ralph Lauren (NYS: RL) currently owns Property, Plant and Equipment worth $1,600 million and has cash on hand of $1,000 million and

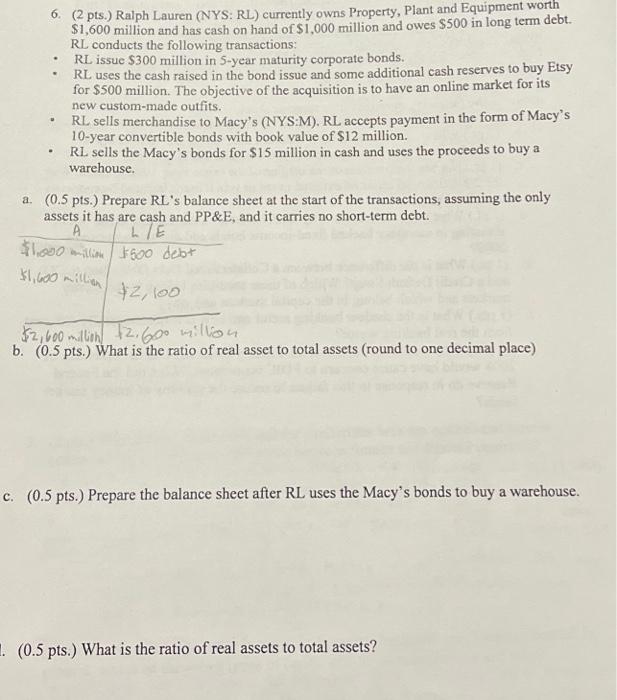

6. (2 pts.) Ralph Lauren (NYS: RL) currently owns Property, Plant and Equipment worth $1,600 million and has cash on hand of $1,000 million and owes $500 in long term debt. RL conducts the following transactions: RL issue $300 million in 5-year maturity corporate bonds. RL uses the cash raised in the bond issue and some additional cash reserves to buy Etsy for $500 million. The objective of the acquisition is to have an online market for its new custom-made outfits. G RL sells merchandise to Macy's (NYS:M). RL accepts payment in the form of Macy's 10-year convertible bonds with book value of $12 million. RL sells the Macy's bonds for $15 million in cash and uses the proceeds to buy a warehouse. a. (0.5 pts.) Prepare RL's balance sheet at the start of the transactions, assuming the only assets it has are cash and PP&E, and it carries no short-term debt. A L/E $1.000 million $500 debt $1,600 million $2,100 $2,600 million 2,600 million b. (0.5 pts.) What is the ratio of real asset to total assets (round to one decimal place) c. (0.5 pts.) Prepare the balance sheet after RL uses the Macy's bonds to buy a warehouse. 1. (0.5 pts.) What is the ratio of real assets to total assets?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started