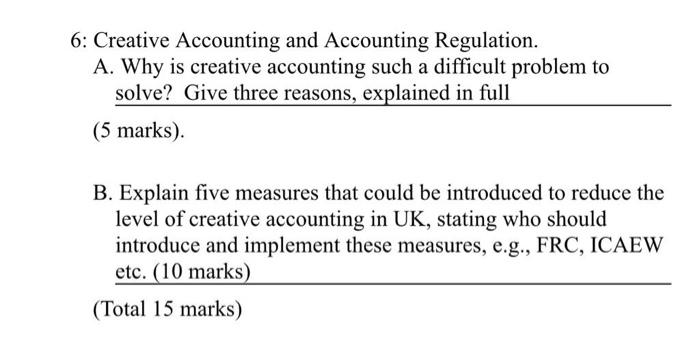

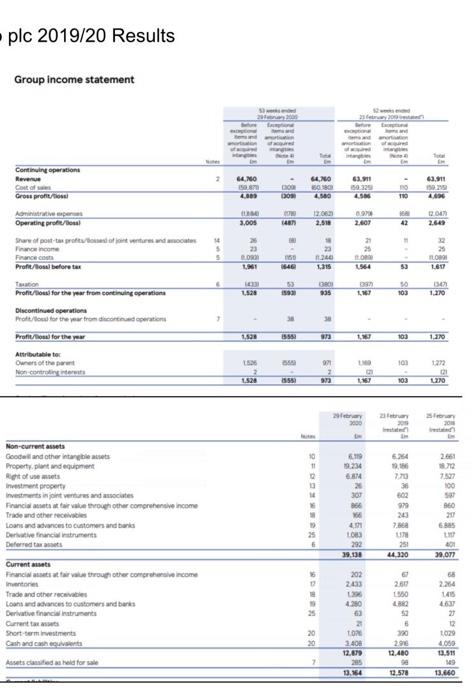

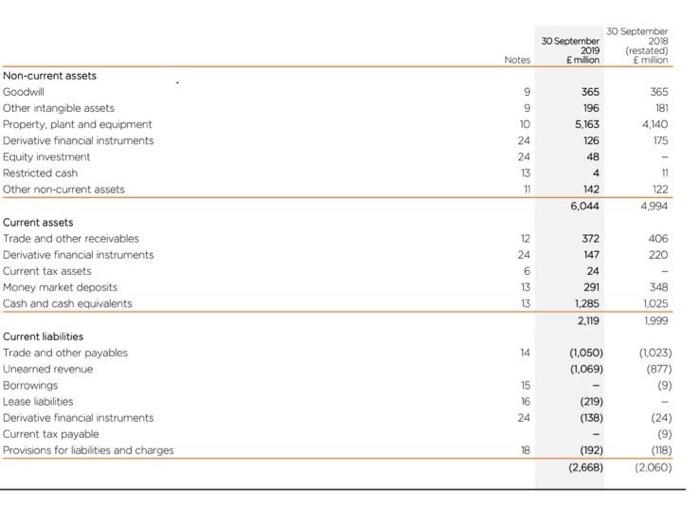

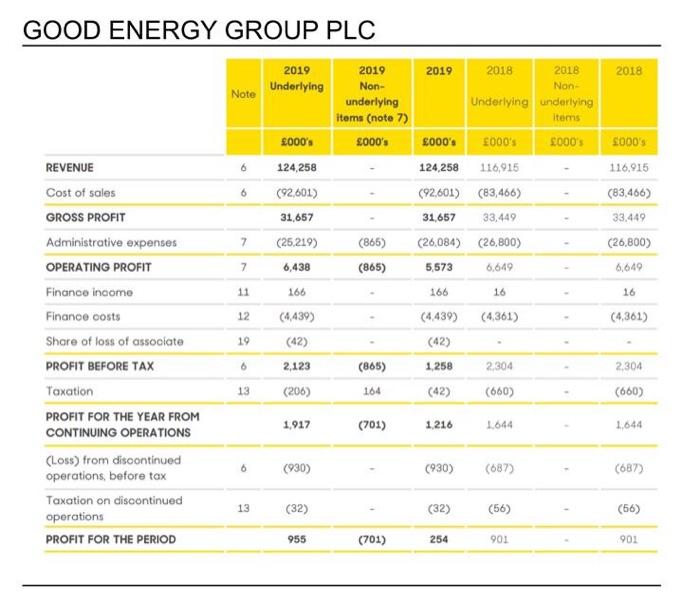

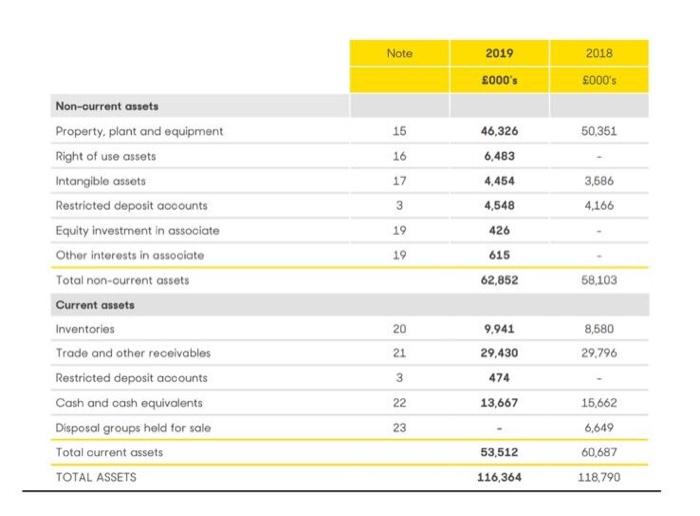

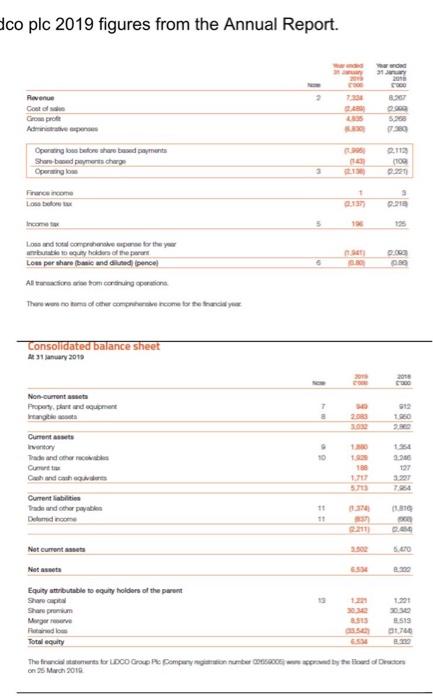

6: Creative Accounting and Accounting Regulation. A. Why is creative accounting such a difficult problem to solve? Give three reasons, explained in full (5 marks) B. Explain five measures that could be introduced to reduce the level of creative accounting in UK, stating who should introduce and implement these measures, eg, FRC, ICAEW etc. (10 marks) (Total 15 marks) Tesco plc 2019/20 Results Group Income statement Easyjet plc 2019 6: Creative Accounting and Accounting Regulation. A. Why is creative accounting such a difficult problem to solve? Give three reasons, explained in full (5 marks). B. Explain five measures that could be introduced to reduce the level of creative accounting in UK, stating who should introduce and implement these measures, e.g., FRC, ICAEW etc. (10 marks) (Total 15 marks) - plc 2019/20 Results Group income statement 1 NO 64.0 500 400 G. 50:32 15021 C Continuing operations Revenue Cast of Gross profil Admin Operating profit/s Sharof post-protsent entradas Finance Profit/ou before tar 3.005 1206 2.518 BO 260 EN 2.607 42 5 23 za 25 25 ILO LOW 46 11 53 . OR 935 1942 1.210 1.50 LE 10) Profit/ou for the year from continuing operations Discontinued operations Protofort trondictions Profill/loss for the year Attributable ter Owners of the parent 1.500 15552 73 103 1.110 103 2 1520 2 9.2 1272 1 UN 5558 UM 103 2000 266 10 11 Non-current assets Good and other intangibles Property, plequipment Right of use Investment property Investments intents and sociales Francia e other comprehensive Income Trade and other receivables Los datosto customers and banks Derivative anstruments Deferred 9234 IN 20 307 7527 100 SP 960 1 401 LOS 25 5 251 44330 39.131 39.077 202 2.24 Current stats Paciwwsarthroother compreencome Into Trade and other receive Loans and advances to customers and banks Derivative financirants Current Short-term investments 1550 LO 30 20 20 LON 3.00 12.679 20 2 1020 4.000 3.511 Assandheld for sale 12.450 De 12.50 13,164 13.640 et plc 2019 Notes Passenger revenue Ancillary revenue Total revenue 30 September 2019 Headline Non-headine Total Emilion Emilion Emillion 5,009 5.009 1.376 1,376 6,385 6,385 30 September 2018 Headline Non-headline Total E million Emilion E million 4.688 4.688 1.210 1,210 5,898 5,898 I 1 26 (1.416) Fuel Airports and ground handling Crew Navigation Maintenance Selling and marketing Other costs Other income EBITDAR (1416) (1845) (859) (409) (302) (157) (456) 29 970 (1.845) (859) (409) (302) (157) (456) 29 970 (1,184) (1649) (754) (400) (313) (143) (507) 13 961 (22) (1.184) (1649) (761) (400) (335) (143) (600) 13 839 (93) (122) (10) (152) (199) Aircraft dry leasing Depreciation Amortisation of intangible assets Operating profit 10 9 (5) (484) (15) 466 (5) (484) (15) 466 (162) (199) (15) 463 595 (132) 21 3 24 12 12 Interest receivable and other financing income Interest payable and other financing charges Net Finance (charges/income (29) (60) (39) (60) (36) (0) (0) (30) (18) 2 3 Profit before tax 3 427 3 430 578 (133) 445 Tox (charge)/credit 6 (78) (3) (81) (112) 25 (87) Profit for the year 349 349 466 (108) 358 30 September 30 September 2018 2019 (restated) Emillion Emilion Notes Non-current assets Goodwill Other intangible assets Property, plant and equipment Derivative financial instruments Equity investment Restricted cash Other non-current assets 9 9 10 24 24 13 11 365 181 4,140 175 365 196 5,163 126 48 4 142 6,044 11 122 4.994 406 Current assets Trade and other receivables Derivative financial instruments Current tax assets Money market deposits Cash and cash equivalents 12 24 6 220 372 147 24 291 1.285 2,119 348 1.025 1999 14 (1,050) (1,069) (1,023) (877) (9) Current liabilities Trade and other payables Unearned revenue Borrowings Lease liabilities Derivative financial instruments Current tax payable Provisions for liabilities and charges 15 16 24 (219) (138) (24) (9) (118) (2.060) 18 (192) (2.668) GOOD ENERGY GROUP PLC 2019 2018 Note Underlying 2019 Non- underlying items (note 7) 5000's 6 000's 124,258 (92,601) 2019 2018 2018 Non- Underlying underlying Items 2000's 2000's 2000's 124.258 116,915 (92,601) (83,466) 31,657 33,449 (26,084) (26,800) 5,573 6649 6 5000's 116915 (83,466) 33.449 (26,800) 6,649 31,657 7 (25219) (865) 7 6,438 (865) 11 166 166 16 - 16 12 (4,430) (4.439) (4.361) (4,361) 19 REVENUE Cost of sales GROSS PROFIT Administrative expenses OPERATING PROFIT Finance income Finance costs Share of loss of associate PROFIT BEFORE TAX Taxation PROFIT FOR THE YEAR FROM CONTINUING OPERATIONS (Loss) from discontinued operations before tax Taxation on discontinued operations PROFIT FOR THE PERIOD (42) 2,123 (206) (42) 1.258 6 (865) 2.304 2,304 13 164 (42) (660) (660) 1,917 (701) 1216 1644 1,644 6 (930) (930) (687) - (687) 13 (32) (32) (56) - (56) 955 (701) 254 901 901 Note 2019 000's 2018 000's 15 50,351 46,326 6,483 16 17 4,454 3,586 3 4,548 4.166 19 426 19 615 62,852 58,103 Non-current assets Property, plant and equipment Right of use assets Intangible assets Restricted deposit accounts Equity Investment in associate Other interests in associate Total non-current assets Current assets Inventories Trade and other receivables Restricted deposit accounts Cash and cash equivalents Disposal groups held for sale Total current assets TOTAL ASSETS 20 9.941 29,430 8,580 29.796 21 3 474 22 13,667 15,662 6,649 23 53,512 60,687 116,364 118,790 co plc 2019 figures from the Annual Report. Reven Cost Groep Admin BG 0.00 5.200 7960 Operating for the Share on charge 22.112 100 2:22 France com + Income 5 Lo and total comprehensive they Quy holders of the Lors per shareDatic and did pence! Al action to continuing point There was no time of other comprare come to the handled your Consolidated balance sheet A 31 january 2010 2018 Co Non-currentes T 12 1960 2900 Current 1.54 3. 10 Cunut Cash and chi 3997 Current liabili Trade and other payable Dolored income 11 Not current sta 5.00 Net Equity attributable to equity holders of the peront Sweet Share prim Merge D 30:30 3513 BUT Total quity The factor LDCO Group Company by the load of Deco on 25 March 2010 6: Creative Accounting and Accounting Regulation. A. Why is creative accounting such a difficult problem to solve? Give three reasons, explained in full (5 marks) B. Explain five measures that could be introduced to reduce the level of creative accounting in UK, stating who should introduce and implement these measures, eg, FRC, ICAEW etc. (10 marks) (Total 15 marks) Tesco plc 2019/20 Results Group Income statement Easyjet plc 2019 6: Creative Accounting and Accounting Regulation. A. Why is creative accounting such a difficult problem to solve? Give three reasons, explained in full (5 marks). B. Explain five measures that could be introduced to reduce the level of creative accounting in UK, stating who should introduce and implement these measures, e.g., FRC, ICAEW etc. (10 marks) (Total 15 marks) - plc 2019/20 Results Group income statement 1 NO 64.0 500 400 G. 50:32 15021 C Continuing operations Revenue Cast of Gross profil Admin Operating profit/s Sharof post-protsent entradas Finance Profit/ou before tar 3.005 1206 2.518 BO 260 EN 2.607 42 5 23 za 25 25 ILO LOW 46 11 53 . OR 935 1942 1.210 1.50 LE 10) Profit/ou for the year from continuing operations Discontinued operations Protofort trondictions Profill/loss for the year Attributable ter Owners of the parent 1.500 15552 73 103 1.110 103 2 1520 2 9.2 1272 1 UN 5558 UM 103 2000 266 10 11 Non-current assets Good and other intangibles Property, plequipment Right of use Investment property Investments intents and sociales Francia e other comprehensive Income Trade and other receivables Los datosto customers and banks Derivative anstruments Deferred 9234 IN 20 307 7527 100 SP 960 1 401 LOS 25 5 251 44330 39.131 39.077 202 2.24 Current stats Paciwwsarthroother compreencome Into Trade and other receive Loans and advances to customers and banks Derivative financirants Current Short-term investments 1550 LO 30 20 20 LON 3.00 12.679 20 2 1020 4.000 3.511 Assandheld for sale 12.450 De 12.50 13,164 13.640 et plc 2019 Notes Passenger revenue Ancillary revenue Total revenue 30 September 2019 Headline Non-headine Total Emilion Emilion Emillion 5,009 5.009 1.376 1,376 6,385 6,385 30 September 2018 Headline Non-headline Total E million Emilion E million 4.688 4.688 1.210 1,210 5,898 5,898 I 1 26 (1.416) Fuel Airports and ground handling Crew Navigation Maintenance Selling and marketing Other costs Other income EBITDAR (1416) (1845) (859) (409) (302) (157) (456) 29 970 (1.845) (859) (409) (302) (157) (456) 29 970 (1,184) (1649) (754) (400) (313) (143) (507) 13 961 (22) (1.184) (1649) (761) (400) (335) (143) (600) 13 839 (93) (122) (10) (152) (199) Aircraft dry leasing Depreciation Amortisation of intangible assets Operating profit 10 9 (5) (484) (15) 466 (5) (484) (15) 466 (162) (199) (15) 463 595 (132) 21 3 24 12 12 Interest receivable and other financing income Interest payable and other financing charges Net Finance (charges/income (29) (60) (39) (60) (36) (0) (0) (30) (18) 2 3 Profit before tax 3 427 3 430 578 (133) 445 Tox (charge)/credit 6 (78) (3) (81) (112) 25 (87) Profit for the year 349 349 466 (108) 358 30 September 30 September 2018 2019 (restated) Emillion Emilion Notes Non-current assets Goodwill Other intangible assets Property, plant and equipment Derivative financial instruments Equity investment Restricted cash Other non-current assets 9 9 10 24 24 13 11 365 181 4,140 175 365 196 5,163 126 48 4 142 6,044 11 122 4.994 406 Current assets Trade and other receivables Derivative financial instruments Current tax assets Money market deposits Cash and cash equivalents 12 24 6 220 372 147 24 291 1.285 2,119 348 1.025 1999 14 (1,050) (1,069) (1,023) (877) (9) Current liabilities Trade and other payables Unearned revenue Borrowings Lease liabilities Derivative financial instruments Current tax payable Provisions for liabilities and charges 15 16 24 (219) (138) (24) (9) (118) (2.060) 18 (192) (2.668) GOOD ENERGY GROUP PLC 2019 2018 Note Underlying 2019 Non- underlying items (note 7) 5000's 6 000's 124,258 (92,601) 2019 2018 2018 Non- Underlying underlying Items 2000's 2000's 2000's 124.258 116,915 (92,601) (83,466) 31,657 33,449 (26,084) (26,800) 5,573 6649 6 5000's 116915 (83,466) 33.449 (26,800) 6,649 31,657 7 (25219) (865) 7 6,438 (865) 11 166 166 16 - 16 12 (4,430) (4.439) (4.361) (4,361) 19 REVENUE Cost of sales GROSS PROFIT Administrative expenses OPERATING PROFIT Finance income Finance costs Share of loss of associate PROFIT BEFORE TAX Taxation PROFIT FOR THE YEAR FROM CONTINUING OPERATIONS (Loss) from discontinued operations before tax Taxation on discontinued operations PROFIT FOR THE PERIOD (42) 2,123 (206) (42) 1.258 6 (865) 2.304 2,304 13 164 (42) (660) (660) 1,917 (701) 1216 1644 1,644 6 (930) (930) (687) - (687) 13 (32) (32) (56) - (56) 955 (701) 254 901 901 Note 2019 000's 2018 000's 15 50,351 46,326 6,483 16 17 4,454 3,586 3 4,548 4.166 19 426 19 615 62,852 58,103 Non-current assets Property, plant and equipment Right of use assets Intangible assets Restricted deposit accounts Equity Investment in associate Other interests in associate Total non-current assets Current assets Inventories Trade and other receivables Restricted deposit accounts Cash and cash equivalents Disposal groups held for sale Total current assets TOTAL ASSETS 20 9.941 29,430 8,580 29.796 21 3 474 22 13,667 15,662 6,649 23 53,512 60,687 116,364 118,790 co plc 2019 figures from the Annual Report. Reven Cost Groep Admin BG 0.00 5.200 7960 Operating for the Share on charge 22.112 100 2:22 France com + Income 5 Lo and total comprehensive they Quy holders of the Lors per shareDatic and did pence! Al action to continuing point There was no time of other comprare come to the handled your Consolidated balance sheet A 31 january 2010 2018 Co Non-currentes T 12 1960 2900 Current 1.54 3. 10 Cunut Cash and chi 3997 Current liabili Trade and other payable Dolored income 11 Not current sta 5.00 Net Equity attributable to equity holders of the peront Sweet Share prim Merge D 30:30 3513 BUT Total quity The factor LDCO Group Company by the load of Deco on 25 March 2010