Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6 The recent global Corporate Tax Agreement through the OECD will lead to: O a. More tax being collected from the MNCs without any other

6

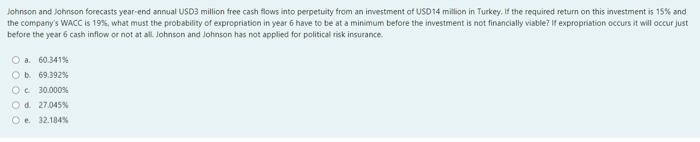

The recent global Corporate Tax Agreement through the OECD will lead to: O a. More tax being collected from the MNCs without any other actions by national governments. O b. Ongoing uncertainty until most national parliaments agree to it first. Oc. An immediately fairer tax system in which MNCs pay more tax to each host country. O d. MNCs slowing down their investing overseas. Oe. None of the options in this question are correct. Johnson and Johnson forecasts year-end annual USD3 million free cash flows into perpetuity from an investment of USD 14 million in Turkey. If the required return on this investment is 15% and the company's WACC IS 19%, what must the probability of expropriation in year 6 have to be at a minimum before the investment is not financially viable? If expropriation occurs it will occur just before the year 6 cash inflow or not at all. Johnson and Johnson has not applied for political risk insurance O a. 60.341% Ob. 69.392% OC 30.000 O d. 27.045 O e 32.184%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started