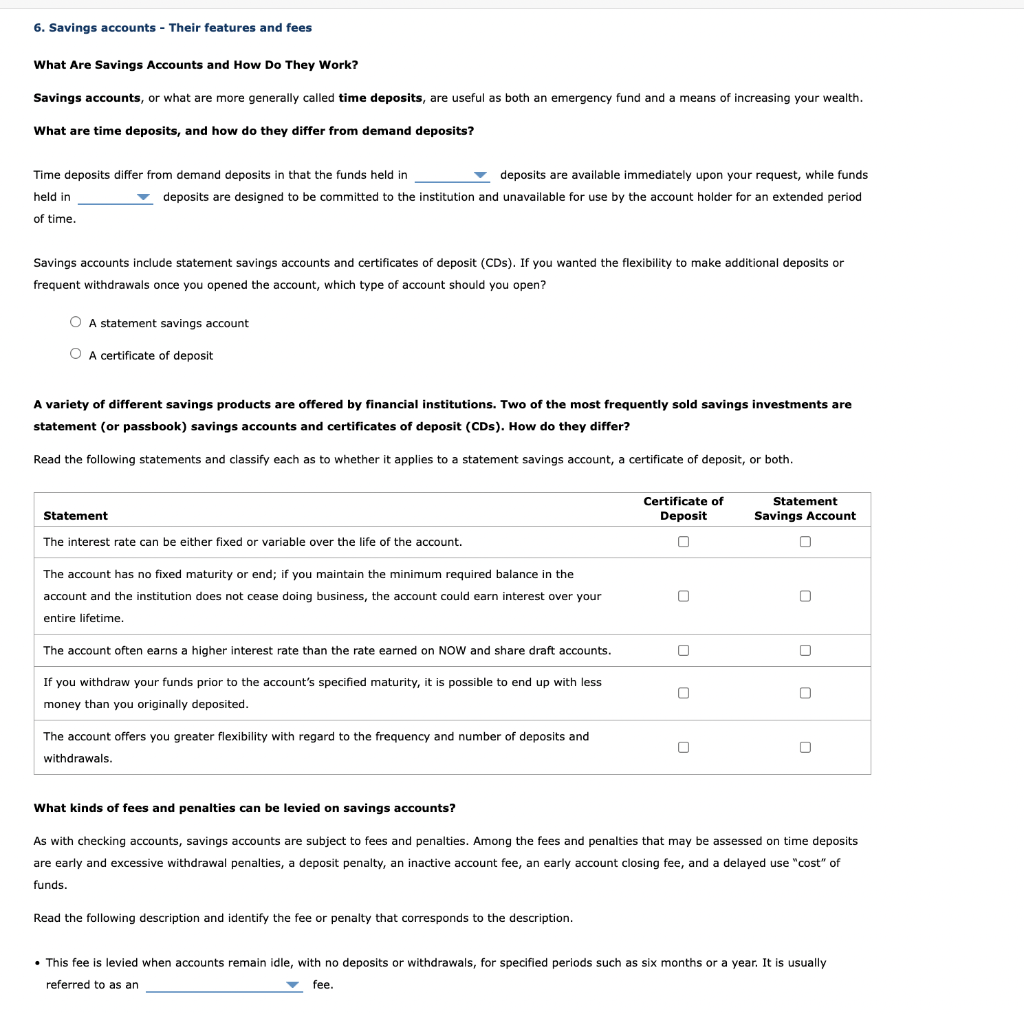

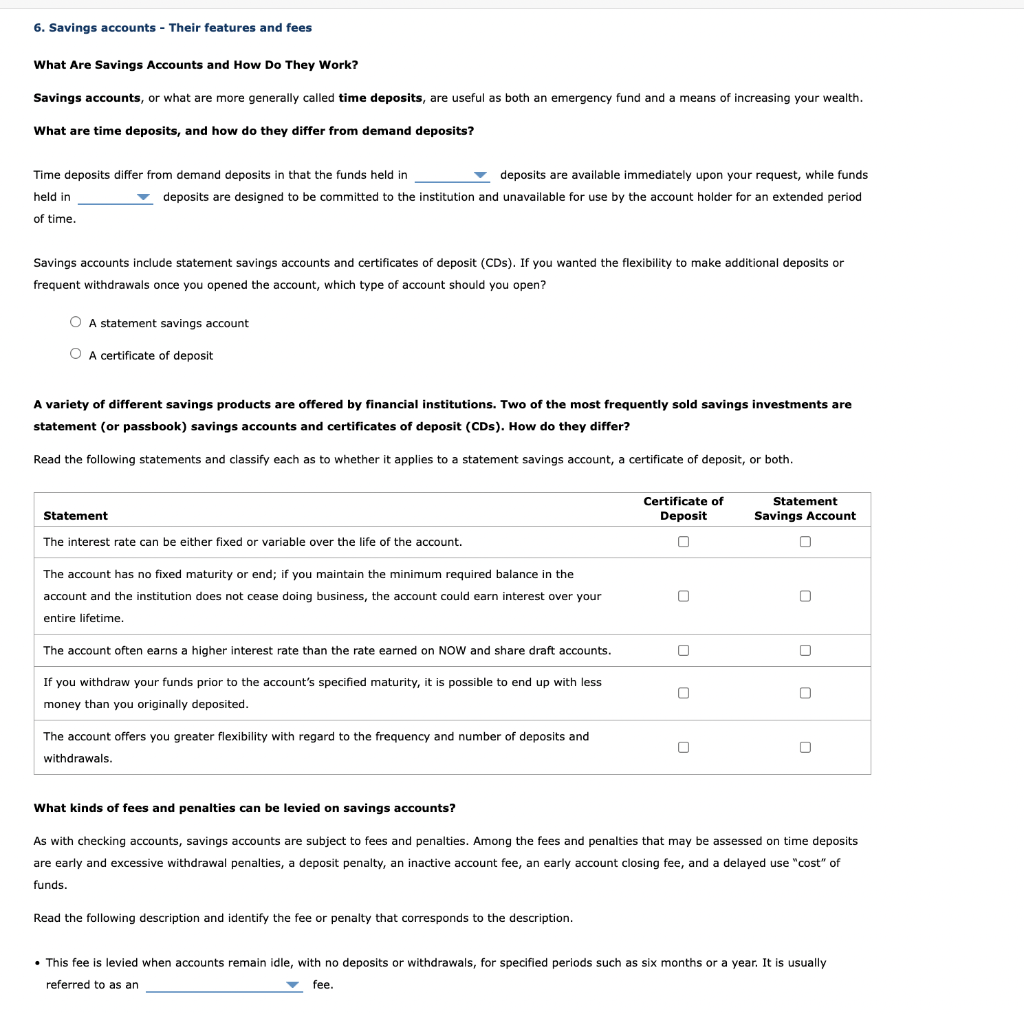

6. Savings accounts - Their features and fees What Are Savings Accounts and How Do They Work? Savings accounts, or what are more generally called time deposits, are useful as both an emergency fund and a means of increasing your wealth. What are time deposits, and how do they differ from demand deposits? Time deposits differ from demand deposits in that the funds held in deposits are available immediately upon your request, while funds held in deposits are designed to be committed to the institution and unavailable for use by the account holder for an extended period of time. Savings accounts include statement savings accounts and certificates of deposit (CDs). you wanted the flexibility to make additional deposits or frequent withdrawals once you opened the account, which type of account should you open? O A statement savings account O A certificate of deposit A variety of different savings products are offered by financial institutions. Two of the most frequently sold savings investments are statement (or passbook) savings accounts and certificates of deposit (CDs). How do they differ? Read the following statements and classify each as to whether it applies to a statement savings account, a certificate of deposit, or both. Certificate of Deposit Statement Statement Savings Account The interest rate can be either fixed or variable over the life of the account. The account has no fixed maturity or end; if you maintain the minimum required balance in the account and the institution does not cease doing business, the account could earn interest over your entire lifetime 0 O The account often earns a higher interest rate than the rate earned on NOW and share draft accounts. O O If you withdraw your funds prior to the account's specified maturity, it is possible to end up with less money than you originally deposited. 0 The account offers you greater flexibility with regard to the frequency and number of deposits and withdrawals. What kinds of fees and penalties can be levied on savings accounts? As with checking accounts, savings accounts are subject to fees and penalties. Among the fees and penalties that may be assessed on time deposits are early and excessive withdrawal penalties, a deposit penalty, an inactive account fee, an early account closing fee, and a delayed use "cost" of funds. Read the following description and identify the fee or penalty that corresponds to the description. This fee is levied when accounts remain idle, with no deposits or withdrawals, for specified periods such as six months or a year. It is usually referred to as an fee