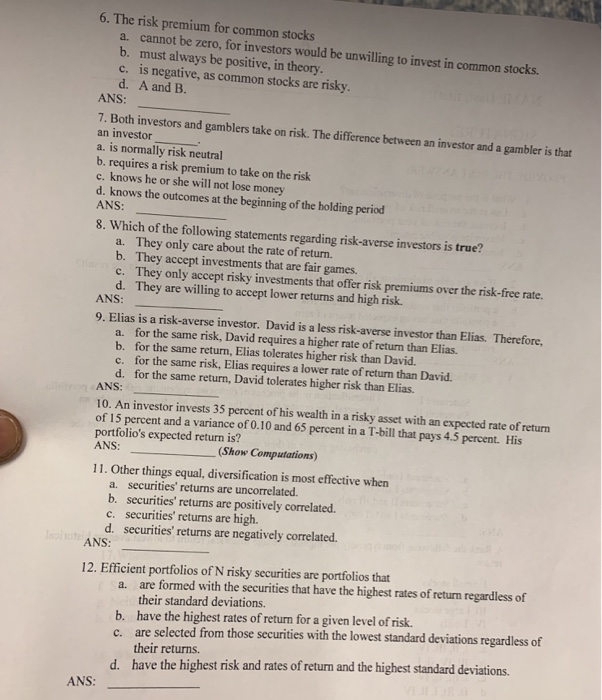

6. The risk premium for common stocks a. cannot be zero, for investors would be unwilling to invest in common stocks. b. must always be positive, in theory c. is negative, as common stocks are risky d. A and B ANS: 7. Both investors and gamblers take on risk. The difference between an investor and a gambler is that an investor a. is normally risk neutral b. requires a risk premium to take on the risk c. knows he or she will not lose money d. knows the outcomes at the beginning of the holding period ANS: 8. Which of the following statements regarding risk-averse investors is true? a. They only care about the rate of return. b. They accept investments that are fair games. c. They only accept risky investments that offer risk premiums over the risk-free rate. d. They are willing to accept lower returns and high risk. ANS: 9. Elias is a risk-averse investor. David is a less risk-averse investor than Elias. Therefore a. for the same risk, David requires a higher rate of return than Elias. b. for the same return, Elias tolerates higher risk than David. c. for the same risk, Elias requires a lower rate of return than David. d. for the same return, David tolerates higher risk than Elias ANS: 10. An investor invests 35 percent of his wealth in a risky asset with an expected rate of return of 15 percent and a variance of 0.10 and 65 percent in a T-bill that pays 4.5 percent. His portfolio's expected return is? ANS: Show Computations) 11. Other things equal, diversification is most effective when a. securities' returns are uncorrelated. b. securities' returns are positively correlated c. securities' returns are high d. securities' returns are negatively correlated. ANS: 12. Efficient portfolios of N risky securities are portfolios that are formed with the securities that have the highest rates of return regardless of a. their standard deviations. b. have the highest rates of return for a given level of risk c. are selected from those securities with the lowest standard deviations regardless of their returns. have the highest risk and rates of return and the highest standard deviations. d. ANS