Answered step by step

Verified Expert Solution

Question

1 Approved Answer

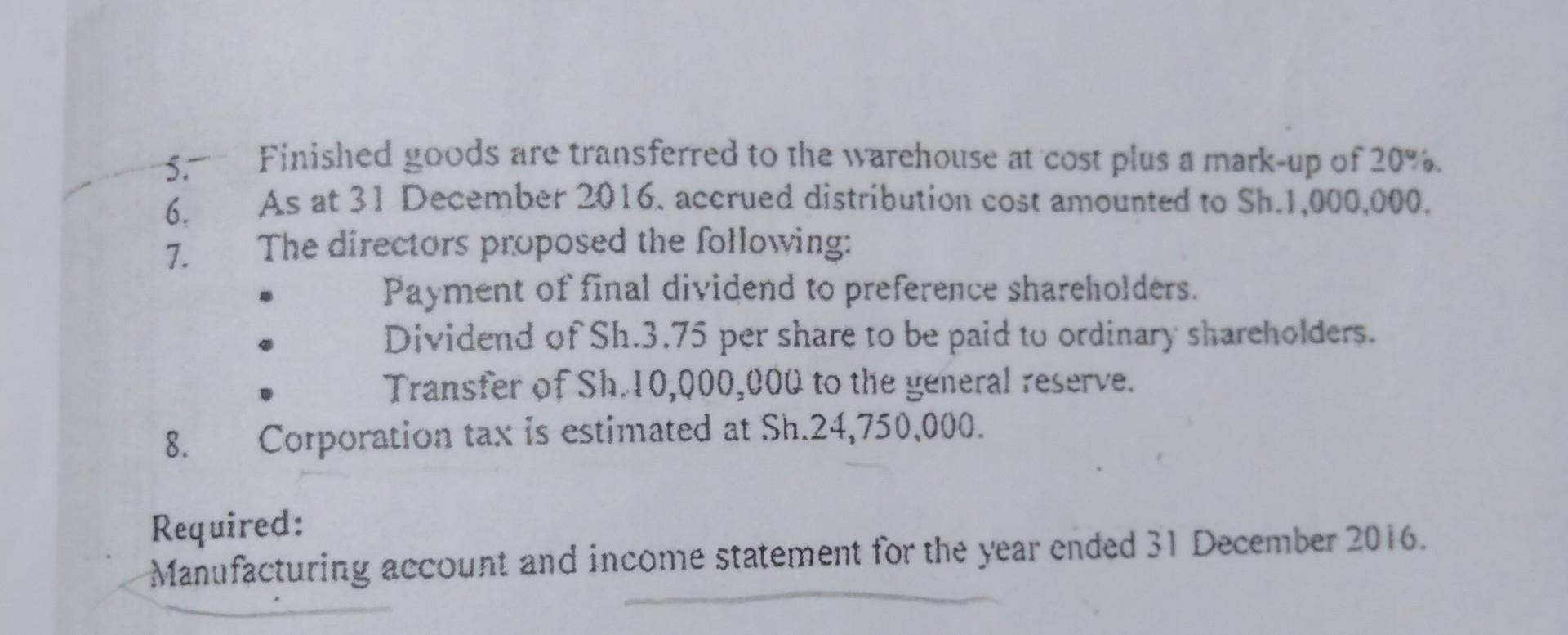

6. 7. Finished goods are transferred to the warehouse at cost plus a mark-up of 20% As at 31 December 2016. accrued distribution cost amounted

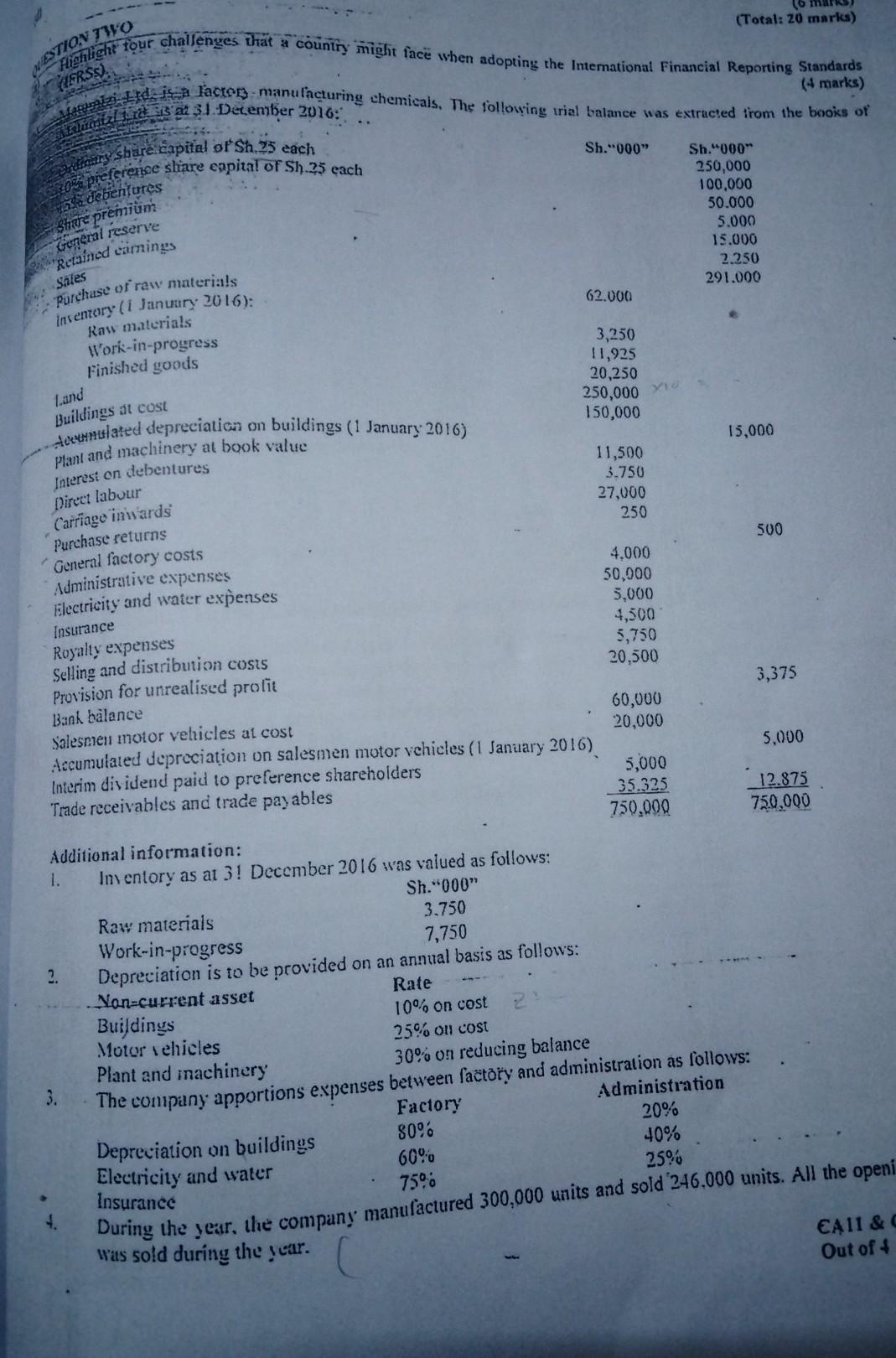

6. 7. Finished goods are transferred to the warehouse at cost plus a mark-up of 20% As at 31 December 2016. accrued distribution cost amounted to Sh.1.000.000, The directors proposed the following: Payment of final dividend to preference shareholders. Dividend of Sh.3.75 per share to be paid to ordinary shareholders. Transfer of Sh.10,000,000 to the veneral reserve. Corporation tax is estimated at Sh.24,750,000. 8. Required: Manufacturing account and income statement for the year ended 31 December 2016. (IFRS). debentures Share premium General reserve "Retained earnings Sales Land Buildings at cost Direct labour Carriage inwards Highlight tour challenges that a country might face when adopting the International Financial Reporting Standards (Total: 20 marks) WAZIO TWO Maria lacter) - manulacluring chemicals. The following trial balance was extracted from the books of mizla 31. December 2016: (4 marks) dary share capital of Sh.25 each Sh."000" 20 preference sliare eapital of Sh25 each Sh."000" 250,000 100.000 50.000 5.000 15.000 2.250 Purchase of raw materials 291.000 insemory ( 1 January 2016): 62.000 Raw materials Work-in-progress 3,250 Finished goods 11,925 20,250 250,000 Hoewelated depreciation on buildings (1 January 2016) 150,000 plant and machinery at book value 15,000 Interest on debentures 11,500 3.750 27,000 250 Purchase returns 500 General factory costs 4.000 Administrative expenses 50,000 Electricity and water expenses 5,000 Insurance 4,500 Royalty expenses 5,750 Selling and distribution costs 20,500 Provision for unrealised profit 3,375 Bank balance 60,000 Salesmeni motor vehicles at ost 20,000 Accumulated depreciation on salesmen motor vehicles (1 January 2016) 5,000 Interim dividend paid to preference shareholders 5,000 Trade receivables and trade payables 35.325 12.875 750,000 750,000 Additional information: 1. Inventory as at 3! December 2016 was valued as follows: Sh."000" Raw materials 3.750 Work-in-progress 7,750 3 Depreciation is to be provided on an annual basis as follows: Non-current asset Rate Buildings 10% on cost Motor vehicles 25% on cost Plant and machinery 30% on reducing balance 3. The company apportions expenses between factory and administration as follows: Factory Administration 20% 80. Depreciation on buildings 40% Electricity and water 25% Insurance 4. During the year, the company manufactured 300,000 units and sold 246,000 units. All the openi Was sold during the year. CA11&d Out of 4 60%. 7506 6. 7. Finished goods are transferred to the warehouse at cost plus a mark-up of 20% As at 31 December 2016. accrued distribution cost amounted to Sh.1.000.000, The directors proposed the following: Payment of final dividend to preference shareholders. Dividend of Sh.3.75 per share to be paid to ordinary shareholders. Transfer of Sh.10,000,000 to the veneral reserve. Corporation tax is estimated at Sh.24,750,000. 8. Required: Manufacturing account and income statement for the year ended 31 December 2016. (IFRS). debentures Share premium General reserve "Retained earnings Sales Land Buildings at cost Direct labour Carriage inwards Highlight tour challenges that a country might face when adopting the International Financial Reporting Standards (Total: 20 marks) WAZIO TWO Maria lacter) - manulacluring chemicals. The following trial balance was extracted from the books of mizla 31. December 2016: (4 marks) dary share capital of Sh.25 each Sh."000" 20 preference sliare eapital of Sh25 each Sh."000" 250,000 100.000 50.000 5.000 15.000 2.250 Purchase of raw materials 291.000 insemory ( 1 January 2016): 62.000 Raw materials Work-in-progress 3,250 Finished goods 11,925 20,250 250,000 Hoewelated depreciation on buildings (1 January 2016) 150,000 plant and machinery at book value 15,000 Interest on debentures 11,500 3.750 27,000 250 Purchase returns 500 General factory costs 4.000 Administrative expenses 50,000 Electricity and water expenses 5,000 Insurance 4,500 Royalty expenses 5,750 Selling and distribution costs 20,500 Provision for unrealised profit 3,375 Bank balance 60,000 Salesmeni motor vehicles at ost 20,000 Accumulated depreciation on salesmen motor vehicles (1 January 2016) 5,000 Interim dividend paid to preference shareholders 5,000 Trade receivables and trade payables 35.325 12.875 750,000 750,000 Additional information: 1. Inventory as at 3! December 2016 was valued as follows: Sh."000" Raw materials 3.750 Work-in-progress 7,750 3 Depreciation is to be provided on an annual basis as follows: Non-current asset Rate Buildings 10% on cost Motor vehicles 25% on cost Plant and machinery 30% on reducing balance 3. The company apportions expenses between factory and administration as follows: Factory Administration 20% 80. Depreciation on buildings 40% Electricity and water 25% Insurance 4. During the year, the company manufactured 300,000 units and sold 246,000 units. All the openi Was sold during the year. CA11&d Out of 4 60%. 7506

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started