Question

6) Suppose that a bond is purchased between coupon periods. The days between the settlement date and the next coupon period are 90. There

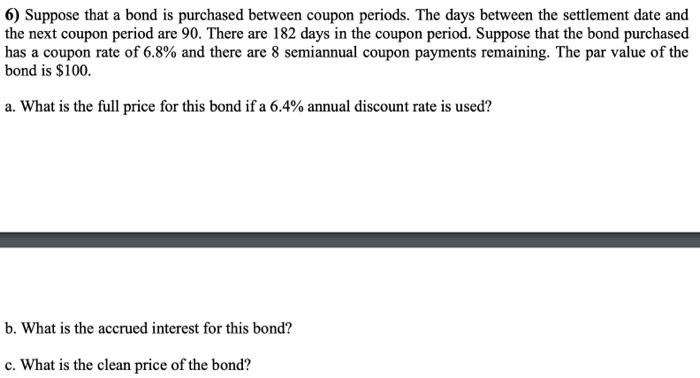

6) Suppose that a bond is purchased between coupon periods. The days between the settlement date and the next coupon period are 90. There are 182 days in the coupon period. Suppose that the bond purchased has a coupon rate of 6.8% and there are 8 semiannual coupon payments remaining. The par value of the bond is $100. a. What is the full price for this bond if a 6.4% annual discount rate is used? b. What is the accrued interest for this bond? c. What is the clean price of the bond?

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the full price accrued interest and clean price of the bond we can follow these steps a Calculate the full price of the bond The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Linear Algebra and Its Applications

Authors: David C. Lay

4th edition

321791541, 978-0321388834, 978-0321791542

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App