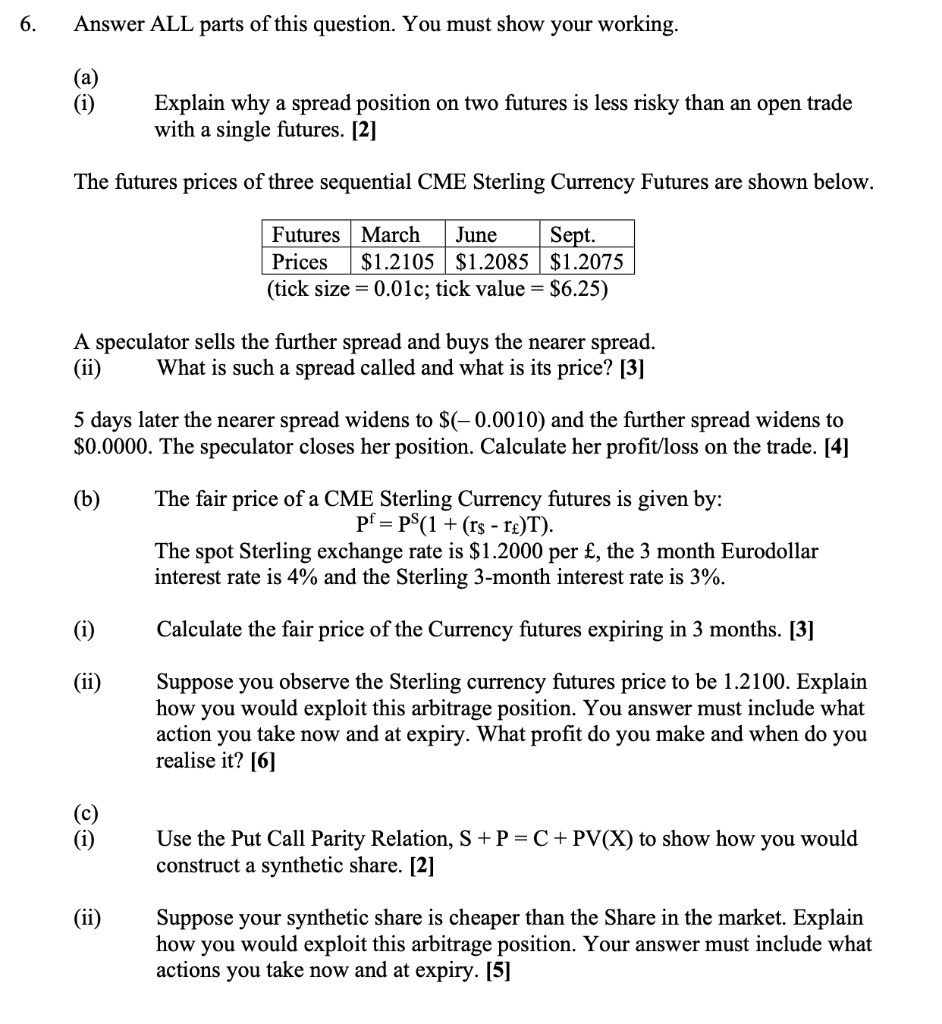

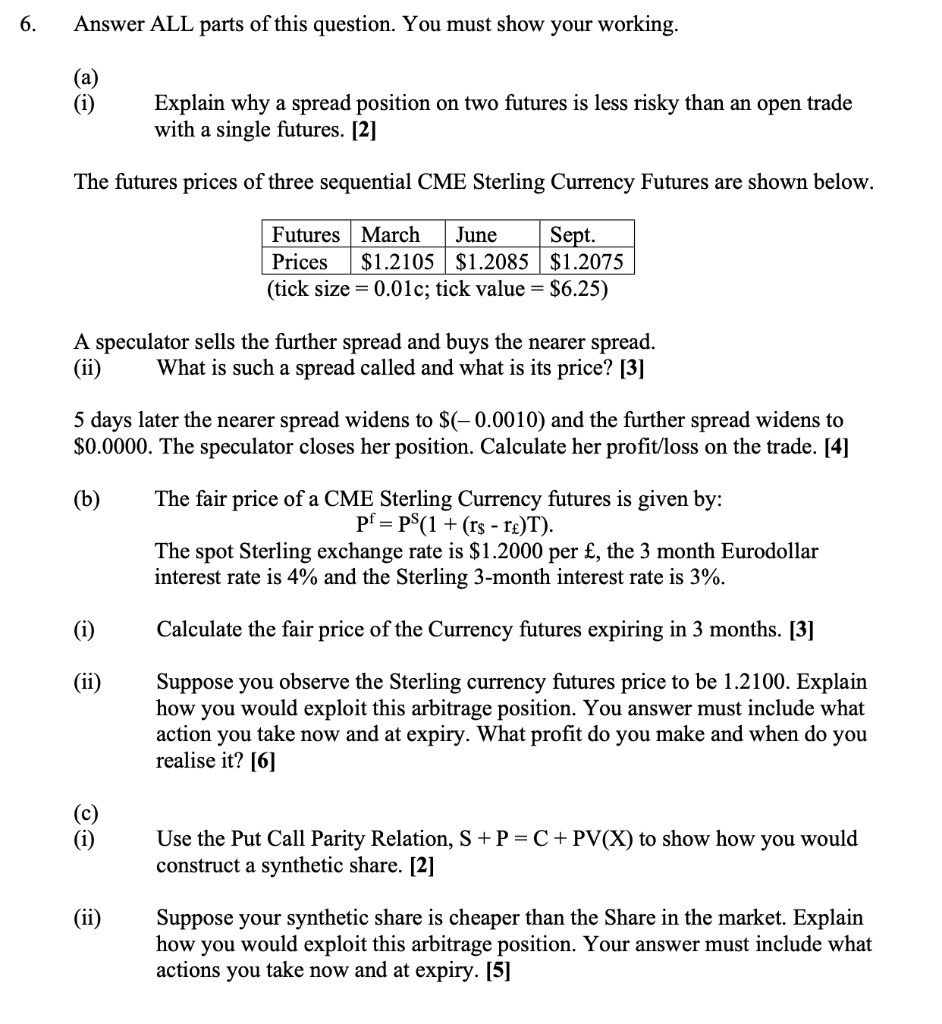

6. Answer ALL parts of this question. You must show your working. (a Explain why a spread position on two futures is less risky than an open trade with a single futures. [2] The futures prices of three sequential CME Sterling Currency Futures are shown below. Futures March June Sept. Prices $1.2105 $1.2085 $1.2075 (tick size = 0.01c; tick value = $6.25) A speculator sells the further spread and buys the nearer spread. (ii) What is such a spread called and what is its price? [3] 5 days later the nearer spread widens to $(-0.0010) and the further spread widens to $0.0000. The speculator closes her position. Calculate her profit/loss on the trade. [4] (b) The fair price of a CME Sterling Currency futures is given by: Pf=P*(1 + (rs - r)T). The spot Sterling exchange rate is $1.2000 per , the 3 month Eurodollar interest rate is 4% and the Sterling 3-month interest rate is 3%. (i) Calculate the fair price of the Currency futures expiring in 3 months. [3] (ii) Suppose you observe the Sterling currency futures price to be 1.2100. Explain how you would exploit this arbitrage position. You answer must include what action you take now and at expiry. What profit do you make and when do you realise it? [6] Use the Put Call Parity Relation, S+P = C + PV(X) to show how you would construct a synthetic share. [2] (ii) Suppose your synthetic share is cheaper than the Share in the market. Explain how you would exploit this arbitrage position. Your answer must include what actions you take now and at expiry. [5] 6. Answer ALL parts of this question. You must show your working. (a Explain why a spread position on two futures is less risky than an open trade with a single futures. [2] The futures prices of three sequential CME Sterling Currency Futures are shown below. Futures March June Sept. Prices $1.2105 $1.2085 $1.2075 (tick size = 0.01c; tick value = $6.25) A speculator sells the further spread and buys the nearer spread. (ii) What is such a spread called and what is its price? [3] 5 days later the nearer spread widens to $(-0.0010) and the further spread widens to $0.0000. The speculator closes her position. Calculate her profit/loss on the trade. [4] (b) The fair price of a CME Sterling Currency futures is given by: Pf=P*(1 + (rs - r)T). The spot Sterling exchange rate is $1.2000 per , the 3 month Eurodollar interest rate is 4% and the Sterling 3-month interest rate is 3%. (i) Calculate the fair price of the Currency futures expiring in 3 months. [3] (ii) Suppose you observe the Sterling currency futures price to be 1.2100. Explain how you would exploit this arbitrage position. You answer must include what action you take now and at expiry. What profit do you make and when do you realise it? [6] Use the Put Call Parity Relation, S+P = C + PV(X) to show how you would construct a synthetic share. [2] (ii) Suppose your synthetic share is cheaper than the Share in the market. Explain how you would exploit this arbitrage position. Your answer must include what actions you take now and at expiry. [5]