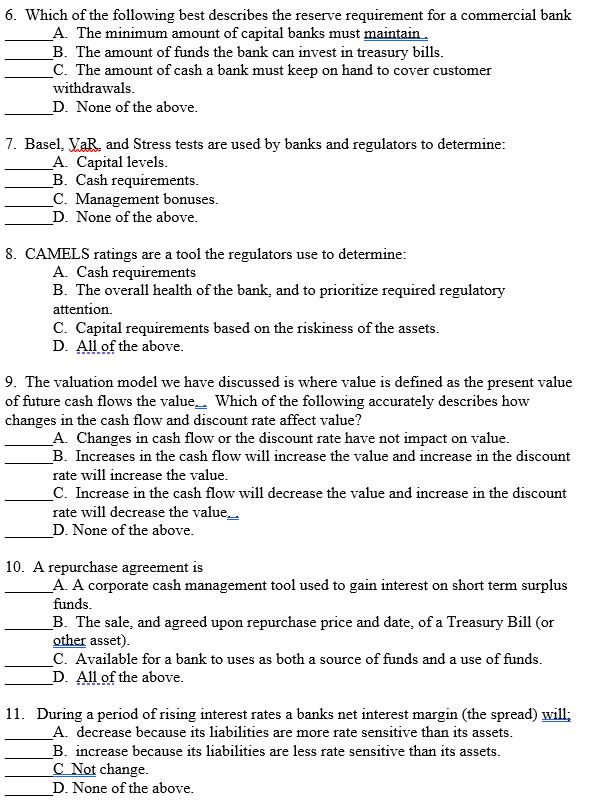

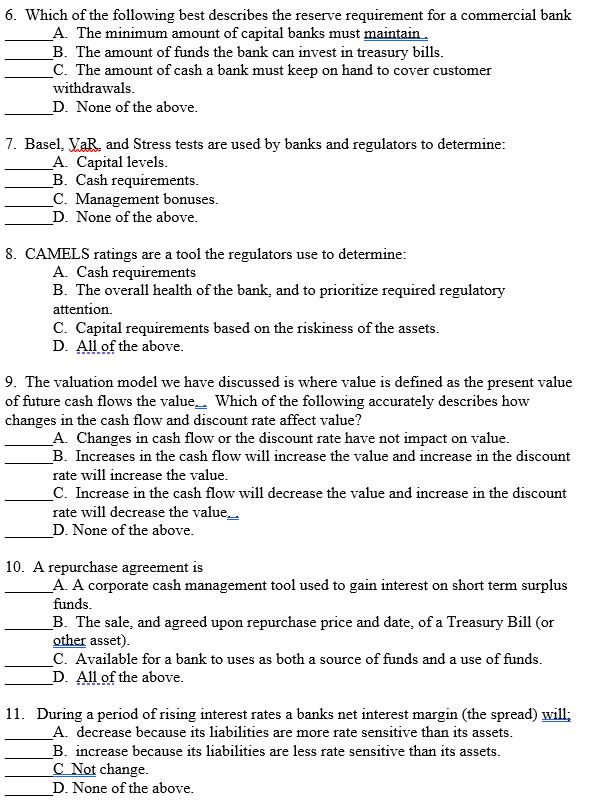

6. Which of the following best describes the reserve requirement for a commercial bank A. The minimum amount of capital banks must maintain B. The amount of funds the bank can invest in treasury bills. C. The amount of cash a bank must keep on hand to cover customer withdrawals. D. None of the above. 7. Basel, Var, and Stress tests are used by banks and regulators to determine: A. Capital levels. B. Cash requirements. C. Management bonuses. D. None of the above. 8. CAMELS ratings are a tool the regulators use to determine: A. Cash requirements B. The overall health of the bank, and to prioritize required regulatory attention. C. Capital requirements based on the riskiness of the assets. D. All of the above. 9. The valuation model we have discussed is where value is defined as the present value of future cash flows the value. Which of the following accurately describes how changes in the cash flow and discount rate affect value? A. Changes in cash flow or the discount rate have not impact on value. B. Increases in the cash flow will increase the value and increase in the discount rate will increase the value. C. Increase in the cash flow will decrease the value and increase in the discount rate will decrease the value.. D. None of the above. 10. A repurchase agreement is A. A corporate cash management tool used to gain interest on short term surplus funds. B. The sale, and agreed upon repurchase price and date, of a Treasury Bill (or other asset). C. Available for a bank to uses as both a source of funds and a use of funds. D. All of the above. 11. During a period of rising interest rates a banks net interest margin (the spread) will; A. decrease because its liabilities are more rate sensitive than its assets. B. increase because its liabilities are less rate sensitive than its assets. C Not change. D. None of the above. 6. Which of the following best describes the reserve requirement for a commercial bank A. The minimum amount of capital banks must maintain B. The amount of funds the bank can invest in treasury bills. C. The amount of cash a bank must keep on hand to cover customer withdrawals. D. None of the above. 7. Basel, Var, and Stress tests are used by banks and regulators to determine: A. Capital levels. B. Cash requirements. C. Management bonuses. D. None of the above. 8. CAMELS ratings are a tool the regulators use to determine: A. Cash requirements B. The overall health of the bank, and to prioritize required regulatory attention. C. Capital requirements based on the riskiness of the assets. D. All of the above. 9. The valuation model we have discussed is where value is defined as the present value of future cash flows the value. Which of the following accurately describes how changes in the cash flow and discount rate affect value? A. Changes in cash flow or the discount rate have not impact on value. B. Increases in the cash flow will increase the value and increase in the discount rate will increase the value. C. Increase in the cash flow will decrease the value and increase in the discount rate will decrease the value.. D. None of the above. 10. A repurchase agreement is A. A corporate cash management tool used to gain interest on short term surplus funds. B. The sale, and agreed upon repurchase price and date, of a Treasury Bill (or other asset). C. Available for a bank to uses as both a source of funds and a use of funds. D. All of the above. 11. During a period of rising interest rates a banks net interest margin (the spread) will; A. decrease because its liabilities are more rate sensitive than its assets. B. increase because its liabilities are less rate sensitive than its assets. C Not change. D. None of the above