Answered step by step

Verified Expert Solution

Question

1 Approved Answer

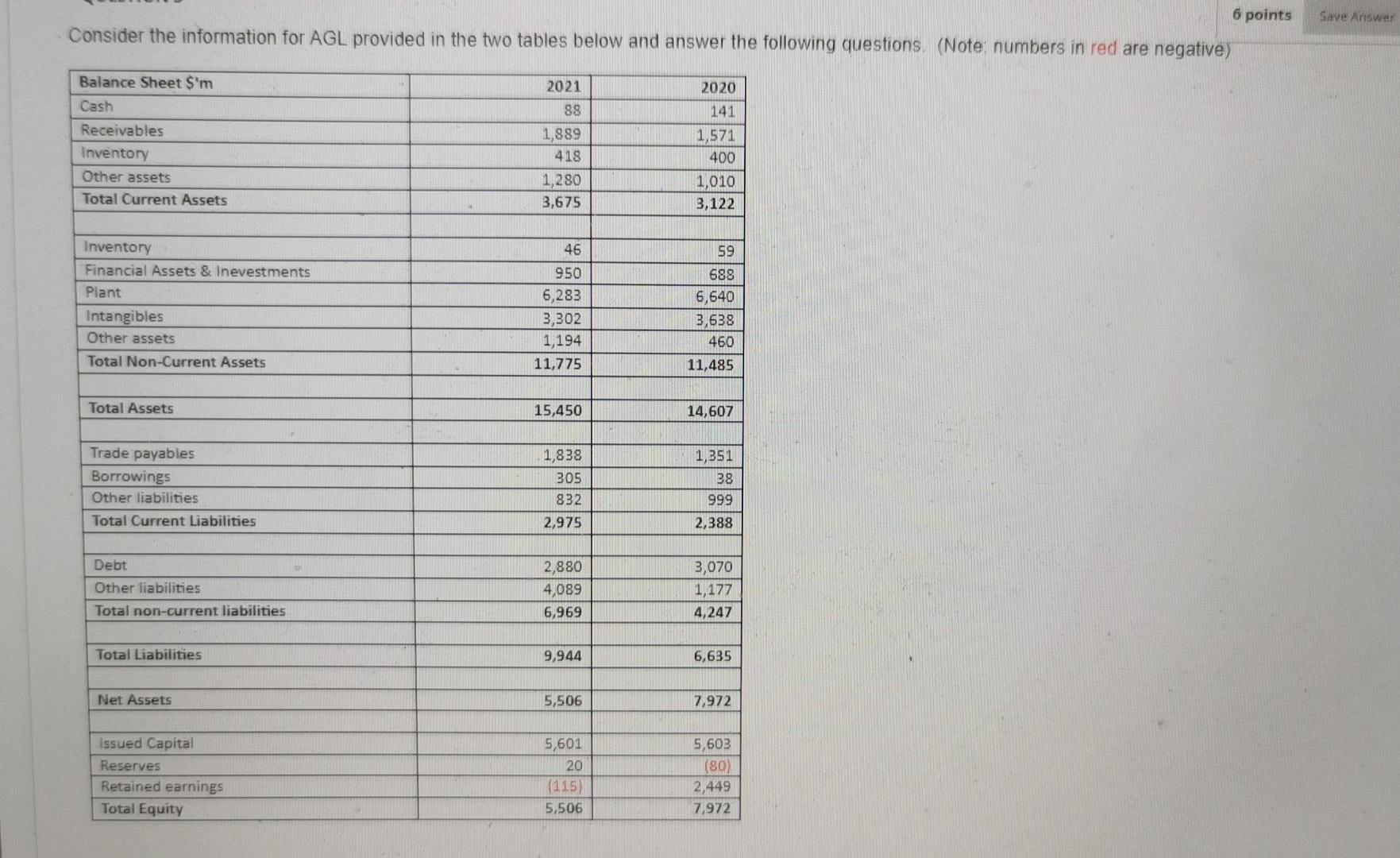

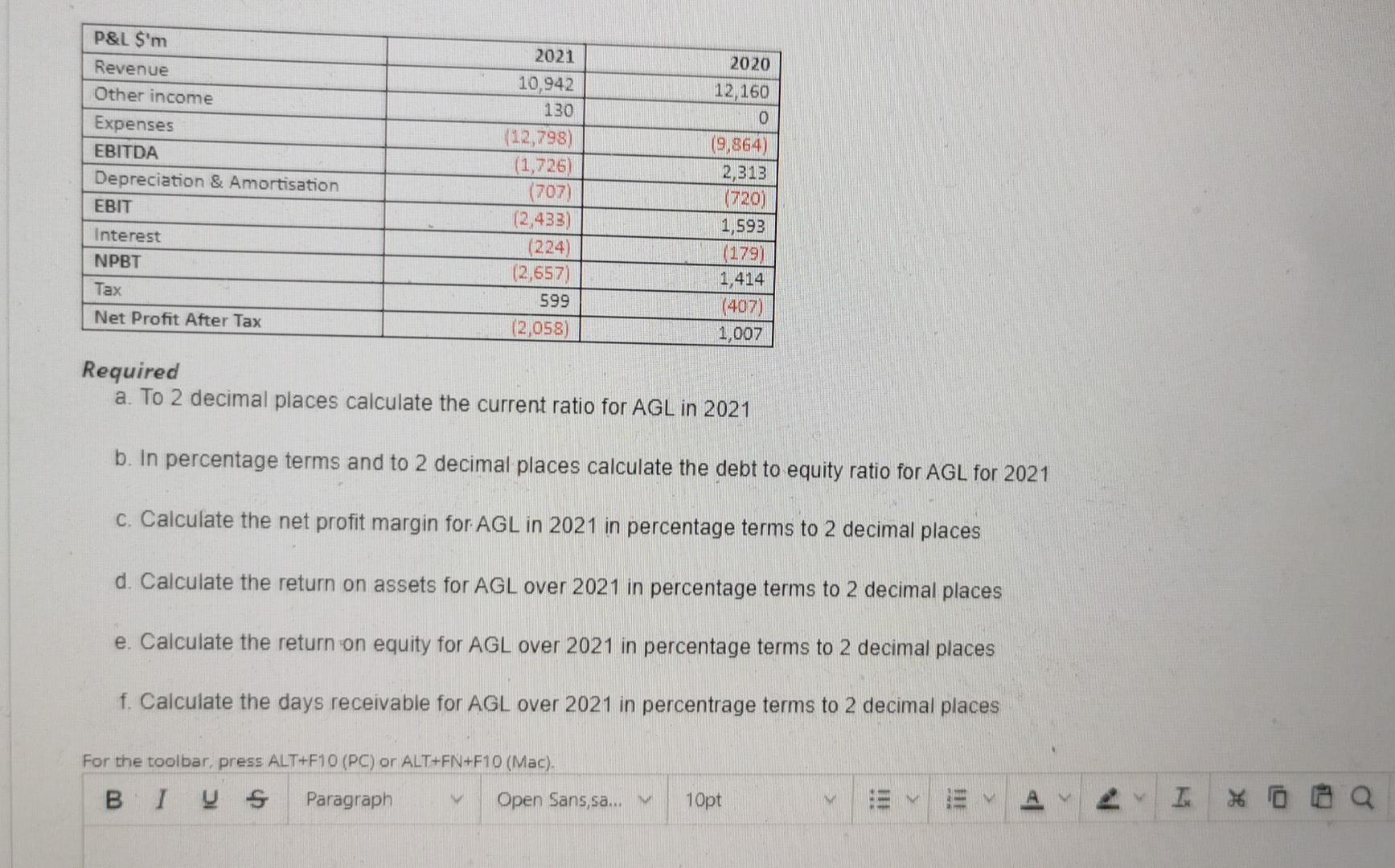

6 points Save Answer Consider the information for AGL provided in the two tables below and answer the following questions. (Note: numbers in red are

6 points Save Answer Consider the information for AGL provided in the two tables below and answer the following questions. (Note: numbers in red are negative) 2021 88 Balance Sheet S'm Cash Receivables Inventory Other assets Total Current Assets 1,889 418 1,280 3,675 2020 141 1,571 400 1,010 3,122 Inventory Financial Assets & Inevestments Plant Intangibles Other assets Total Non-Current Assets 46 950 6,283 3,302 1,194 11,775 59 688 6,640 3,638 460 11,485 Total Assets 15,450 14,607 Trade payables Borrowings Other liabilities Total Current Liabilities 1,838 305 832 2,975 1,351 38 999 2,388 Debt Other liabilities Total non-current liabilities 2,880 4,089 6,969 3,070 1,177 4,247 Total Liabilities 9,944 6,635 Net Assets 5,506 7,972 Issued Capital Reserves Retained earnings Total Equity 5,601 20 (115) 5,506 5,603 (80) 2,449 7,972 P&L S'm Revenue Other income Expenses EBITDA Depreciation & Amortisation EBIT 2021 10,942 130 (12,798) (1,726) (707) (2,433) (224) (2,657) 599 (2,058) 2020 12,160 0 (9,864) 2,313 (720) 1,593 (179) 1,414 (407) 1,007 Interest NPBT Tax Net Profit After Tax Required a. To 2 decimal places calculate the current ratio for AGL in 2021 b. In percentage terms and to 2 decimal places calculate the debt to equity ratio for AGL for 2021 C. Calculate the net profit margin for AGL in 2021 in percentage terms to 2 decimal places d. Calculate the return on assets for AGL over 2021 in percentage terms to 2 decimal places e. Calculate the return on equity for AGL over 2021 in percentage terms to 2 decimal places f. Calculate the days receivable for GL over 2021 in percentage terms to 2 decimal places For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac), I ps Paragraph Open Sans,sa... 10pt iii !!! A IK K

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started