Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#6 b2 and c On January 1, 20X0, Pepper Corporation Issued 8,000 of Its $15 par value shares to acquire 45 percent of the shares

#6 b2 and c

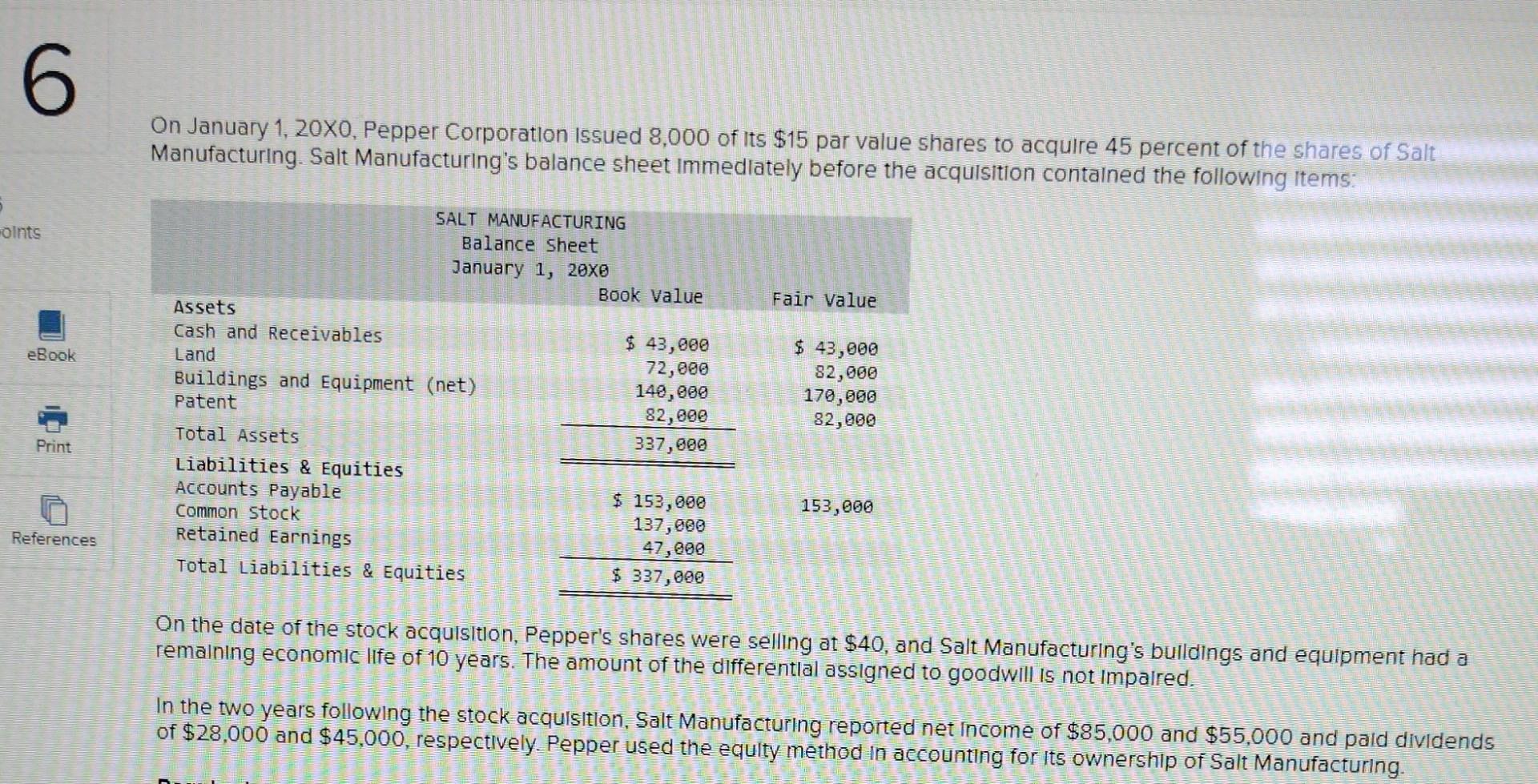

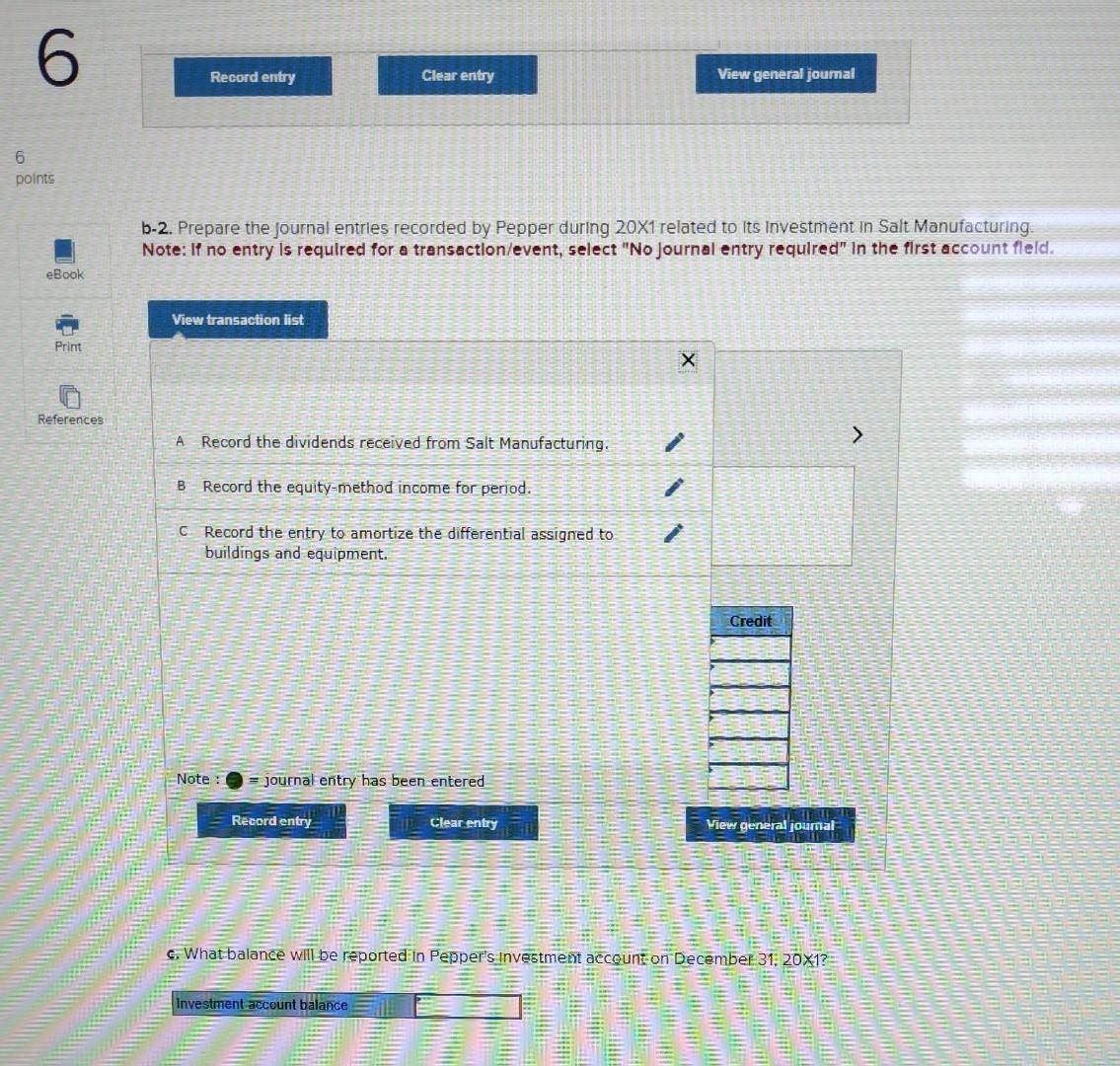

On January 1, 20X0, Pepper Corporation Issued 8,000 of Its $15 par value shares to acquire 45 percent of the shares of Salt Manufacturing. Salt Manufacturing's balance sheet Immediately before the acquisition contained the following items: On the date of the stock acquisition, Pepper's shares were selling at $40, and Salt Manufacturing's bulldings and equipment had a remaining economic life of 10 years. The amount of the differential assigned to goodwill is not impaired. In the two years following the stock acquisition, Salt Manufacturing reported net income of $85,000 and $55,000 and pald dividends of $28,000 and $45,000, respectively. Pepper used the equity method In accounting for its ownership of Salt Manufacturing. b-2. Prepare the Journal entrles recorded by Pepper during 201 related to Its Investment in Salt Manufacturing. Note: If no entry Is required for a transactlon/event, select "No journal entry required" In the first account fleld. A Record the dividends received from Salt Manufacturing. B Record the equity-method income for period. C Record the entry to amortize the differential assigned to buildings and equipment. c. Whatbalance wilibe reported in Pepper's investment account: on December 31:201Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started