Answered step by step

Verified Expert Solution

Question

1 Approved Answer

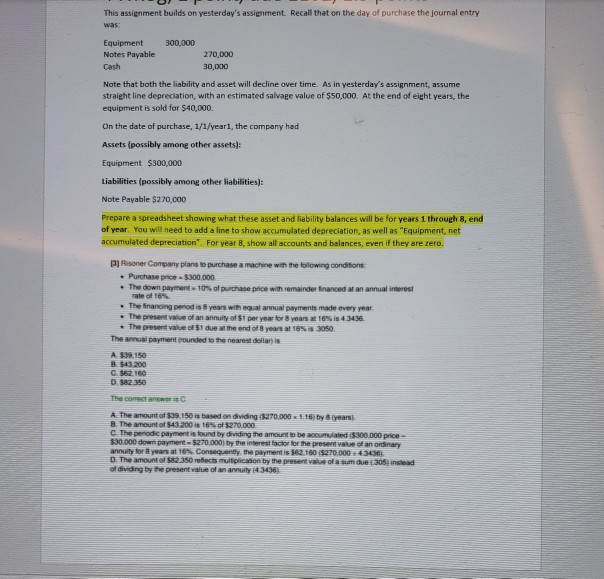

This assignment builds on yesterday's assignment. Recall that on the day of purchase the journal entry was Equipment 300,000 Notes Payable 270,000 Cash 30,000 Note

This assignment builds on yesterday's assignment. Recall that on the day of purchase the journal entry was Equipment 300,000 Notes Payable 270,000 Cash 30,000 Note that both the liability and asset will decline over time. As in yesterday's assignment, assume straight line depreciation, with an estimated salvage value of $50,000. At the end of eight years, the equipment is sold for $40,000. On the date of purchase, 1/1/year1, the company had Assets (possibly among other assets) Equipment $300,000 Liabilities (possibly among other liabilities): Note Payable $270,000 Prepare a spreadsheet shawing what these asset and liability balances will be forr years 1 through 8, end of year You will need to add a line to show accumulated depreciation, as well as "Equipment, net accumulated depreciation" For year 8, show all accounts and balances, even if they are zero. IRisoner Company plans to purchase a machine with the toilowing conditions Purchase price-$300,000 The down payment 10% of purchase price with remainder fnanced at an annual interest rate of 16% The inancing period is 8 years with equal annual payments made every year The present value of an annuity of $1 per year for 8 years at 16% is 4.3436 The present value of $1 due al the end of 8 years at 16% is 3050 The annual payment rounded to the nearest dellar) is A $39.150 B $43,200 C. $62.160 D s82.350 The comect answeris A The amount of $39.150 is based on dividing ($270,000 16) by 8 (years) B. The amount of $43.200 is 16% of $270.000 C The periodic payment is found by dividing the amount to be acoumulated (S300.000 price- $30000 down payment-$270,000) by the interest factor for the present value of an ondinary annuity for 8 years at 16% Consequenty the payment is $62.160 ($27000043436 D The amount of $82.350 refects multiplicaion by the present value of a sum due (305) instead of dividing by the present value of an annuity 4.3436

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started