Question

6. Assume that there is a ideal money market with constant effective rate R = .04. Consider a stock S with current price per

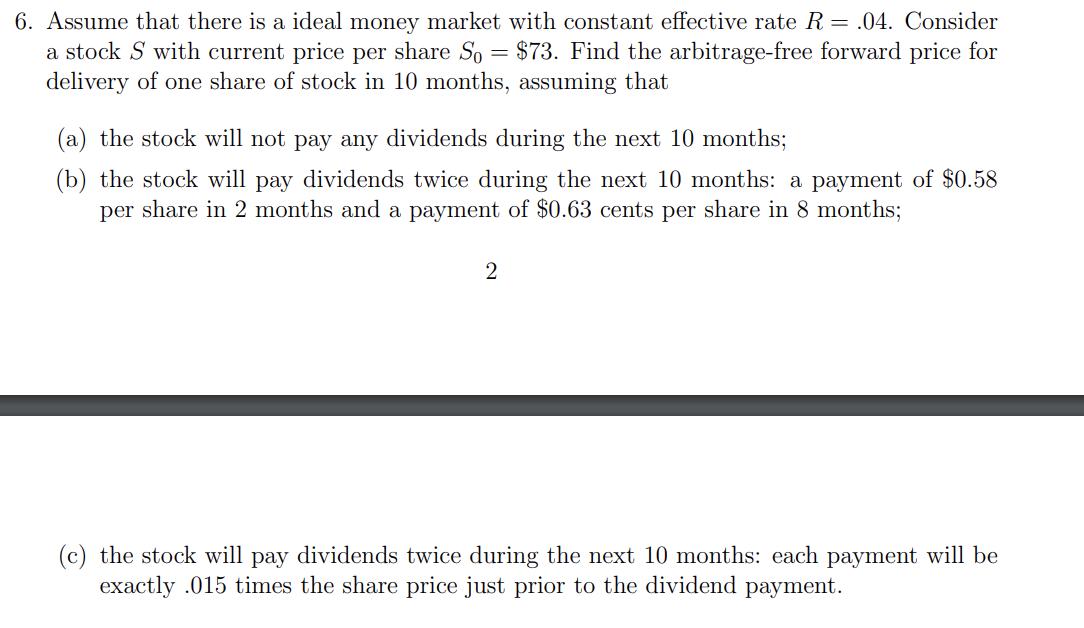

6. Assume that there is a ideal money market with constant effective rate R = .04. Consider a stock S with current price per share So = $73. Find the arbitrage-free forward price for delivery of one share of stock in 10 months, assuming that (a) the stock will not pay any dividends during the next 10 months; (b) the stock will pay dividends twice during the next 10 months: a payment of $0.58 per share in 2 months and a payment of $0.63 cents per share in 8 months; 2 the stock will pay dividends twice during the next 10 months: each payment will be exactly .015 times the share price just prior to the dividend payment.

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To find the arbitragefree forward price we need to use the costofcarry formula F S0 erq t where F is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Derivatives And Risk Management

Authors: Don M. Chance, Robert Brooks

10th Edition

130510496X, 978-1305104969

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App