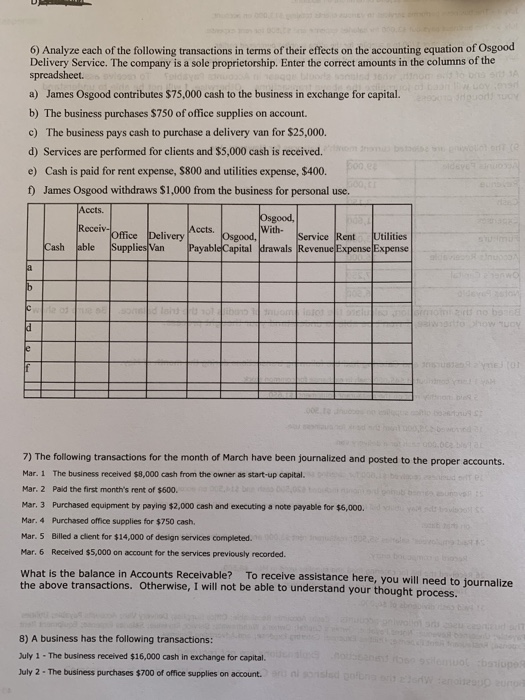

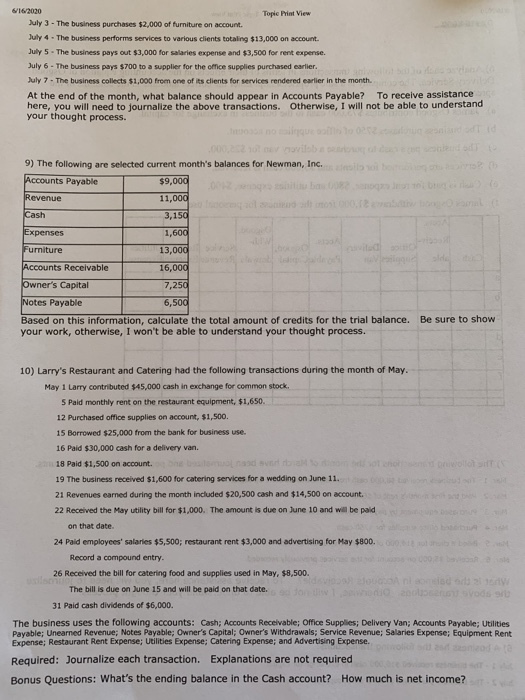

6) Analyze each of the following transactions in terms of their effects on the accounting equation of Osgood Delivery Service. The company is a sole proprietorship. Enter the correct amounts in the columns of the spreadsheet. a) James Osgood contributes $75,000 cash the business in exchange for capital. b) The business purchases $750 of office supplies on account. c) The business pays cash to purchase a delivery van for $25,000. d) Services are performed for clients and $5,000 cash is received or bette e) Cash is paid for rent expense, $800 and utilities expense, $400. fone f) James Osgood withdraws $1,000 from the business for personal use. Accts. Osgood, Receiv- With- Office Delivery Osgood, Service Rent Utilities Cash Jable Supplies Van Payable Capital drawals Revenue Expense Expense Accts. a b C momo nobo Woow UV ld le f SEO 7) The following transactions for the month of March have been journalized and posted to the proper accounts. Mar. 1 The business received $8,000 cash from the owner as start-up capital. Mar. 2 Paid the first month's rent of $600. be Mar. 3 Purchased equipment by paying $2,000 cash and executing a note payable for $6,000. Mar. 4 Purchased office supplies for $750 cash. Mar. 5 Billed a client for $14,000 of design services completed. Mar. 6 Received $5,000 on account for the services previously recorded. What is the balance in Accounts Receivable? To receive assistance here, you will need to journalize the above transactions. Otherwise, I will not be able to understand your thought process. 8) A business has the following transactions: July 1 - The business received $16,000 cash in exchange for capital. July 2. The business purchases $700 of office supplies on account. 6/16/2020 Topic Print View July 3 - The business purchases $2,000 of furniture on account July 4 - The business performs services to various clients totaling $13,000 on account. July 5 - The business pays out $3,000 for salaries expense and $3,500 for rent expense. July 6 - The business pays $700 to a supplier for the office supplies purchased earlier. July 7 - The business collects $1,000 from one of its clients for services rendered earlier in the month. At the end of the month, what balance should appear in Accounts Payable? To receive assistance here, you will need to journalize the above transactions. Otherwise, I will not be able to understand your thought process. 02102 9) The following are selected current month's balances for Newman, Inc. Accounts Payable $9,000 HOS Revenue 11,000 o sebe Cash 3,150 Expenses 1,600 Furniture 13,000 Accounts Receivable 16,000 Owner's Capital 7,250 Notes Payable 6,500 Based on this information, calculate the total amount of credits for the trial balance. Be sure to show your work, otherwise, I won't be able to understand your thought process. 10) Larry's Restaurant and Catering had the following transactions during the month of May. May 1 Larry contributed $45,000 cash in exchange for common stock. 5 Pald monthly rent on the restaurant equipment, $1,650. 12 Purchased office supplies on account, $1,500. 15 Borrowed $25,000 from the bank for business use. 16 Paid $30,000 cash for a delivery van. 18 Paid $1,500 on account. Lol nad blood wood 19 The business received $1,600 for catering services for a wedding on June 11. 21 Revenues earned during the month included $20,500 cash and $14,500 on account. 22 Received the May utility bill for $1,000. The amount is due on June 10 and will be paid on that date 24 Paid employees' salaries $5,500; restaurant rent $3,000 and advertising for May $800. Record a compound entry. 26 Received the bill for catering food and supplies used in May, $8,500. or The bill is due on June 15 and will be paid on that date. 31 Paid cash dividends of $6,000. The business uses the following accounts: Cash; Accounts Receivable; Office Supplies; Delivery Van; Accounts Payable; Utilities Payable; Unearned Revenue; Notes Payable; Owner's Capital; Owner's Withdrawals; Service Revenue; Salaries Expense; Equipment Rent Expense; Restaurant Rent Expense; Utilities Expense; Catering Expense; and Advertising Expense. Required: Journalize each transaction. Explanations are not required Bonus Questions: What's the ending balance in the Cash account? How much is net income