Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. A property is being purchased for $125,000. The appraisal comes in at $128,000. The bank is charging 2 points and a 1% loan origination

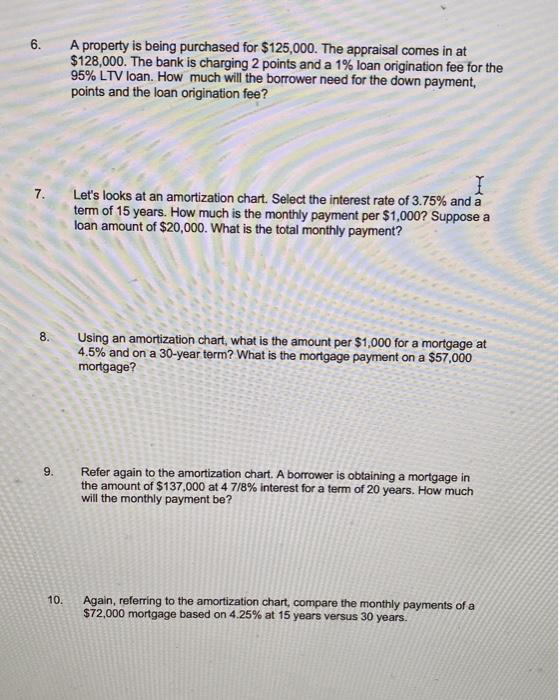

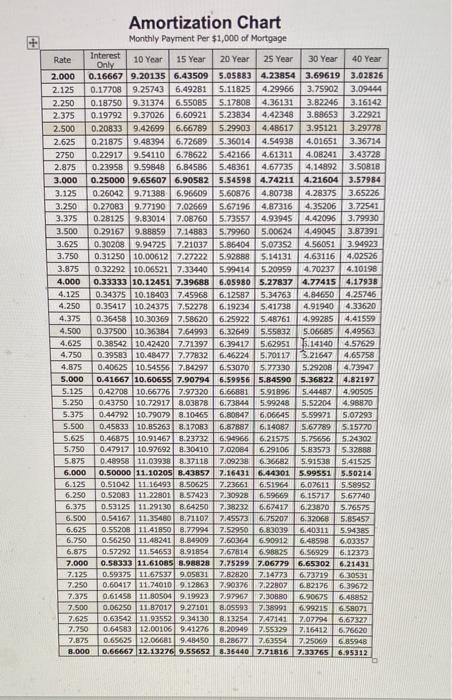

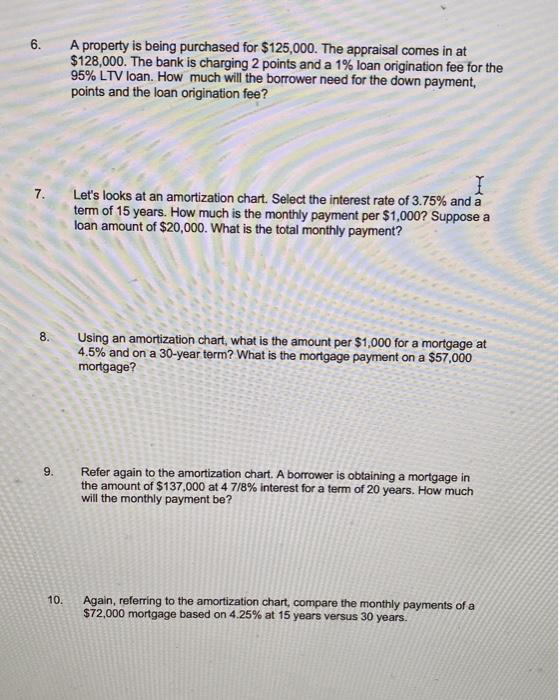

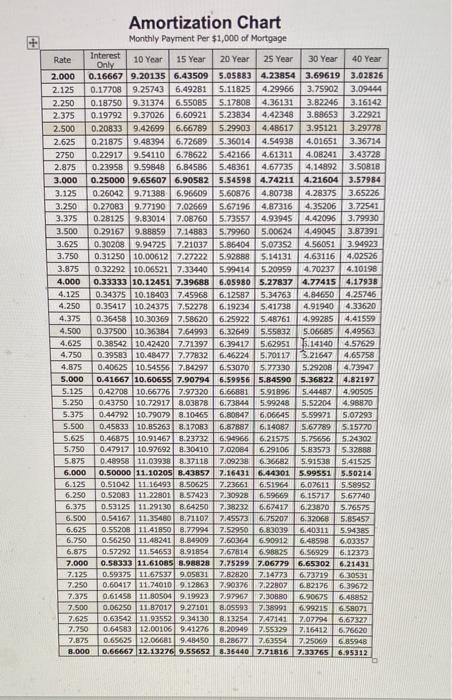

6. A property is being purchased for $125,000. The appraisal comes in at $128,000. The bank is charging 2 points and a 1% loan origination fee for the 95% LTV loan. How much will the borrower need for the down payment, points and the loan origination fee? 7. Let's looks at an amortization chart. Select the interest rate of 3.75% and a term of 15 years. How much is the monthly payment per $1,000 ? Suppose a loan amount of $20,000. What is the total monthly payment? 8. Using an amortization chart, what is the amount per $1,000 for a mortgage at 4.5% and on a 30 -year term? What is the mortgage payment on a $57,000 mortgage? 9. Refer again to the amortization chart. A borrower is obtaining a mortgage in the amount of $137,000 at 47/8% interest for a term of 20 years. How much will the monthly payment be? 10. Again, referring to the amortization chart, compare the monthly payments of a $72,000 mortgage based on 4.25% at 15 years versus 30 years. A

6. A property is being purchased for $125,000. The appraisal comes in at $128,000. The bank is charging 2 points and a 1% loan origination fee for the 95% LTV loan. How much will the borrower need for the down payment, points and the loan origination fee? 7. Let's looks at an amortization chart. Select the interest rate of 3.75% and a term of 15 years. How much is the monthly payment per $1,000 ? Suppose a loan amount of $20,000. What is the total monthly payment? 8. Using an amortization chart, what is the amount per $1,000 for a mortgage at 4.5% and on a 30 -year term? What is the mortgage payment on a $57,000 mortgage? 9. Refer again to the amortization chart. A borrower is obtaining a mortgage in the amount of $137,000 at 47/8% interest for a term of 20 years. How much will the monthly payment be? 10. Again, referring to the amortization chart, compare the monthly payments of a $72,000 mortgage based on 4.25% at 15 years versus 30 years. A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started