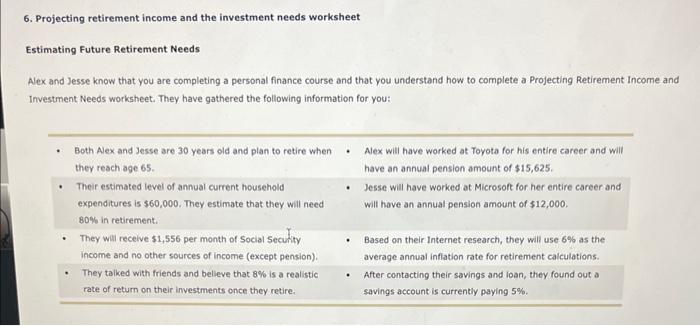

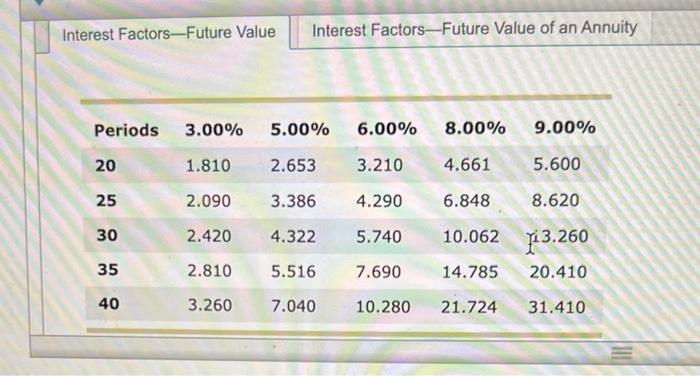

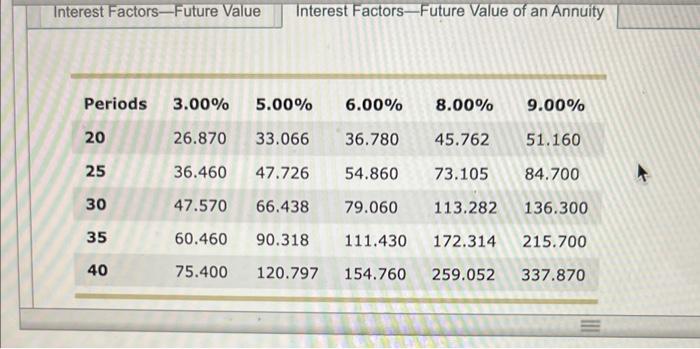

6. Projecting retirement income and the investment needs worksheet Estimating Future Retirement Needs Alex and Jesse know that you are completing a personal finance course and that you understand how to complete a Projecting Retirement Income and Investment Needs worksheet. They have gathered the following information for you: Interest Factors-Future Value Interest Factors-Future Value Interest Factors-Future Value of an Annuity \begin{tabular}{|l|llllll|} \hline Periods & 3.00% & 5.00% & 6.00% & 8.00% & 9.00% \\ \hline 20 & 26.870 & 33.066 & 36.780 & 45.762 & 51.160 \\ \hline 25 & 36.460 & 47.726 & 54.860 & 73.105 & 84.700 \\ \hline 30 & 47.570 & 66.438 & 79.060 & 113.282 & 136.300 \\ \hline 35 & 60.460 & 90.318 & 111.430 & 172.314 & 215.700 \\ \hline 40 & 75.400 & 120.797 & 154.760 & 259.052 & 337.870 \\ \hline \end{tabular} Complete the following sections of the worksheet. Note: 1) Every field must have a value (if your answer is zero, type "0"); 2) some values are repeated; and 3) round the average annual inflation rate and the expected rate of return on investments prior to retirement to three decimal places, and round everything else to two decimal places (or the nearest whole number if it does not let you enter decimals). Projecting Retirement Income and Investment Needs III. Inflation Factor J. Expected average annual inflation rate over the period to retirement K. Inflation factor (a) Years to retirement (A) (b) Average annual inflation rate (J) L. Size of inflation-adjusted annual shortfall Projecting Retirement Income and Investment Needs IV. Funding the Shortfall M. Anticipated return on assets held after retirement N. Amount of retirement fund required (your nest egg) O. Expected rate of return on investments prior to retirement P. Compound interest factor (a) Years to retirement (A) (b) Expected rate of return on investments prior to retirement (O)5% Q. Annual savings required to fund retirement nest egg (NP) 6. Projecting retirement income and the investment needs worksheet Estimating Future Retirement Needs Alex and Jesse know that you are completing a personal finance course and that you understand how to complete a Projecting Retirement Income and Investment Needs worksheet. They have gathered the following information for you: Interest Factors-Future Value Interest Factors-Future Value Interest Factors-Future Value of an Annuity \begin{tabular}{|l|llllll|} \hline Periods & 3.00% & 5.00% & 6.00% & 8.00% & 9.00% \\ \hline 20 & 26.870 & 33.066 & 36.780 & 45.762 & 51.160 \\ \hline 25 & 36.460 & 47.726 & 54.860 & 73.105 & 84.700 \\ \hline 30 & 47.570 & 66.438 & 79.060 & 113.282 & 136.300 \\ \hline 35 & 60.460 & 90.318 & 111.430 & 172.314 & 215.700 \\ \hline 40 & 75.400 & 120.797 & 154.760 & 259.052 & 337.870 \\ \hline \end{tabular} Complete the following sections of the worksheet. Note: 1) Every field must have a value (if your answer is zero, type "0"); 2) some values are repeated; and 3) round the average annual inflation rate and the expected rate of return on investments prior to retirement to three decimal places, and round everything else to two decimal places (or the nearest whole number if it does not let you enter decimals). Projecting Retirement Income and Investment Needs III. Inflation Factor J. Expected average annual inflation rate over the period to retirement K. Inflation factor (a) Years to retirement (A) (b) Average annual inflation rate (J) L. Size of inflation-adjusted annual shortfall Projecting Retirement Income and Investment Needs IV. Funding the Shortfall M. Anticipated return on assets held after retirement N. Amount of retirement fund required (your nest egg) O. Expected rate of return on investments prior to retirement P. Compound interest factor (a) Years to retirement (A) (b) Expected rate of return on investments prior to retirement (O)5% Q. Annual savings required to fund retirement nest egg (NP)