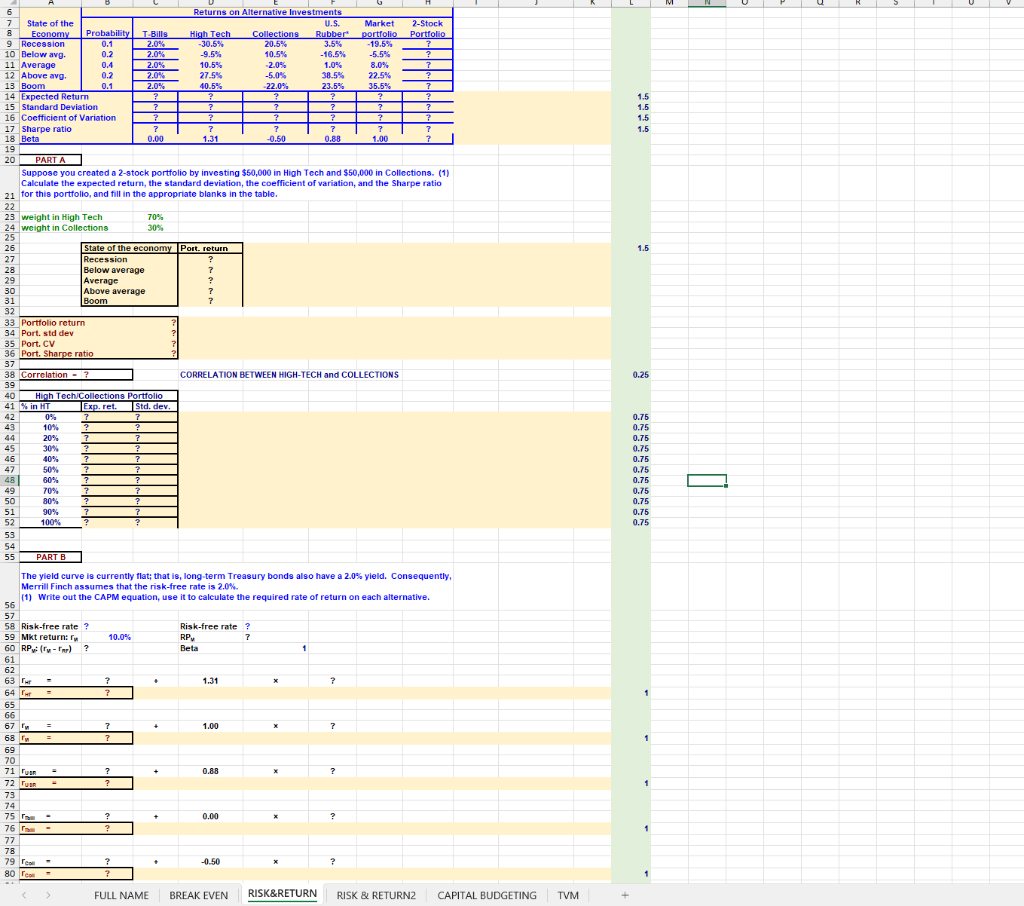

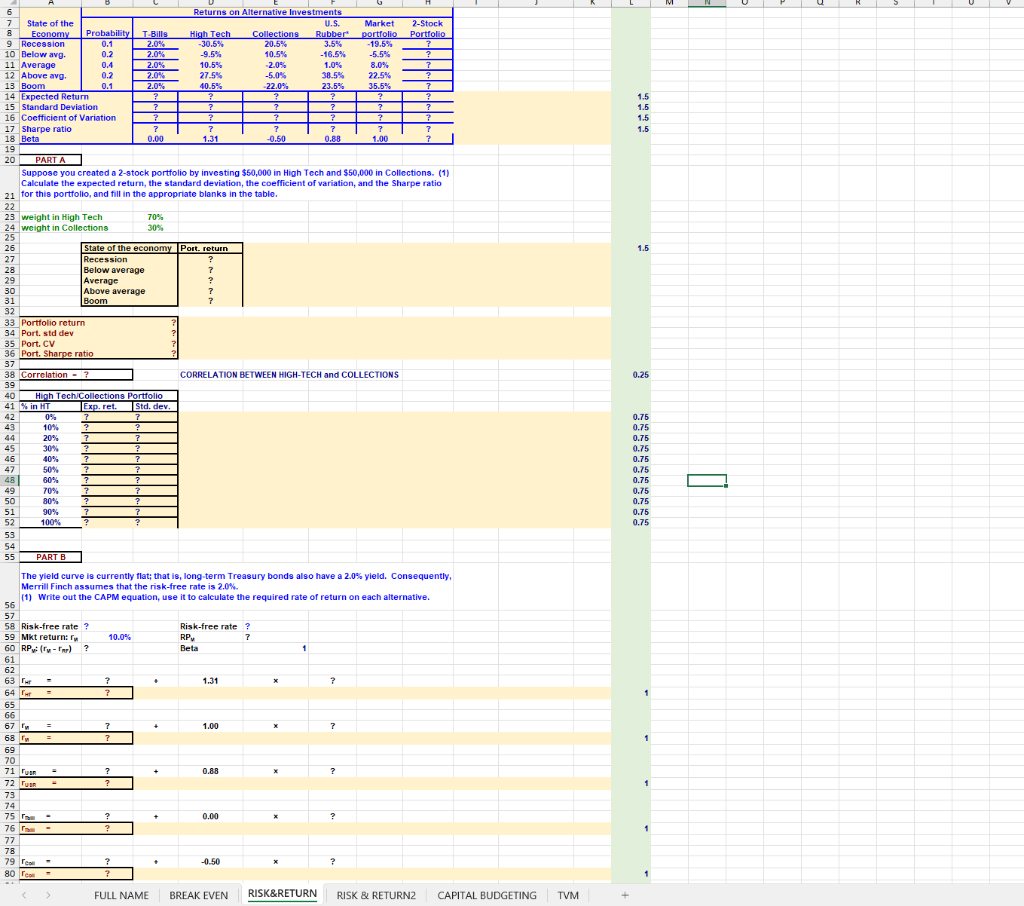

6 Returns on Alternative Investments 7 8 Probability T-Bills 0.1 2.0% U.S. Collections Rubber 20.5% 3.5% -16.5% High Tech -30.5% -9.5% 9 Recession Market 2-Stock portfolio Portfolio -19.5% ? 10 Below avg. 0.2 2.0% 10.5% -5.5% ? 11 Average 0.4 2.0% 10.5% -2.0% 1.0% 8.0% ? 12 Above avg. 0.2 2.0% 27.5% -5.0% 38.5% 22.5% ? 13 Boom 0.1 2.0% 40.5% -22.0% 23.5% 35.5% ? 14 Expected Return ? ? ? ? ? ? 15 Standard Deviation ? ? ? ? ? ? 16 Coefficient of Variation ? ? ? ? 17 Sharpe ratio ? ? ? ? ? ? 18 Beta 0.00 1.31 -0.50 0.88 1.00 ? 19 20 PART A Suppose you created a 2-stock portfolio by investing $50,000 in High Tech and $50,000 in Collections. (1) Calculate the expected return, the standard deviation, the coefficient of variation, and the Sharpe ratio expecteutetum 21 for this portfolio, and fill in the appropriate blanks in the table. 22 23 weight in High Tech 70% 30% 24 weight in Collections. 25 26 State of the economy Port. return Recession 27 ? 28 Below average 29 Average 30 ? Above average Boom 31 ? 32 33 Portfolio return 34 Port. std dev 35 Port, CV 36 Port. Sharpe ratio 37 38 Correlation ? CORRELATION BETWEEN HIGH-TECH and COLLECTIONS 39 40 High Tech/Collections 41 % in HT Exp. ret. 42 0% ? 43 10% ? 44 20% ? 45 30% ? ? 46 40% ? ? 47 50% ? ? 48 60% ? ? 49 70% ? ? 50 80% ? ? 51 90% 7 52 100% ? ? 53 54 55 PART B The yield curve is currently flat; that is, long-term Treasury bonds also have a 2.0% yield. Consequently, Merrill Finch assumes that the risk-free rate is 2.0%. (1) Write out the CAPM equation, use it to calculate the required rate of return on each alternative. 56 57 58 Risk-free rate ? 59 Mkt return: 10.0% Risk-free rate ? RP ? Beta 60 RP: (-) ? 61 62 63 H - 1.31 ? 64 H 65 66 67 1.00 ? 68 m 69 70 71 Tu 0.88 ? 72 Tu 73 74 75 0.00 ? 76 77 78 79 -0.50 ? 80 BREAK EVEN RISK & RETURN2 CAPITAL BUDGETING State of the Economy = - Portfolio Std. dev. ? ? ? ? ? ? ? ? ? ? ? ? ? FULL NAME + ? ? x RISK&RETURN ? TVM 1.5 1.5 1.5 1.5 1.5 0.25 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 1 1 6 Returns on Alternative Investments 7 8 Probability T-Bills 0.1 2.0% U.S. Collections Rubber 20.5% 3.5% -16.5% High Tech -30.5% -9.5% 9 Recession Market 2-Stock portfolio Portfolio -19.5% ? 10 Below avg. 0.2 2.0% 10.5% -5.5% ? 11 Average 0.4 2.0% 10.5% -2.0% 1.0% 8.0% ? 12 Above avg. 0.2 2.0% 27.5% -5.0% 38.5% 22.5% ? 13 Boom 0.1 2.0% 40.5% -22.0% 23.5% 35.5% ? 14 Expected Return ? ? ? ? ? ? 15 Standard Deviation ? ? ? ? ? ? 16 Coefficient of Variation ? ? ? ? 17 Sharpe ratio ? ? ? ? ? ? 18 Beta 0.00 1.31 -0.50 0.88 1.00 ? 19 20 PART A Suppose you created a 2-stock portfolio by investing $50,000 in High Tech and $50,000 in Collections. (1) Calculate the expected return, the standard deviation, the coefficient of variation, and the Sharpe ratio expecteutetum 21 for this portfolio, and fill in the appropriate blanks in the table. 22 23 weight in High Tech 70% 30% 24 weight in Collections. 25 26 State of the economy Port. return Recession 27 ? 28 Below average 29 Average 30 ? Above average Boom 31 ? 32 33 Portfolio return 34 Port. std dev 35 Port, CV 36 Port. Sharpe ratio 37 38 Correlation ? CORRELATION BETWEEN HIGH-TECH and COLLECTIONS 39 40 High Tech/Collections 41 % in HT Exp. ret. 42 0% ? 43 10% ? 44 20% ? 45 30% ? ? 46 40% ? ? 47 50% ? ? 48 60% ? ? 49 70% ? ? 50 80% ? ? 51 90% 7 52 100% ? ? 53 54 55 PART B The yield curve is currently flat; that is, long-term Treasury bonds also have a 2.0% yield. Consequently, Merrill Finch assumes that the risk-free rate is 2.0%. (1) Write out the CAPM equation, use it to calculate the required rate of return on each alternative. 56 57 58 Risk-free rate ? 59 Mkt return: 10.0% Risk-free rate ? RP ? Beta 60 RP: (-) ? 61 62 63 H - 1.31 ? 64 H 65 66 67 1.00 ? 68 m 69 70 71 Tu 0.88 ? 72 Tu 73 74 75 0.00 ? 76 77 78 79 -0.50 ? 80 BREAK EVEN RISK & RETURN2 CAPITAL BUDGETING State of the Economy = - Portfolio Std. dev. ? ? ? ? ? ? ? ? ? ? ? ? ? FULL NAME + ? ? x RISK&RETURN ? TVM 1.5 1.5 1.5 1.5 1.5 0.25 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 1 1