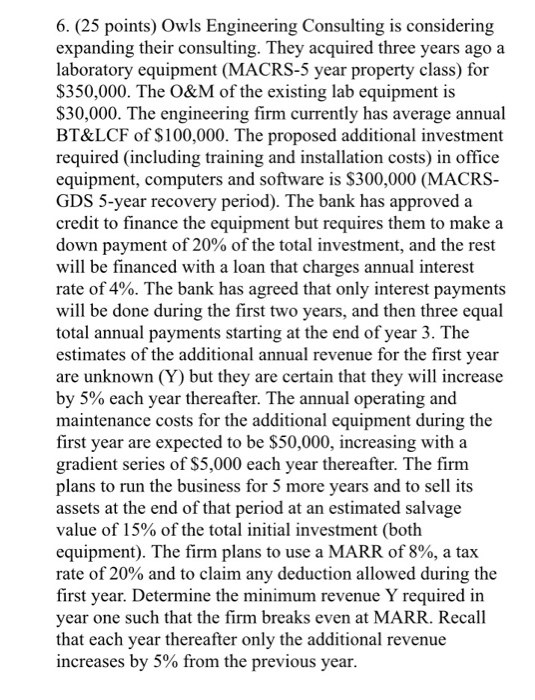

6. (25 points) Owls Engineering Consulting is considering expanding their consulting. They acquired three years ago a laboratory equipment (MACRS-5 year property class) for $350,000. The O&M of the existing lab equipment is $30,000. The engineering firm currently has average annual BT&LCF of $100,000. The proposed additional investment required (including training and installation costs) in office equipment, computers and software is $300,000 (MACRS- GDS 5-year recovery period). The bank has approved a credit to finance the equipment but requires them to make a down payment of 20% of the total investment, and the rest will be financed with a loan that charges annual interest rate of 4%. The bank has agreed that only interest payments will be done during the first two years, and then three equal total annual payments starting at the end of year 3. The estimates of the additional annual revenue for the first year are unknown (Y) but they are certain that they will increase by 5% each year thereafter. The annual operating and maintenance costs for the additional equipment during the first year are expected to be $50,000, increasing with a gradient series of $5,000 each year thereafter. The firm plans to run the business for 5 more years and to sell its assets at the end of that period at an estimated salvage value of 15% of the total initial investment (both equipment). The firm plans to use a MARR of 8%, a tax rate of 20% and to claim any deduction allowed during the first year. Determine the minimum revenue Y required in year one such that the firm breaks even at MARR. Recall that each year thereafter only the additional revenue increases by 5% from the previous year. 6. (25 points) Owls Engineering Consulting is considering expanding their consulting. They acquired three years ago a laboratory equipment (MACRS-5 year property class) for $350,000. The O&M of the existing lab equipment is $30,000. The engineering firm currently has average annual BT&LCF of $100,000. The proposed additional investment required (including training and installation costs) in office equipment, computers and software is $300,000 (MACRS- GDS 5-year recovery period). The bank has approved a credit to finance the equipment but requires them to make a down payment of 20% of the total investment, and the rest will be financed with a loan that charges annual interest rate of 4%. The bank has agreed that only interest payments will be done during the first two years, and then three equal total annual payments starting at the end of year 3. The estimates of the additional annual revenue for the first year are unknown (Y) but they are certain that they will increase by 5% each year thereafter. The annual operating and maintenance costs for the additional equipment during the first year are expected to be $50,000, increasing with a gradient series of $5,000 each year thereafter. The firm plans to run the business for 5 more years and to sell its assets at the end of that period at an estimated salvage value of 15% of the total initial investment (both equipment). The firm plans to use a MARR of 8%, a tax rate of 20% and to claim any deduction allowed during the first year. Determine the minimum revenue Y required in year one such that the firm breaks even at MARR. Recall that each year thereafter only the additional revenue increases by 5% from the previous year