Answered step by step

Verified Expert Solution

Question

1 Approved Answer

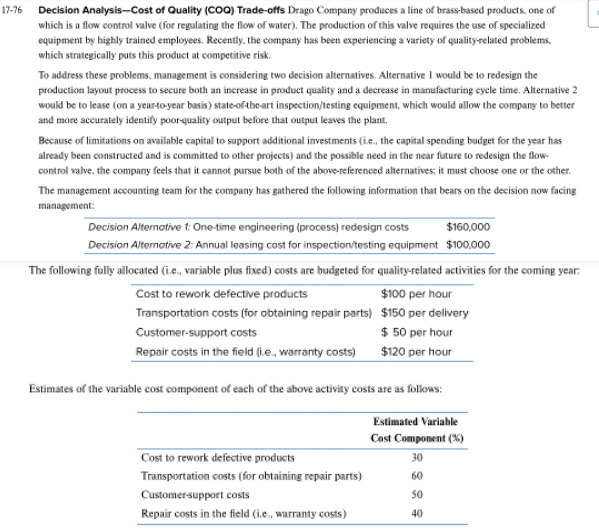

6 Decision Analysis-Cost of Quality (COO) Trade-offs Drago Company produces a line of brass-based products, one of which is a flow control valve (for regulating

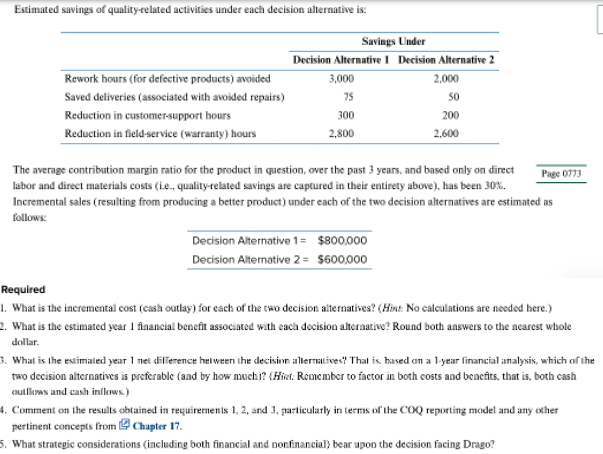

6 Decision Analysis-Cost of Quality (COO) Trade-offs Drago Company produces a line of brass-based products, one of which is a flow control valve (for regulating the flow of water). The production of this valve requires the use of specialized equipment by highly trained employees. Recently, the company has been experiencing a variety of quality-related problems, which strategically pots this product at competitive risk. To address these problems, management is considering two decision alternatives. Alternative 1 would be to redesign the production layout process to secure both an increase in product quality and a decrease in manufacturing cycle time. Alternative 2 would be to lease (on a year-toyear basis) stateof-the-art inspection/testing equipment, which woald allow the company to better and more aceurately identify poor-quality output before that output leaves the plant. Because of limitations on available capital to support additional investments (i.e., the capital spending budget for the year has already been constructed and is committed to other projects) and the possible need in the near future to redesign the flowcontrol valve, the company feels that it cannot pursue both of the above-referenced alternatives it must choose one or the other. The management accounting team for the company has gathered the following information that bears on the decision now facing management: The following fully allocated (i.e. variable plus fixed) costs are budgeted for quality-related activities for the coming year: Estimates of the variable cost component of each of the above activity costs are as follows: Estimated savings of quality-related activities under each decision alternative is: The average contribution margin ratio for the product in question, over the past 3 years, and based only on direct labor and direct materials costs (i.e., quality-related savings are captured in their entirety above), has been 30%. Incremental sales (resulting from producing a better product) under each of the two decision alternatives are estimated as follows: Required 1. What is the incremental cost (cash outlay) for each of the two decision alternatives? ( Hivz No calculations are needed here.) 2. What is the estimated year 1 flaancial benefit associated with eaca docision alteraatiw?? Round both aaswers to the acarest whole dollar. . What is the estimated year 1 net dilterence hulween the decisinn allemetives? That is, hased on a 1-year financial iamalysik, which of the two decision alternatives is preferable (and by how much)? (Hiidi. Remember to factor in both costs and bencfits, that is, both cash oullhws and cash in(lows) 4. Comment on the results obtained in requirements 1, 2, and 3 , particularly in terms of the COQ reporting model and any olher pertinent concepts from [ Chapter 17. What strategic considerations (incleding both financial and nonfinancial) bear upon the decision facing Drago

6 Decision Analysis-Cost of Quality (COO) Trade-offs Drago Company produces a line of brass-based products, one of which is a flow control valve (for regulating the flow of water). The production of this valve requires the use of specialized equipment by highly trained employees. Recently, the company has been experiencing a variety of quality-related problems, which strategically pots this product at competitive risk. To address these problems, management is considering two decision alternatives. Alternative 1 would be to redesign the production layout process to secure both an increase in product quality and a decrease in manufacturing cycle time. Alternative 2 would be to lease (on a year-toyear basis) stateof-the-art inspection/testing equipment, which woald allow the company to better and more aceurately identify poor-quality output before that output leaves the plant. Because of limitations on available capital to support additional investments (i.e., the capital spending budget for the year has already been constructed and is committed to other projects) and the possible need in the near future to redesign the flowcontrol valve, the company feels that it cannot pursue both of the above-referenced alternatives it must choose one or the other. The management accounting team for the company has gathered the following information that bears on the decision now facing management: The following fully allocated (i.e. variable plus fixed) costs are budgeted for quality-related activities for the coming year: Estimates of the variable cost component of each of the above activity costs are as follows: Estimated savings of quality-related activities under each decision alternative is: The average contribution margin ratio for the product in question, over the past 3 years, and based only on direct labor and direct materials costs (i.e., quality-related savings are captured in their entirety above), has been 30%. Incremental sales (resulting from producing a better product) under each of the two decision alternatives are estimated as follows: Required 1. What is the incremental cost (cash outlay) for each of the two decision alternatives? ( Hivz No calculations are needed here.) 2. What is the estimated year 1 flaancial benefit associated with eaca docision alteraatiw?? Round both aaswers to the acarest whole dollar. . What is the estimated year 1 net dilterence hulween the decisinn allemetives? That is, hased on a 1-year financial iamalysik, which of the two decision alternatives is preferable (and by how much)? (Hiidi. Remember to factor in both costs and bencfits, that is, both cash oullhws and cash in(lows) 4. Comment on the results obtained in requirements 1, 2, and 3 , particularly in terms of the COQ reporting model and any olher pertinent concepts from [ Chapter 17. What strategic considerations (incleding both financial and nonfinancial) bear upon the decision facing Drago Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started