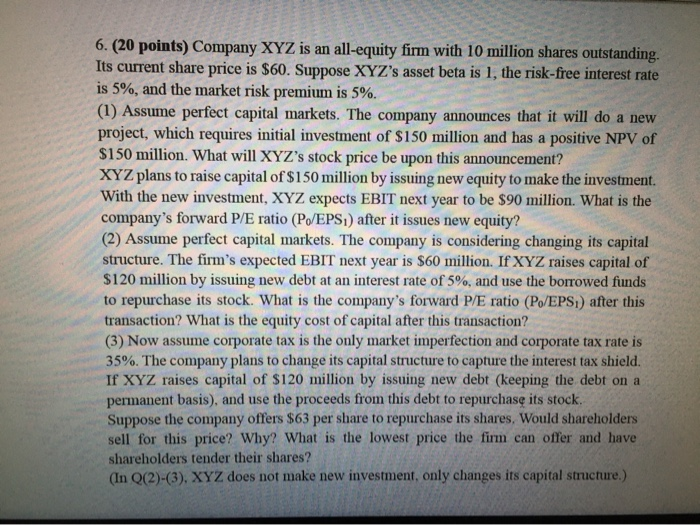

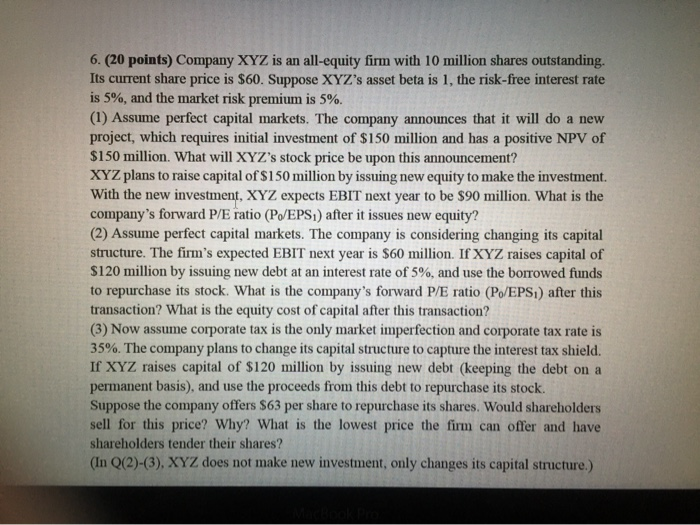

6. (20 points) Company XYZ is an all-equity firm with 10 million shares outstanding. Its current share price is $60. Suppose XYZ's asset beta is 1, the risk-free interest rate is 5%, and the market risk premium is 5%. (1) Assume perfect capital markets. The company announces that it will do a new project, which requires initial investment of $150 million and has a positive NPV of $150 million. What will XYZ's stock price be upon this announcement? XYZ plans to raise capital of $150 million by issuing new equity to make the investment. With the new investment, XYZ expects EBIT next year to be $90 million. What is the company's forward P/E ratio (P/EPS1) after it issues new equity? (2) Assume perfect capital markets. The company is considering changing its capital structure. The firm's expected EBIT next year is $60 million. If XYZ raises capital of $120 million by issuing new debt at an interest rate of 5%, and use the borrowed funds to repurchase its stock. What is the company's forward P/E ratio (Po/EPS) after this transaction? What is the equity cost of capital after this transaction? (3) Now assume corporate tax is the only market imperfection and corporate tax rate is 35%. The company plans to change its capital structure to capture the interest tax shield. If XYZ raises capital of $120 million by issuing new debt (keeping the debt on a permanent basis), and use the proceeds from this debt to repurchase its stock. Suppose the company offers $63 per share to repurchase its shares. Would shareholders sell for this price? Why? What is the est price the irm can offer and have shareholders tender their shares? (In Q(2)-(3), XYZ does not make new investment, only changes its capital structure.) 6. (20 points) Company XYZ is an all-equity firm with 10 million shares outstanding. Its current share price is $60. Suppose XYZ's asset beta is 1, the risk-free interest rate is 5%, and the market risk premium is 5%. (1) Assume perfect capital markets. The company announces that it will do a new project, which requires initial investment of $150 million and has a positive NPV of $150 million. What will XYZ's stock price be upon this announcement? XYZ plans to raise capital of $150 million by issuing new equity to make the investment. With the new investment, XYZ expects EBIT next year to be $90 million. What is the company's forward P/E ratio (P/EPS1) after it issues new equity? (2) Assume perfect capital markets. The company is considering changing its capital structure. The firm's expected EBIT next year is $60 million. If XYZ raises capital of $120 million by issuing new debt at an interest rate of 5%, and use the borrowed funds to repurchase its stock. What is the company's forward P/E ratio (P/EPS) after this transaction? What is the equity cost of capital after this transaction? (3) Now assume corporate tax is the only market imperfection and corporate tax rate is 35%. The company plans to change its capital structure to capture the interest tax shield. If XYZ raises capital of $120 million by issuing new debt (keeping the debt on a permanent basis), and use the proceeds from this debt to repurchase its stock. Suppose the company offers $63 per share to repurchase its shares. Would shareholders sell for this price? Why? What is the lowest price the firm can offer and have shareholders tender their shares? (In Q(2)-(3), XYZ does not make new investment, only changes its capital structure.)