Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. 7. 8. 9. 10. 11. 12. 2. 3. 4. 5. 1. Commercial savings account of $627,000 and a commercial checking account balance of $828,900

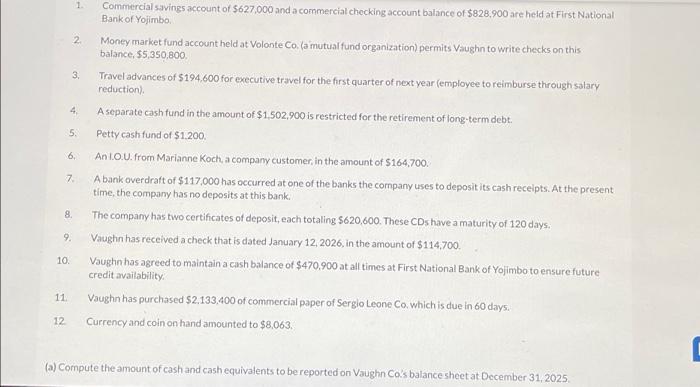

6. 7. 8. 9. 10. 11. 12. 2. 3. 4. 5. 1. Commercial savings account of $627,000 and a commercial checking account balance of $828,900 are held at First National Bank of Yojimbo. Money market fund account held at Volonte Co. (a mutual fund organization) permits Vaughn to write checks on this balance, $5,350,800. Travel advances of $194,600 for executive travel for the first quarter of next year (employee to reimburse through salary reduction). A separate cash fund in the amount of $1,502,900 is restricted for the retirement of long-term debt. Petty cash fund of $1,200. An I.O.U. from Marianne Koch, a company customer, in the amount of $164,700. A bank overdraft of $117,000 has occurred at one of the banks the company uses to deposit its cash receipts. At the present time, the company has no deposits at this bank. The company has two certificates of deposit, each totaling $620,600. These CDs have a maturity of 120 days. Vaughn has received a check that is dated January 12, 2026, in the amount of $114,700. Vaughn has agreed to maintain a cash balance of $470,900 at all times at First National Bank of Yojimbo to ensure future credit availability. Vaughn has purchased $2,133,400 of commercial paper of Sergio Leone Co. which is due in 60 days. Currency and coin on hand amounted to $8,063. (a) Compute the amount of cash and cash equivalents to be reported on Vaughn Co.'s balance sheet at December 31, 2025.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started