Answered step by step

Verified Expert Solution

Question

1 Approved Answer

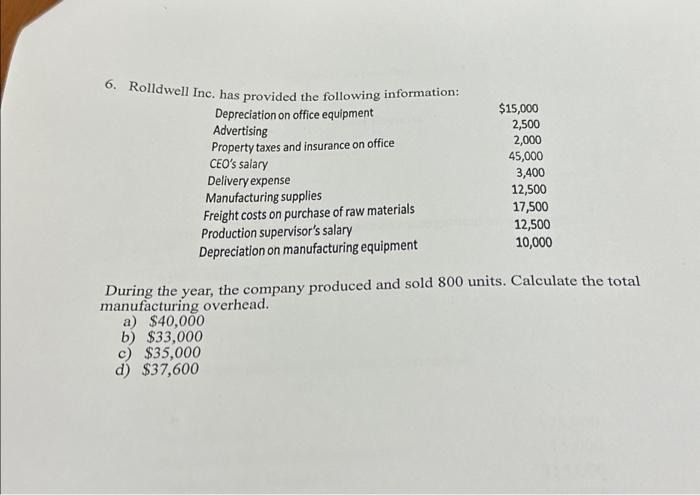

6. Rolldwell Inc. has provided the following information: Depreciation on office equipment Advertising Property taxes and insurance on office CEO's salary Delivery expense Manufacturing supplies

6. Rolldwell Inc. has provided the following information: Depreciation on office equipment Advertising Property taxes and insurance on office CEO's salary Delivery expense Manufacturing supplies Freight costs on purchase of raw materials Production supervisor's salary Depreciation on manufacturing equipment $15,000 2,500 2,000 45,000 a) $40,000 b) $33,000 c) $35,000 d) $37,600 3,400 12,500 17,500 12,500 10,000 During the year, the company produced and sold 800 units. Calculate the total manufacturing overhead.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started