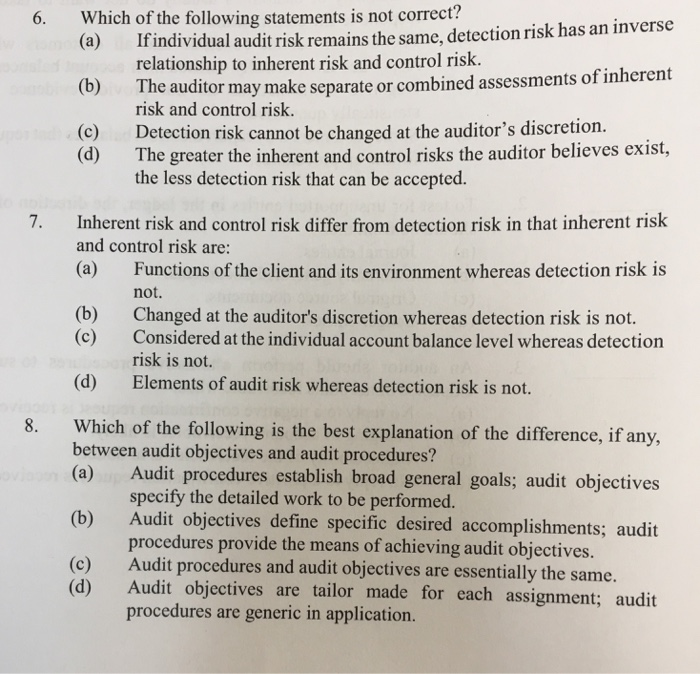

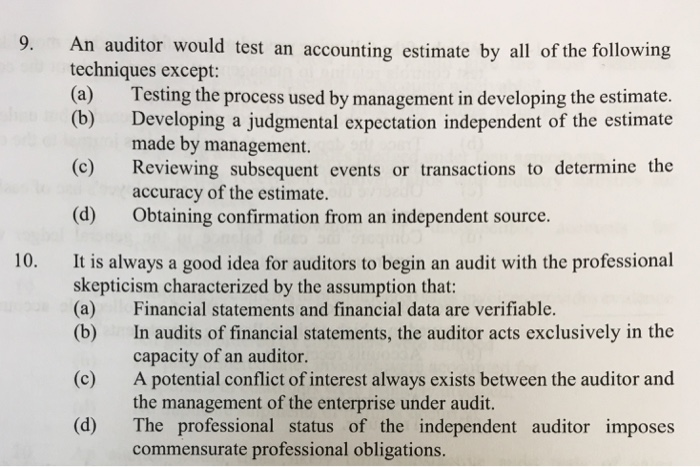

6. Which of the following statements is not correct? If (a) (b) (c) individual audit risk remains the same, detection risk has an inverse relationship to inherent risk and control risk. The auditor may make separate or combined assessments of inherent risk and control risk. Detection risk cannot be changed at the auditor's discretion The greater the inherent and control risks the auditor believes exist, the less detection risk that can be accepted. (d) 7. Inherent risk and control risk differ from detection risk in that inherent risk and control risk are: (a) Functions of the client and its environment whereas detection risk is not. Changed at the auditor's discretion whereas detection risk is not. Considered at the individual account balance level whereas detection risk is not. Elements of audit risk whereas detection risk is not. (b) (c) (d) 8. Which of the following is the best explanation of the difference, if any, between audit objectives and audit procedures? (a) Audit procedures establish broad general goals; audit objectives specify the detailed work to be performed. Audit objectives define specific desired accomplishments; audit procedures provide the means of achieving audit objectives. Audit procedures and audit objectives are essentially the same. (b) (c) (d) Audit objectives are tailor made for each assignment; audit procedures are generic in application. 9. An auditor would test an accounting estimate by all of the following techniques except: (a) Testing the process used by management in developing the estimate. (b) Developing a judgmental expectation independent of the estimate made by management. Reviewing subsequent events or transactions to determine accuracy of the estimate. Obtaining confirmation from an independent source. (c) the (d) It is always a good idea for auditors to begin an audit with the professional skepticism characterized by the assumption that: (a) Financial statements and financial data are verifiable. (b) In audits of financial statements, the auditor acts exclusively in the 10. capacity of an auditor. A potential conflict of interest always exists between the auditor and the management of the enterprise under audit. (c) (d) The professional status of the independent auditor imposes commensurate professional obligations