Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve in excel and show all work. 13. Cost of goods sold-LIFO and FIFO (L04-2) At the end of January, Mineral Labs had an

Please solve in excel and show all work.

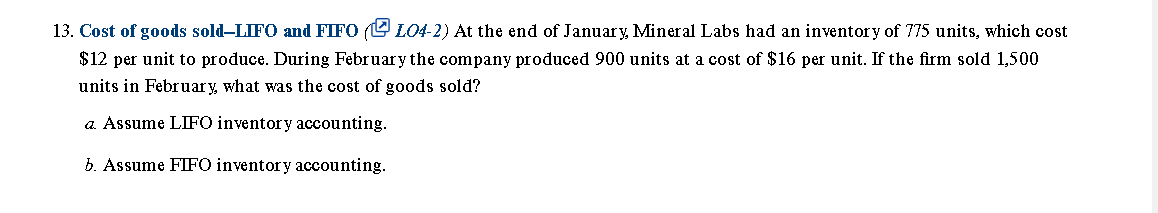

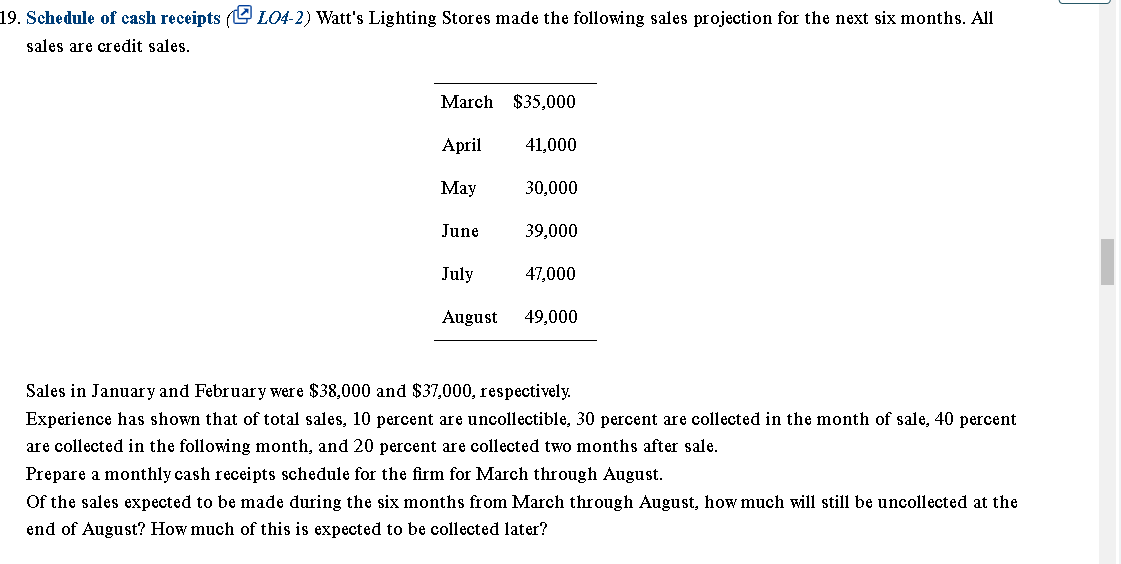

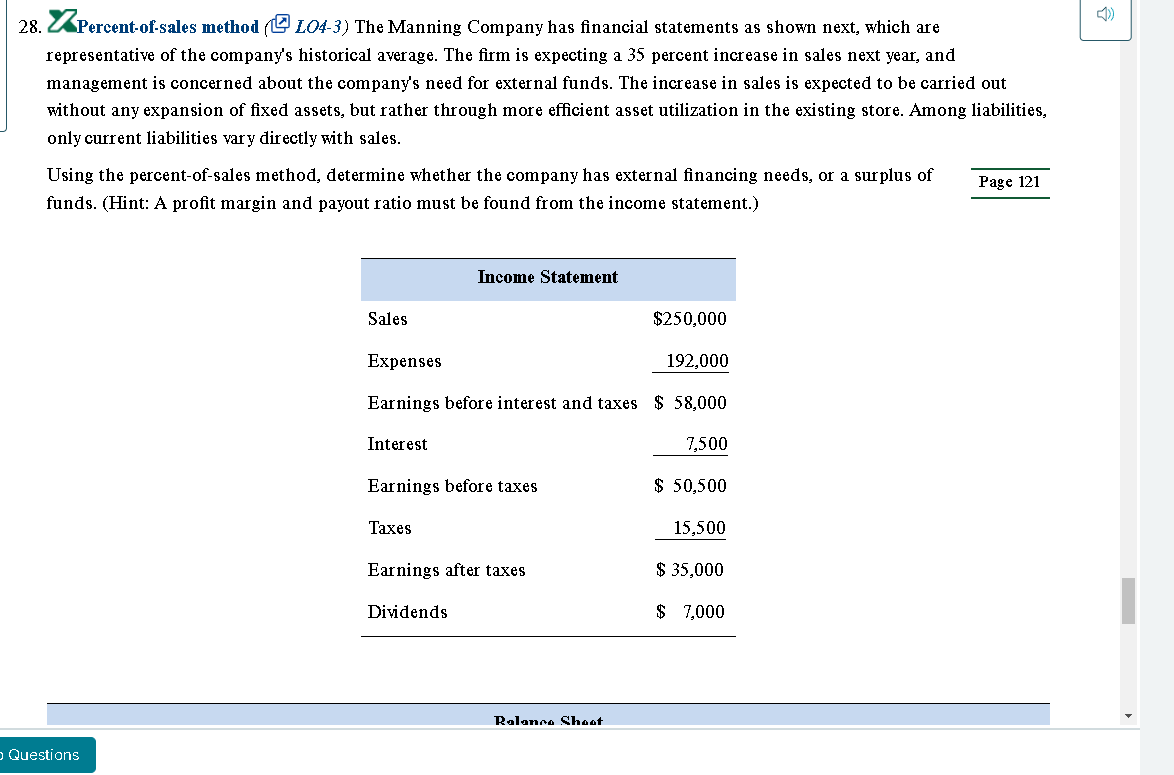

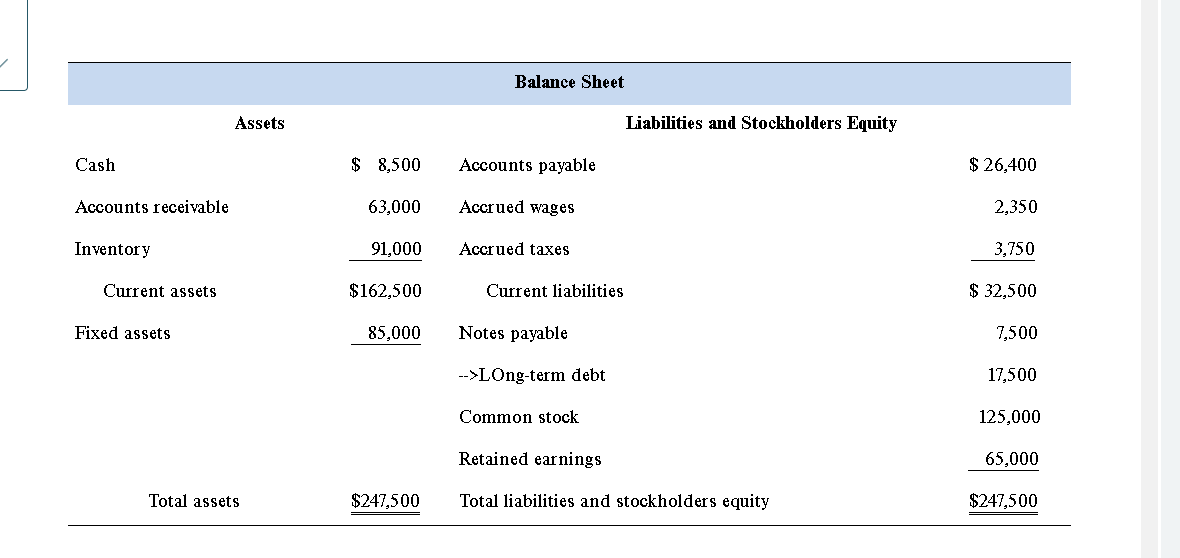

13. Cost of goods sold-LIFO and FIFO (L04-2) At the end of January, Mineral Labs had an inventory of 775 units, which cost $12 per unit to produce. During February the company produced 900 units at a cost of $16 per unit. If the firm sold 1,500 units in February, what was the cost of goods sold? a. Assume LIFO inventory accounting. b. Assume FIFO inventory accounting. 19. Schedule of cash receipts (L04-2) Watt's Lighting Stores made the following sales projection for the next six months. All sales are credit sales. March $35,000 April 41,000 May 30,000 June 39,000 July 47,000 August 49,000 Sales in January and February were $38,000 and $37,000, respectively. Experience has shown that of total sales, 10 percent are uncollectible, 30 percent are collected in the month of sale, 40 percent are collected in the following month, and 20 percent are collected two months after sale. Prepare a monthly cash receipts schedule for the firm for March through August. Of the sales expected to be made during the six months from March through August, how much will still be uncollected at the end of August? How much of this is expected to be collected later? 1) 28. XPercent-of-sales method (L04-3) The Manning Company has financial statements as shown next, which are representative of the company's historical average. The firm is expecting a 35 percent increase in sales next year, and management is concerned about the company's need for external funds. The increase in sales is expected to be carried out without any expansion of fixed assets, but rather through more efficient asset utilization in the existing store. Among liabilities, only current liabilities vary directly with sales. Using the percent-of-sales method, determine whether the company has external financing needs, or a surplus of Page 121 funds. (Hint: A profit margin and payout ratio must be found from the income statement.) Income Statement Sales $250,000 Expenses 192,000 Earnings before interest and taxes $ 58,000 Interest 7,500 Earnings before taxes $ 50,500 Taxes 15,500 Earnings after taxes $ 35,000 Dividends $ 7,000 Rolanna Shoot Questions Balance Sheet Assets Liabilities and Stockholders Equity Cash $ 8,500 Accounts payable $ 26,400 Accounts receivable 63,000 Accrued wages 2,350 Inventory 91,000 Accrued taxes 3,750 Current assets $162,500 Current liabilities $ 32,500 Fixed assets 85,000 Notes payable 7,500 -->LOng-term debt 17,500 Common stock 125,000 Retained earnings 65,000 Total assets $247,500 Total liabilities and stockholders equity $247,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started