Answered step by step

Verified Expert Solution

Question

1 Approved Answer

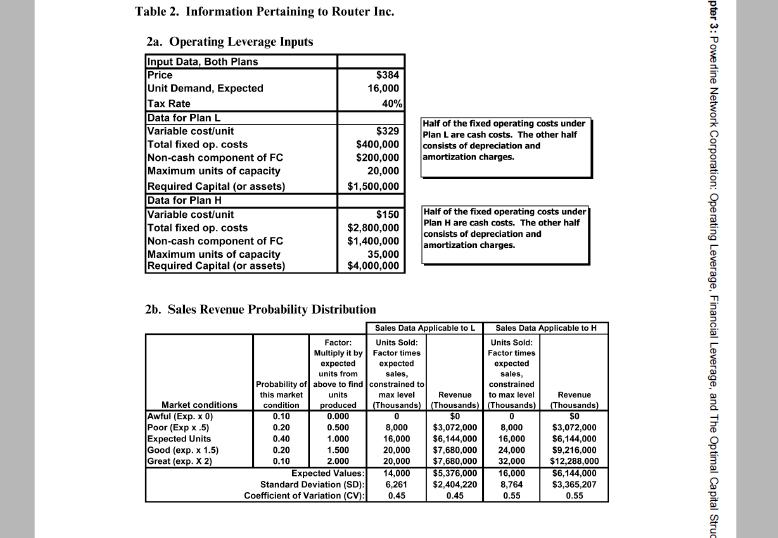

Now consider Routers use of financial leverage. Information Table 2 indicates the relationship between the amount of debt used and the cost of debt. What

Now consider Router’s use of financial leverage. Information Table 2 indicates the relationship between the amount of debt used and the cost of debt. What is the source of that information, and how reliable would you expect it to be?

Table 2. Information Pertaining to Router Inc. 2a. Operating Leverage Inputs Input Data, Both Plans Price Unit Demand, Expected Tax Rate Data for Plan L Variable cost/unit Total fixed op. costs Non-cash component of FC Maximum units of capacity Required Capital (or assets) Data for Plan H Variable cost/unit Total fixed op. costs Non-cash component of FC Maximum units of capacity Required Capital (or assets) $384 16,000 40% Half of the fixed operating costs under Plan L are cash costs. The other half consists of depreciation and amortization charges. $329 $400,000 $200,000 20,000 $1,500,000 Half of the fixed operating costs under Plan H are cash costs. The other half consists of depreciation and amortization charges. $150 $2,800,000 $1,400,000 35,000 $4,000,000 2b. Sales Revenue Probability Distribution Sales Data Applicable to L Sales Data Applicable to H Factor: Units Sold: Units Sold: Multiply it by Factor times expected sales, Probability of above to find constrained to max level Factor times expected expected sales, units from constrained this market units Revenue to max level Revenue Market conditions Awful (Exp. x 0) Poor (Exp x .5) Expected Units Good (exp. 1.5) Great (exp. X 2) (Thousands) (Thousands) (Thousands) $0 $3,072,000 $6,144,000 $7,680,000 $7,680,000 $5,376,000 condition produced (Thousands) 0.10 0.000 0.20 0.500 8,000 16,000 20,000 8,000 16,000 $3,072,000 $6,144,000 $9,216,000 0.40 1.000 0.20 1.500 24,000 2.000 Expected Values: Standard Deviation (SD): Coefficient of Variation (CV): 0.10 20,000 14,000 32,000 $12,288,000 16,000 $6,144,000 6,261 0,45 $2,404,220 0.45 8,764 0.55 $3,365,207 0.55 pter 3: Powerline Network Corporation: Ope rating Leverage, Financial Leverage, and The Optimal Capital Struc

Step by Step Solution

★★★★★

3.55 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

As the question has suggested the use of financial leverage the source of information of the data co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d64ea0cefe_175184.pdf

180 KBs PDF File

635d64ea0cefe_175184.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started