Answered step by step

Verified Expert Solution

Question

1 Approved Answer

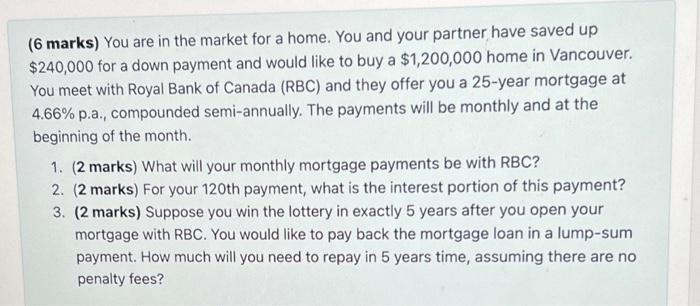

(6 marks) You are in the market for a home. You and your partner have saved up $240,000 for a down payment and would

(6 marks) You are in the market for a home. You and your partner have saved up $240,000 for a down payment and would like to buy a $1,200,000 home in Vancouver. You meet with Royal Bank of Canada (RBC) and they offer you a 25-year mortgage at 4.66% p.a., compounded semi-annually. The payments will be monthly and at the beginning of the month. 1. (2 marks) What will your monthly mortgage payments be with RBC? 2. (2 marks) For your 120th payment, what is the interest portion of this payment? 3. (2 marks) Suppose you win the lottery in exactly 5 years after you open your mortgage with RBC. You would like to pay back the mortgage loan in a lump-sum payment. How much will you need to repay in 5 years time, assuming there are no penalty fees?

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Converting into compound interest Semiannually interest monthy 002332 1 00466 16 12 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started