Question

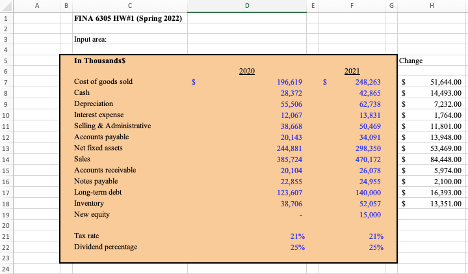

6. How would you describe the company' cash flows for 2021? Write a brief discussion. 7. In light of your discussion in th eprevious quesiotn,

6. How would you describe the company' cash flows for 2021? Write a brief discussion.

7. In light of your discussion in th eprevious quesiotn, do you think it is a good time for the company to expand business (i.e., buy more equipments/machines) at this time?

| 8. Please calculate the following Financial Ratios of the company, in year 2020 and 2021 respectively. Please briefly explain the trend of the company's financial position. | |||||||

| Ratio Category | Ratios | 2020 | 2021 | ||||

| Liquidity Ratio: | Current Ratio | ||||||

| Quick Ratio | |||||||

| Asset Management Ratio: | Inventory Turnover | ||||||

| Days Sales Outstanding | |||||||

| Fixed Asset Turnover | |||||||

| Total Asset Turnover | |||||||

| Debt Management Ratio: | Debt Ratio | ||||||

| Times interest earned (TIE) | |||||||

| Profitabiltiy Ratio: | Net Profit Margin | ||||||

| Operating Profit Margin | |||||||

| Basic Earning Power | |||||||

| ROA | |||||||

| ROE | |||||||

9. Please calculate the Du-Pont Ratio in 2020 and 2021, respectively. Please explain the changes over years.

10. By the end of year 2021, the firm has 100 millions of common shares. Stock price per share is $40 in 2020 and $50 in 2021.

Please calculate the P/E ratio and EPS in 2020 and 2021, respectively. Please explain the changes over years.

| Number of Common Shares | 100,000,000 |

| Stock price in 2020 | |

| Net Income | |

| Dividend | |

| EPS in 2020 | |

| P/E Ratio in 2020 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started