Question: 6. Estimate the value of the stock using two different models using your calculated estimates (you must provide the models used from text or used

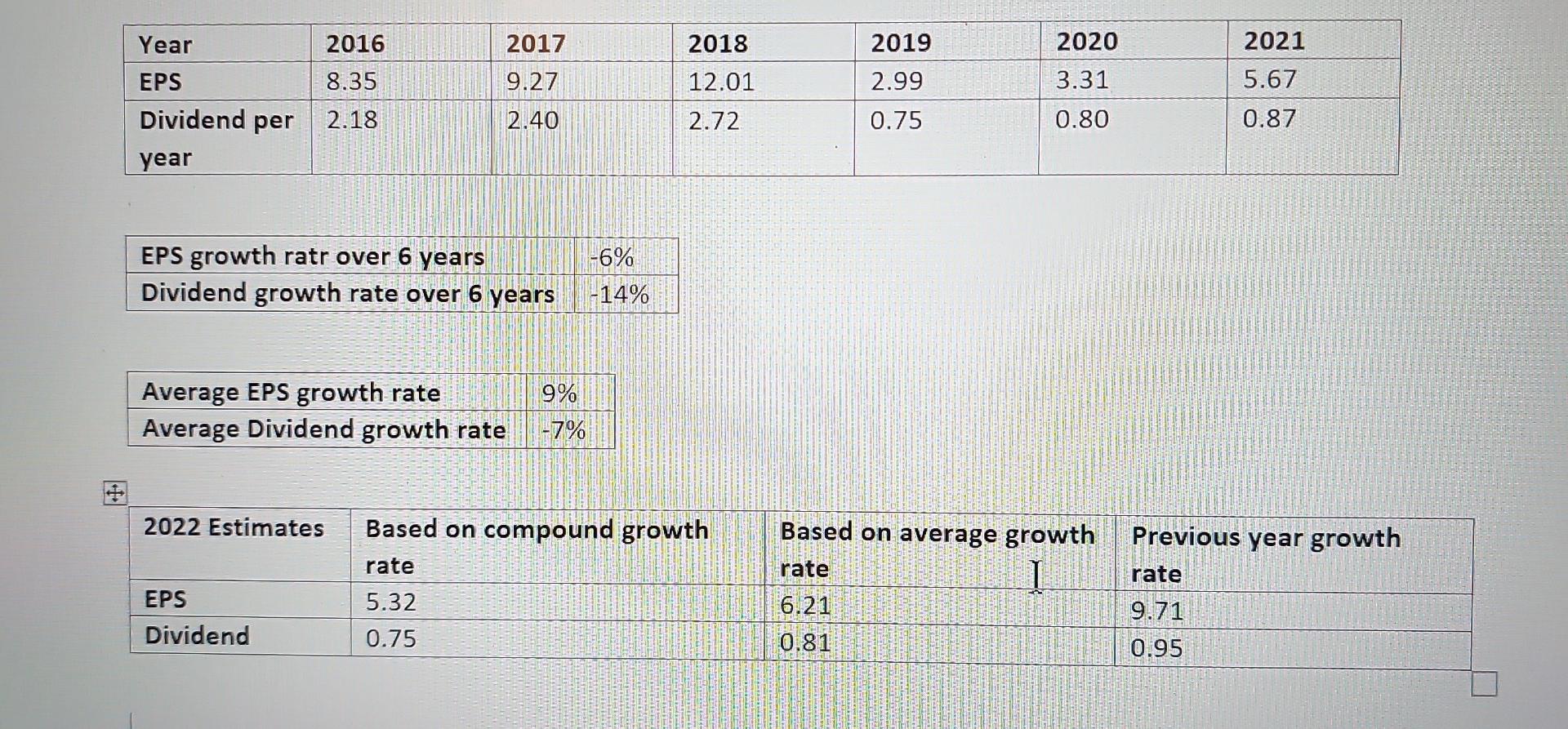

6. Estimate the value of the stock using two different models using your calculated estimates (you must provide the models used from text or used in class and show your calculations). 7. Estimate the value of the stock using the models and the Bloomberg estimate of EPS. 8. Given your value (price) estimate (in 6 above) versus the current price explain any spread/difference between your estimate of value and the current price. 2017 9.27 2.40 Year 2016 EPS 8.35 Dividend per 2.18 year EPS growth ratr over 6 years Dividend growth rate over 6 years Average EPS growth rate 9% Average Dividend growth rate -7% 2022 Estimates Based on compound growth rate EPS 5.32 Dividend 0.75 -6% -14% 2018 12.01 2.72 2019 2020 2.99 3.31 0.75 0.80 Based on average growth rate I 6.21 0.81 2021 5.67 0.87 Previous year growth rate 9.71 0.95 6. Estimate the value of the stock using two different models using your calculated estimates (you must provide the models used from text or used in class and show your calculations). 7. Estimate the value of the stock using the models and the Bloomberg estimate of EPS. 8. Given your value (price) estimate (in 6 above) versus the current price explain any spread/difference between your estimate of value and the current price. 2017 9.27 2.40 Year 2016 EPS 8.35 Dividend per 2.18 year EPS growth ratr over 6 years Dividend growth rate over 6 years Average EPS growth rate 9% Average Dividend growth rate -7% 2022 Estimates Based on compound growth rate EPS 5.32 Dividend 0.75 -6% -14% 2018 12.01 2.72 2019 2020 2.99 3.31 0.75 0.80 Based on average growth rate I 6.21 0.81 2021 5.67 0.87 Previous year growth rate 9.71 0.95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts