Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#6 Answer is not complete? #7 ? On August 1, 2018, Limbaugh Communications issued $20 million of 10% nonconvertible bonds at 104. The bonds are

#6 Answer is not complete?

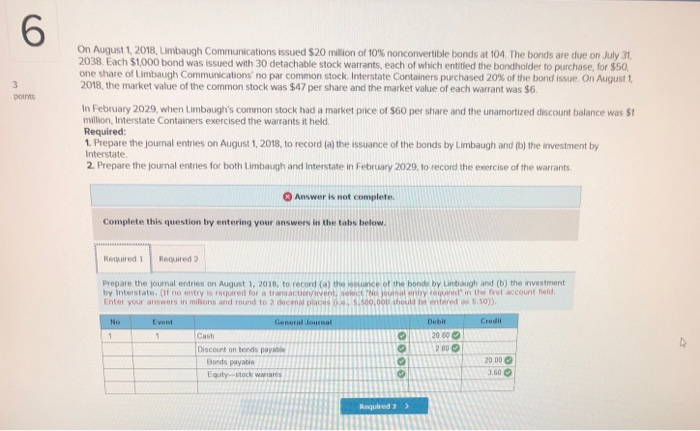

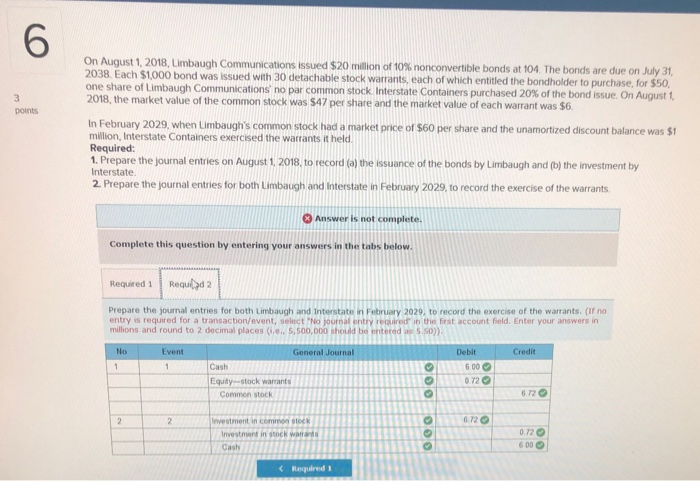

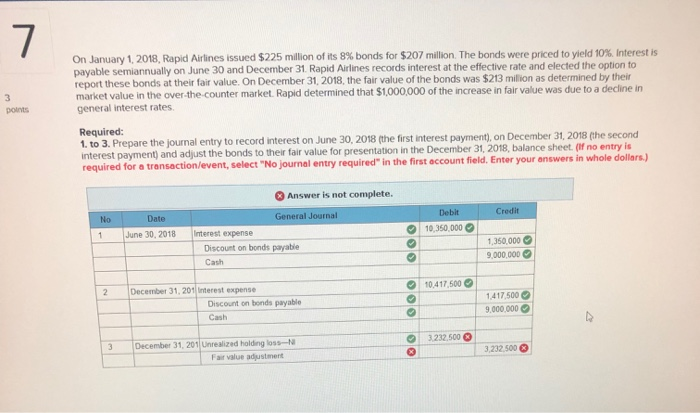

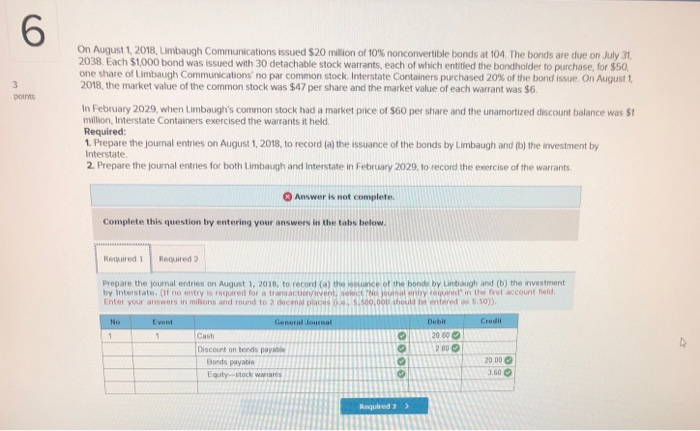

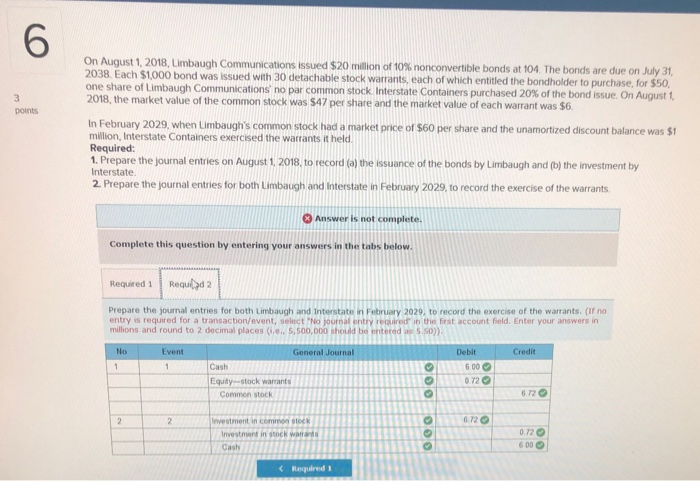

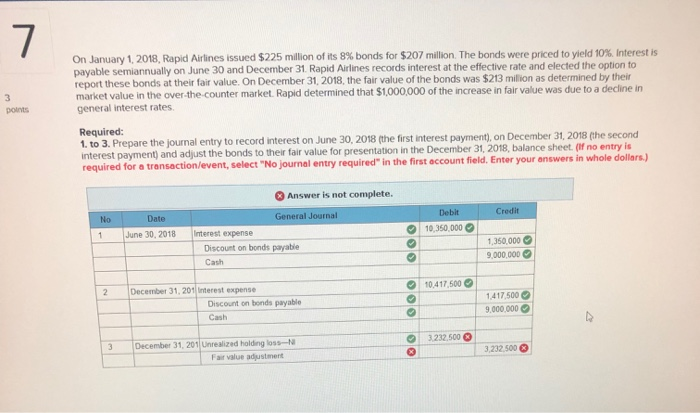

On August 1, 2018, Limbaugh Communications issued $20 million of 10% nonconvertible bonds at 104. The bonds are due on July 31 2038. Each $1,000 bond was issued with 30 detachable stock warrants, each of which entitled the bondholder to purchase, for $50, one share of Limbaugh Communications no par common stock. Interstate Containers purchased 20% of the bond issue. On August 1 2018, the market value of the common stock was $47 per share and the market value of each warrant was $6. points In February 2029, when Limbaugh's common stock had a market price of $60 per share and the unamortized discount balance was $1 million, Interstate Containers exercised the warrants it held. Required: 1. Prepare the journal entries on August 1, 2018, to record (a) the issuance of the bonds by Limbaugh and (b) the investment by Interstate. 2. Prepare the journal entries for both Limbaugh and Interstate in February 2029 to record the exercise of the warrants Answer is not complete Complete this question by entering your answers in the tabs below. Rented Required 2 Prepare the journal entries on August 1, 2018, to record (a) the e of the bonde by Limbaugh and (b) the investment try Interstate. I no entry is required for at t ent Wal on ty tegund in the fut account hield, Enter your answers in minions and round to dec S00,000 hould be evitand 5.50)). General Journal Debit Credit (cash OM20.800 200 Discount on bonds payable Bands payabia Equity stock warrant 2000 3.60 Required 2 > On August 1, 2018, Limbaugh Communications issued $20 million of 10% nonconvertible bonds at 104. The bonds are due on July 31, 2038. Each $1,000 bond was issued with 30 detachable stock warrants, each of which entitled the bondholder to purchase, for $50, one share of Limbaugh Communications no par common stock Interstate Containers purchased 20% of the bond issue. On August 2018, the market value of the common stock was $47 per share and the market value of each warrant was $6. Doints In February 2029, when Limbaugh's common stock had a market price of $60 per share and the unamortized discount balance was 51 million, Interstate Containers exercised the warrants it held. Required: 1. Prepare the journal entries on August 1, 2018, to record(a) the issuance of the bonds by Limbaugh and (b) the investment by Interstate. 2. Prepare the journal entries for both Limbaugh and Interstate in February 2029 to record the exercise of the warrants Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Requad 2 Prepare the journal entries for both Limbaugh and Interstate Ferry2029 to record the exercise of the warrants. If no entry is required for a transaction/event, select journal entry read this account field Enter your answers in millons and round to 2 decimal places ne S,SCO,000 should be enteredS SO) No Event General Journal Credit Debit 600 Cash Equty-stack warrare Commen stock 672 Investment in com Investment in to Regedi On January 1, 2018, Rapid Airlines issued $225 million of its 8% bonds for $207 million. The bonds were priced to yield 10% Interestis payable semiannually on June 30 and December 31. Rapid Airlines records interest at the effective rate and elected the option to report these bonds at their fair value. On December 31, 2018, the fair value of the bonds was $213 million as determined by their market value in the over-the-counter market. Rapid determined that $1,000,000 of the increase in fair value was due to a decline in general interest rates Required: 1. to 3. Prepare the journal entry to record interest on June 30, 2018 (the first interest payment), on December 31, 2018 (the second interest payment) and adjust the bonds to their fair value for presentation in the December 31, 2018, balance sheet (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in whole dollars.) Answer is not complete. No Date Doble Credit June 30, 2018 10.350.000 General Journal Interest expense Discount on bonds payable Cash 1.350.000 9 000 000 December 31, 2011 10.417 500 enest expense Discount on bonds payable 1417500 900 000 Cash December 31, 201 Unrealized holding loss 3232 500

#7 ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started