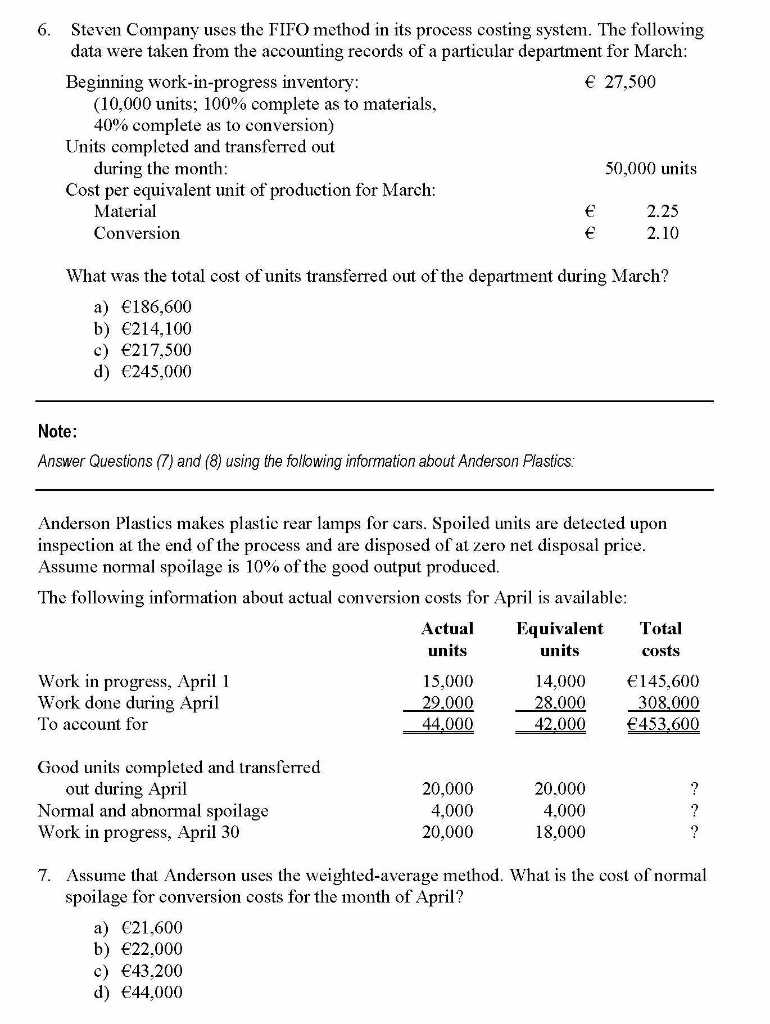

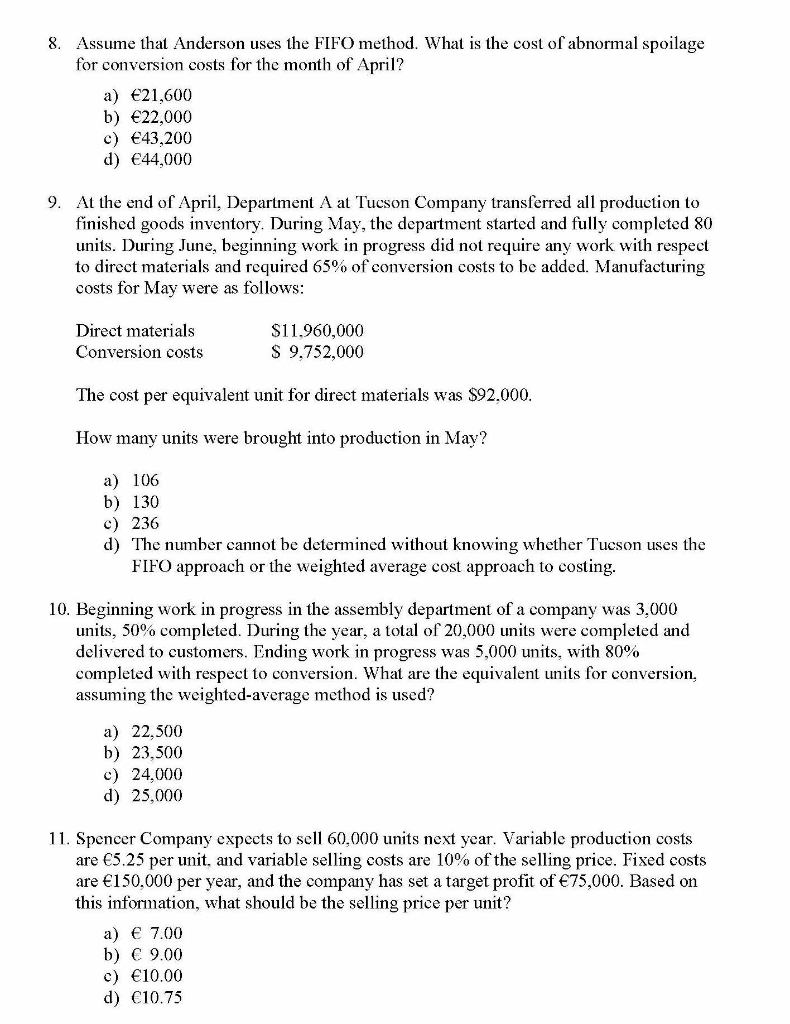

6. Steven Company uses the FIFO method in its process costing system. The following data were taken from the accounting records of a particular department for March: Beginning work-in-progress inventory: 27,500 (10,000 units; 100% complete as to materials, 40% complete as to conversion) Units completed and transferred out during the month: 50,000 units Cost per equivalent unit of production for March: Material 2.25 Conversion 2.10 What was the total cost of units transferred out of the department during March? a) 186,600 b) 214,100 c) 217,500 d) 245,000 Note: Answer Questions (7) and (8) using the following information about Anderson Plastics: Anderson Plastics makes plastic rear lamps for cars. Spoiled units are detected upon inspection at the end of the process and are disposed of at zero net disposal price. Assume normal spoilage is 10% of the good output produced. The following information about actual conversion costs for April is available: Actual Equivalent Total units units Work in progress, April 1 15,000 14,000 145,600 Work done during April 29,000 28.000 308,000 To account for 44,000 42.000 453,600 costs Good units completed and transferred out during April Normal and abnormal spoilage Work in progress, April 30 20,000 4,000 20,000 20.000 4.000 18,000 ? ? ? norm 7. Assume that Anderson uses the weighted average method. What is the cost spoilage for conversion costs for the month of April? a) 21.600 b) 22.000 c) 43,200 d) 44,000 8. Assume that Anderson uses the FIFO method. What is the cost of abnormal spoilage for conversion costs for the month of April? a) 21,600 b) 22,000 c) 43,200 d) 44,000 9. At the end of April, Department A at Tucson Company transferred all production to finished goods inventory. During May, the department started and fully completed 80 units. During June, beginning work in progress did not require any work with respect to direct materials and required 65% of conversion costs to be added. Manufacturing costs for May were as follows: Direct materials Conversion costs $11.960,000 $ 9,752,000 The cost per equivalent unit for direct materials was $92.000. How many units were brought into production in May? a) 106 b) 130 c) 236 d) The number cannot be determined without knowing whether Tucson uses the FIFO approach or the weighted average cost approach to costing. 10. Beginning work in progress in the assembly department of a company was 3,000 units, 50% completed. During the year, a total of 20,000 units were completed and delivered to customers. Ending work in progress was 5,000 units, with 80% completed with respect to conversion. What are the equivalent units for conversion, assuming the weighted average method is used? a) 22,500 b) 23,500 c) 24,000 d) 25.000 11. Spencer Company expects to sell 60,000 units next year. Variable production costs are 5.25 per unit, and variable selling costs are 10% of the selling price. Fixed costs are 150,000 per year, and the company has set a target profit of 75,000. Based on this information, what should be the selling price per unit? a) 7.00 b) C 9.00 c) 10.00 d) C10.75