Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. FGH Inc. has a bonus plan covering all employees. The total bonus is equal to 10% of FGH's pre-bonus and pretax income a reduced

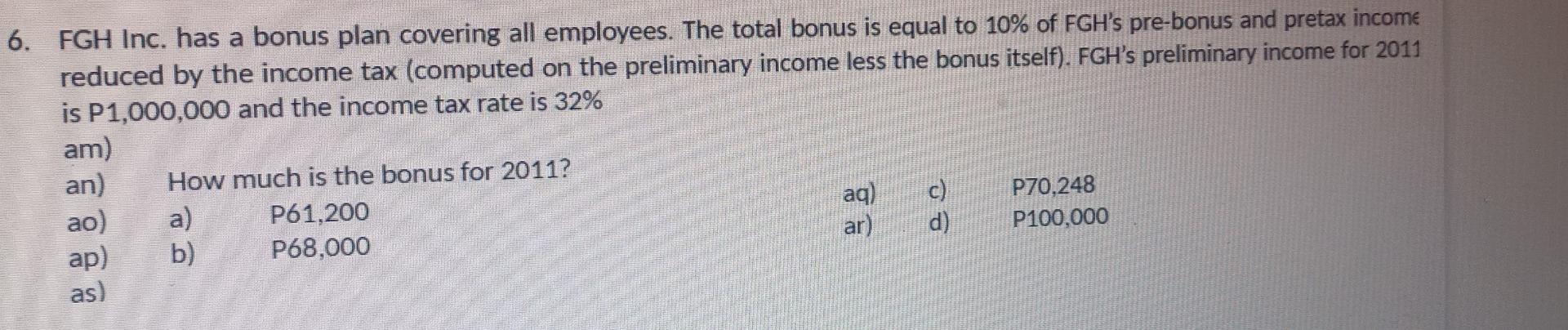

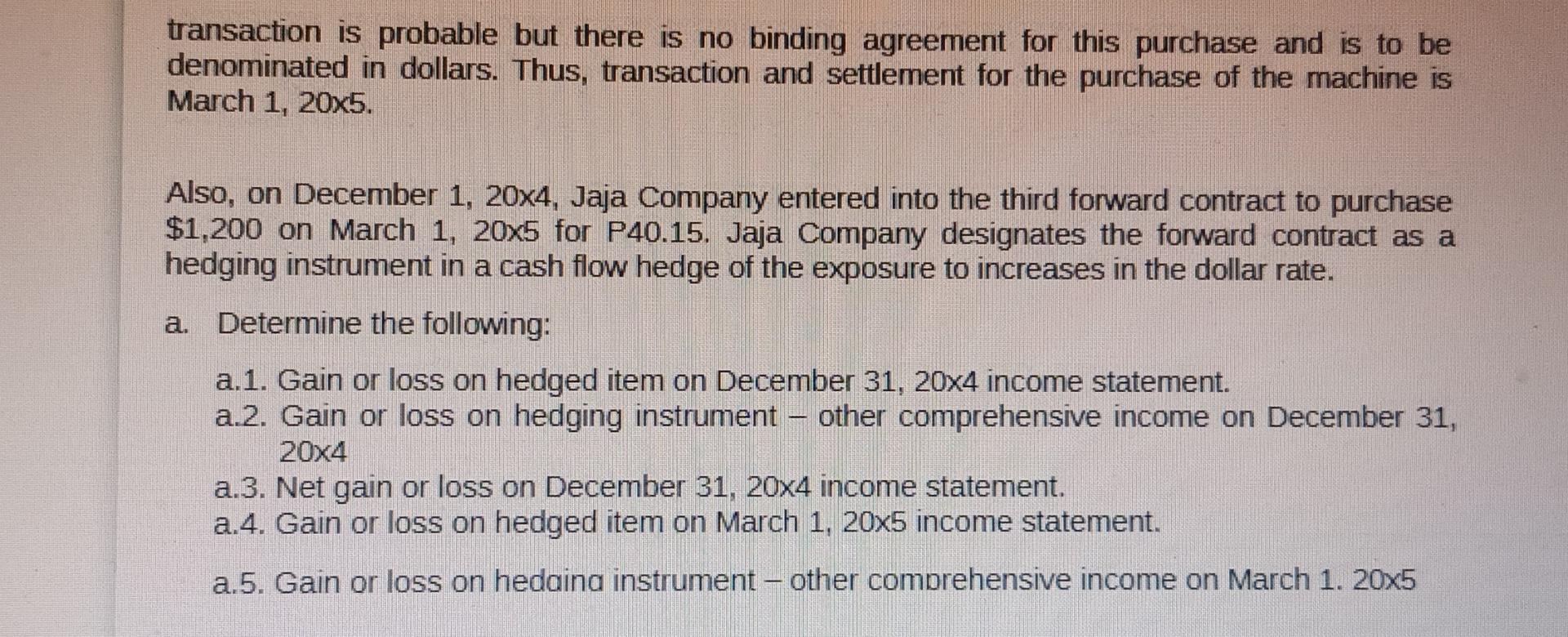

6. FGH Inc. has a bonus plan covering all employees. The total bonus is equal to 10% of FGH's pre-bonus and pretax income a reduced by the income tax (computed on the preliminary income less the bonus itself). FGH's preliminary income for 2011 is P1,000,000 and the income tax rate is 32% am) an) How much is the bonus for 2011? aq) P70,248 a) c) ao) P61,200 ar) d) P100,000 ap) b) P68,000 as) transaction is probable but there is no binding agreement for this purchase and is to be denominated in dollars. Thus, transaction and settlement for the purchase of the machine is March 1, 20x5. Also, on December 1, 20x4, Jaja Company entered into the third forward contract to purchase $1,200 on March 1, 20x5 for P40.15. Jaja Company designates the forward contract as a hedging instrument in a cash flow hedge of the exposure to increases in the dollar rate. a. Determine the following: a.1. Gain or loss on hedged item on December 31, 20x4 income statement. a.2. Gain or loss on hedging instrument - other comprehensive income on December 31, 20X4 a.3. Net gain or loss on December 31, 20x4 income statement. a.4. Gain or loss on hedged item on March 1, 20x5 income statement. a.5. Gain or loss on hedaina instrument - other comprehensive income on March 1. 20x5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started