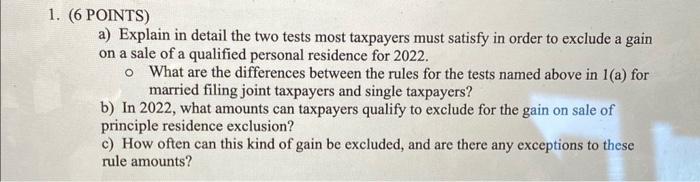

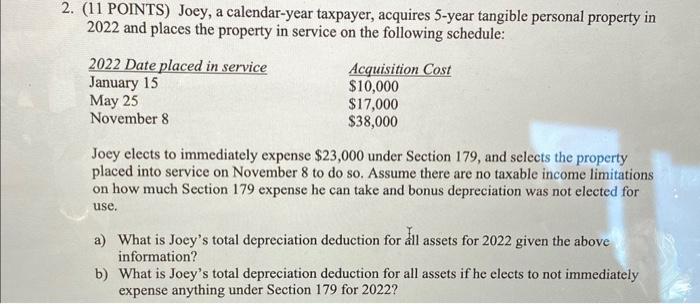

(6 POINTS) a) Explain in detail the two tests most taxpayers must satisfy in order to exclude a gain on a sale of a qualified personal residence for 2022. - What are the differences between the rules for the tests named above in 1(a) for married filing joint taxpayers and single taxpayers? b) In 2022, what amounts can taxpayers qualify to exclude for the gain on sale of principle residence exclusion? c) How often can this kind of gain be excluded, and are there any exceptions to these rule amounts? (11 POINTS) Joey, a calendar-year taxpayer, acquires 5-year tangible personal property in 2022 and places the property in service on the following schedule: Joey elects to immediately expense $23,000 under Section 179, and selects the property placed into service on November 8 to do so. Assume there are no taxable income limitations on how much Section 179 expense he can take and bonus depreciation was not elected for use. a) What is Joey's total depreciation deduction for all assets for 2022 given the above information? b) What is Joey's total depreciation deduction for all assets if he elects to not immediately expense anything under Section 179 for 2022 ? (6 POINTS) a) Explain in detail the two tests most taxpayers must satisfy in order to exclude a gain on a sale of a qualified personal residence for 2022. - What are the differences between the rules for the tests named above in 1(a) for married filing joint taxpayers and single taxpayers? b) In 2022, what amounts can taxpayers qualify to exclude for the gain on sale of principle residence exclusion? c) How often can this kind of gain be excluded, and are there any exceptions to these rule amounts? (11 POINTS) Joey, a calendar-year taxpayer, acquires 5-year tangible personal property in 2022 and places the property in service on the following schedule: Joey elects to immediately expense $23,000 under Section 179, and selects the property placed into service on November 8 to do so. Assume there are no taxable income limitations on how much Section 179 expense he can take and bonus depreciation was not elected for use. a) What is Joey's total depreciation deduction for all assets for 2022 given the above information? b) What is Joey's total depreciation deduction for all assets if he elects to not immediately expense anything under Section 179 for 2022