Question

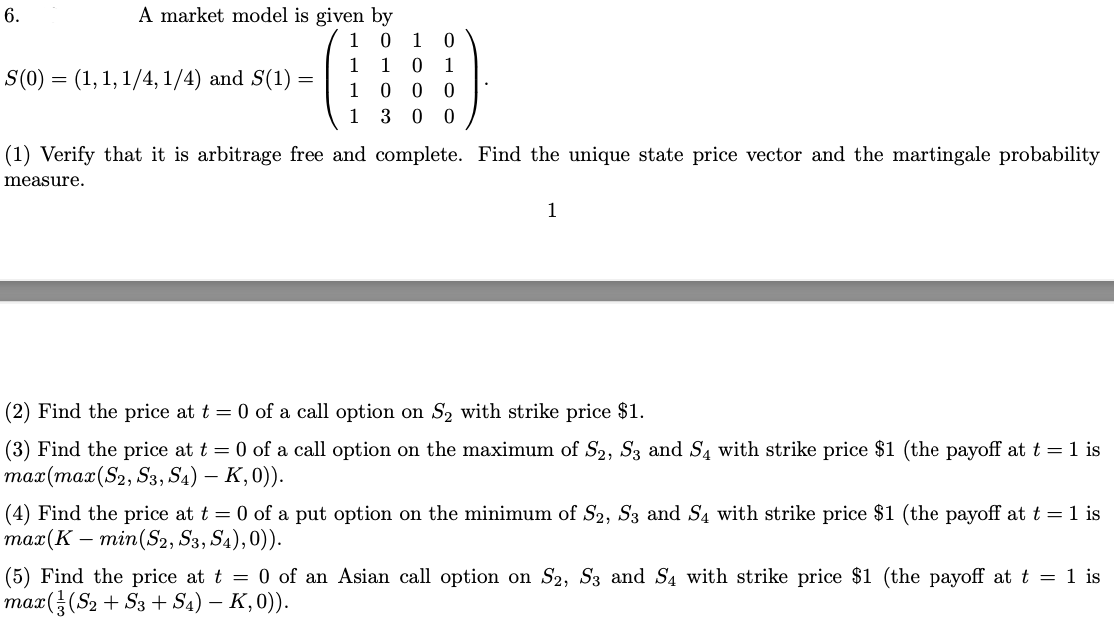

6. A market model is given by 1010 S(0) = (1,1,1/4,1/4) and S(1) = 1 1 0 1 . 1 0 0 0 1300 (a)

6. A market model is given by 1010 S(0) = (1,1,1/4,1/4) and S(1) = 1 1 0 1 . 1 0 0 0 1300

(a) Verify that it is arbitrage free and complete. Find the unique state price vector and the martingale probability measure.1

(b) Find the price at t = 0 of a call option on S2 with strike price $1.

(c)Findthepriceatt=0ofacalloptiononthemaximumofS2,S3 andS4 withstrikeprice$1(thepayoffatt=1ismax(max(S2, S3, S4) K, 0)). (d)Findthepriceatt=0ofaputoptionontheminimumofS2,S3 andS4 withstrikeprice$1(thepayoffatt=1is max(K min(S2, S3, S4), 0)). (e)Findthepriceatt=0ofanAsiancalloptiononS2,S3 andS4 withstrikeprice$1(thepayoffatt=1ismax(13(S2 +S3 +S4)K,0)).

Please answer ASAP with full solutions and explanations!!

6. A market model is given by S(0)=(1,1,1/4,1/4) and S(1)=1111010310000100. (1) Verify that it is arbitrage free and complete. Find the unique state price vector and the martingale probability measure. 1 (2) Find the price at t=0 of a call option on S2 with strike price $1. (3) Find the price at t=0 of a call option on the maximum of S2,S3 and S4 with strike price $1 (the payoff at t=1 is max(max(S2,S3,S4)K,0)). (4) Find the price at t=0 of a put option on the minimum of S2,S3 and S4 with strike price $1 (the payoff at t=1 is max(Kmin(S2,S3,S4),0)) (5) Find the price at t=0 of an Asian call option on S2,S3 and S4 with strike price $1 (the payoff at t=1 is max(31(S2+S3+S4)K,0)) 6. A market model is given by S(0)=(1,1,1/4,1/4) and S(1)=1111010310000100. (1) Verify that it is arbitrage free and complete. Find the unique state price vector and the martingale probability measure. 1 (2) Find the price at t=0 of a call option on S2 with strike price $1. (3) Find the price at t=0 of a call option on the maximum of S2,S3 and S4 with strike price $1 (the payoff at t=1 is max(max(S2,S3,S4)K,0)). (4) Find the price at t=0 of a put option on the minimum of S2,S3 and S4 with strike price $1 (the payoff at t=1 is max(Kmin(S2,S3,S4),0)) (5) Find the price at t=0 of an Asian call option on S2,S3 and S4 with strike price $1 (the payoff at t=1 is max(31(S2+S3+S4)K,0))Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started