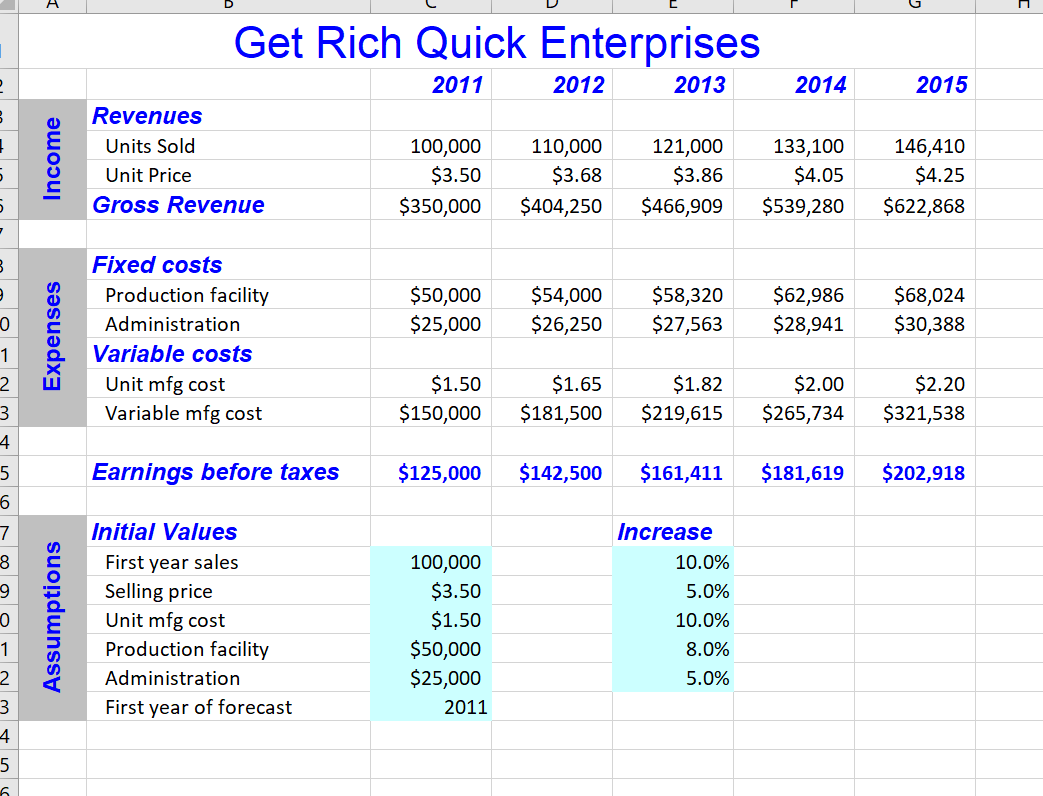

6) Data Tables Review the worksheet labeled 6-Data Tables (This is the same worksheet we worked on in class to illustrate formula auditing tools in Excel). The business would like to know the following: What would be the impact on Gross Revenue and Earnings before Taxes if first year unit sales ranged from 75,000 units to 125,000 units (in increments of 5,000 units)? Create a table, appropriately labeled, to show this information. The business would also like to know what Earnings before Taxes would be on the same range of first year unit sales (as above) as well as if the percentage increase in first year unit sales ranged from 8% to 12% (in increments of 1%). Create a table, appropriately labeled, to show this information. Hint: Be sure to use the Data Table function to answer both questions. Get Rich Quick Enterprises 2 2011 2012 2013 2014 2015 3 Income Revenues Units Sold Unit Price Gross Revenue 100,000 $3.50 $350,000 110,000 $3.68 $404,250 121,000 $3.86 $466,909 133,100 $4.05 $539,280 146,410 $4.25 $622,868 3 $50,000 $25,000 Expenses $54,000 $26,250 $58,320 $27,563 $62,986 $28,941 $68,024 $30,388 0 Fixed costs Production facility Administration Variable costs Unit mfg cost Variable mfg cost $1.50 $150,000 $1.65 $181,500 $1.82 $219,615 $2.00 $265,734 $2.20 $321,538 3 4 5 Earnings before taxes $125,000 $142,500 $161,411 $181,619 $202,918 6 7 8 9 0 Assumptions Initial Values First year sales Selling price Unit mfg cost Production facility Administration First year of forecast 100,000 $3.50 $1.50 $50,000 $25,000 2011 Increase 10.0% 5.0% 10.0% 8.0% 5.0% 1 2 3 4 6) Data Tables Review the worksheet labeled 6-Data Tables (This is the same worksheet we worked on in class to illustrate formula auditing tools in Excel). The business would like to know the following: What would be the impact on Gross Revenue and Earnings before Taxes if first year unit sales ranged from 75,000 units to 125,000 units (in increments of 5,000 units)? Create a table, appropriately labeled, to show this information. The business would also like to know what Earnings before Taxes would be on the same range of first year unit sales (as above) as well as if the percentage increase in first year unit sales ranged from 8% to 12% (in increments of 1%). Create a table, appropriately labeled, to show this information. Hint: Be sure to use the Data Table function to answer both questions. Get Rich Quick Enterprises 2 2011 2012 2013 2014 2015 3 Income Revenues Units Sold Unit Price Gross Revenue 100,000 $3.50 $350,000 110,000 $3.68 $404,250 121,000 $3.86 $466,909 133,100 $4.05 $539,280 146,410 $4.25 $622,868 3 $50,000 $25,000 Expenses $54,000 $26,250 $58,320 $27,563 $62,986 $28,941 $68,024 $30,388 0 Fixed costs Production facility Administration Variable costs Unit mfg cost Variable mfg cost $1.50 $150,000 $1.65 $181,500 $1.82 $219,615 $2.00 $265,734 $2.20 $321,538 3 4 5 Earnings before taxes $125,000 $142,500 $161,411 $181,619 $202,918 6 7 8 9 0 Assumptions Initial Values First year sales Selling price Unit mfg cost Production facility Administration First year of forecast 100,000 $3.50 $1.50 $50,000 $25,000 2011 Increase 10.0% 5.0% 10.0% 8.0% 5.0% 1 2 3 4