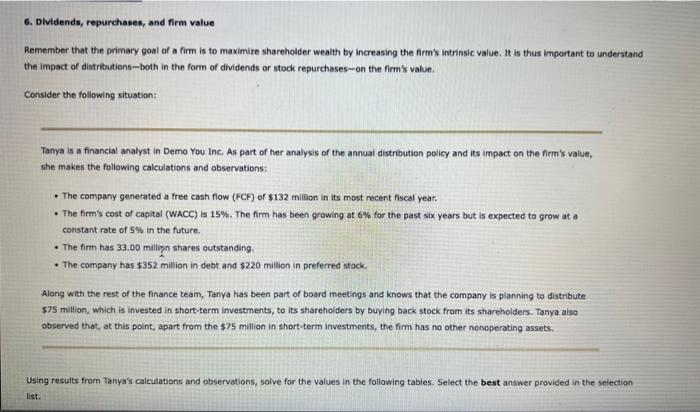

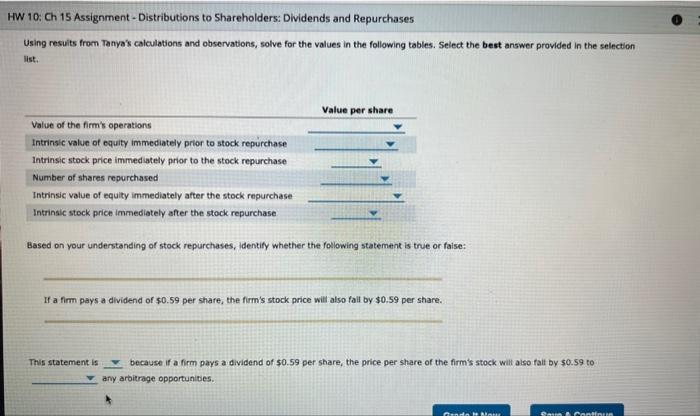

6. Dividends, repurchases, and firm value Remember that the primary goal of a firm is to maximize shareholder wealth by increasing the firm's intrinsic value. It is thus important to understand the impact of distributions-both in the form of dividends or stock repurchases-on the firm's value. Consider the following situation: Tanya is a financial analyst in Demo You Inc, As part of her analysis of the annual distribution policy and its impact on the firm's value, she makes the following calculations and observations: - The company generated a free cash flow (FCF) of $132 million in its most recent fiscal year. - The firm's cost of capital (WACC) is 15\%. The firm has been growing at 6% for the past six years but is expected to grow at a constant rate of 5% in the future. - The firm has 33.00 milizn shares outstanding. - The company has $352 million in debt and $220 million in preferred stock. Along with the rest of the finance team, Tanya has been part of board meetings and knows that the company is planning to distribute $75 million, which is invested in short-term investments, to its sharetiolders by buying back stock from its shareholders. Tanya also observed that, at this point, apart from the $75 million in short-term investments, the firm has no other nonoperating assets. Using results from Tanya's calculations and observations, solve for the values in the following tables. Select the best answer provided in the selection list: Using resuits from Tanya's calculations and observations, solve for the values in the following tables. Select the best answer provided in the selection list, Based on your understanding of stock repurchases, identify whether the following statement is true or faise: If a firm pays a dividend of $0.59 per share, the firm's stock price will also fall by $0.59 per share. This statement is because if a firm pays a dividend of $0.59 per share, the price per share of the firm's stock will also falt by $0.59 to any arbitrage opportunites. 6. Dividends, repurchases, and firm value Remember that the primary goal of a firm is to maximize shareholder wealth by increasing the firm's intrinsic value. It is thus important to understand the impact of distributions-both in the form of dividends or stock repurchases-on the firm's value. Consider the following situation: Tanya is a financial analyst in Demo You Inc, As part of her analysis of the annual distribution policy and its impact on the firm's value, she makes the following calculations and observations: - The company generated a free cash flow (FCF) of $132 million in its most recent fiscal year. - The firm's cost of capital (WACC) is 15\%. The firm has been growing at 6% for the past six years but is expected to grow at a constant rate of 5% in the future. - The firm has 33.00 milizn shares outstanding. - The company has $352 million in debt and $220 million in preferred stock. Along with the rest of the finance team, Tanya has been part of board meetings and knows that the company is planning to distribute $75 million, which is invested in short-term investments, to its sharetiolders by buying back stock from its shareholders. Tanya also observed that, at this point, apart from the $75 million in short-term investments, the firm has no other nonoperating assets. Using results from Tanya's calculations and observations, solve for the values in the following tables. Select the best answer provided in the selection list: Using resuits from Tanya's calculations and observations, solve for the values in the following tables. Select the best answer provided in the selection list, Based on your understanding of stock repurchases, identify whether the following statement is true or faise: If a firm pays a dividend of $0.59 per share, the firm's stock price will also fall by $0.59 per share. This statement is because if a firm pays a dividend of $0.59 per share, the price per share of the firm's stock will also falt by $0.59 to any arbitrage opportunites