Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6. Reinvestment Rate. Sarah is considering the purchase of a 20 -year 7% coupon bond selling for $816 and a par value of $1,000. The

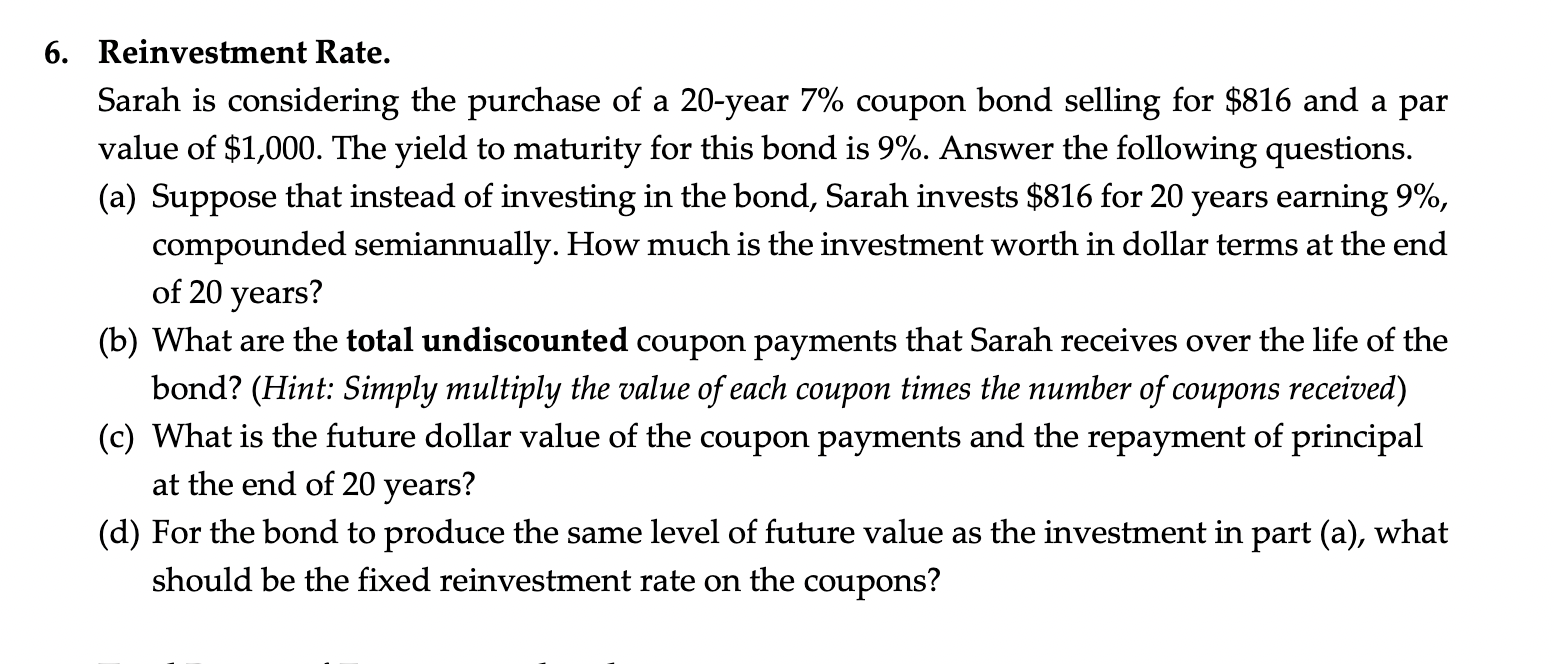

6. Reinvestment Rate. Sarah is considering the purchase of a 20 -year 7% coupon bond selling for $816 and a par value of $1,000. The yield to maturity for this bond is 9%. Answer the following questions. (a) Suppose that instead of investing in the bond, Sarah invests $816 for 20 years earning 9%, compounded semiannually. How much is the investment worth in dollar terms at the end of 20 years? (b) What are the total undiscounted coupon payments that Sarah receives over the life of the bond? (Hint: Simply multiply the value of each coupon times the number of coupons received) (c) What is the future dollar value of the coupon payments and the repayment of principal at the end of 20 years? (d) For the bond to produce the same level of future value as the investment in part (a), what should be the fixed reinvestment rate on the coupons

6. Reinvestment Rate. Sarah is considering the purchase of a 20 -year 7% coupon bond selling for $816 and a par value of $1,000. The yield to maturity for this bond is 9%. Answer the following questions. (a) Suppose that instead of investing in the bond, Sarah invests $816 for 20 years earning 9%, compounded semiannually. How much is the investment worth in dollar terms at the end of 20 years? (b) What are the total undiscounted coupon payments that Sarah receives over the life of the bond? (Hint: Simply multiply the value of each coupon times the number of coupons received) (c) What is the future dollar value of the coupon payments and the repayment of principal at the end of 20 years? (d) For the bond to produce the same level of future value as the investment in part (a), what should be the fixed reinvestment rate on the coupons Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started