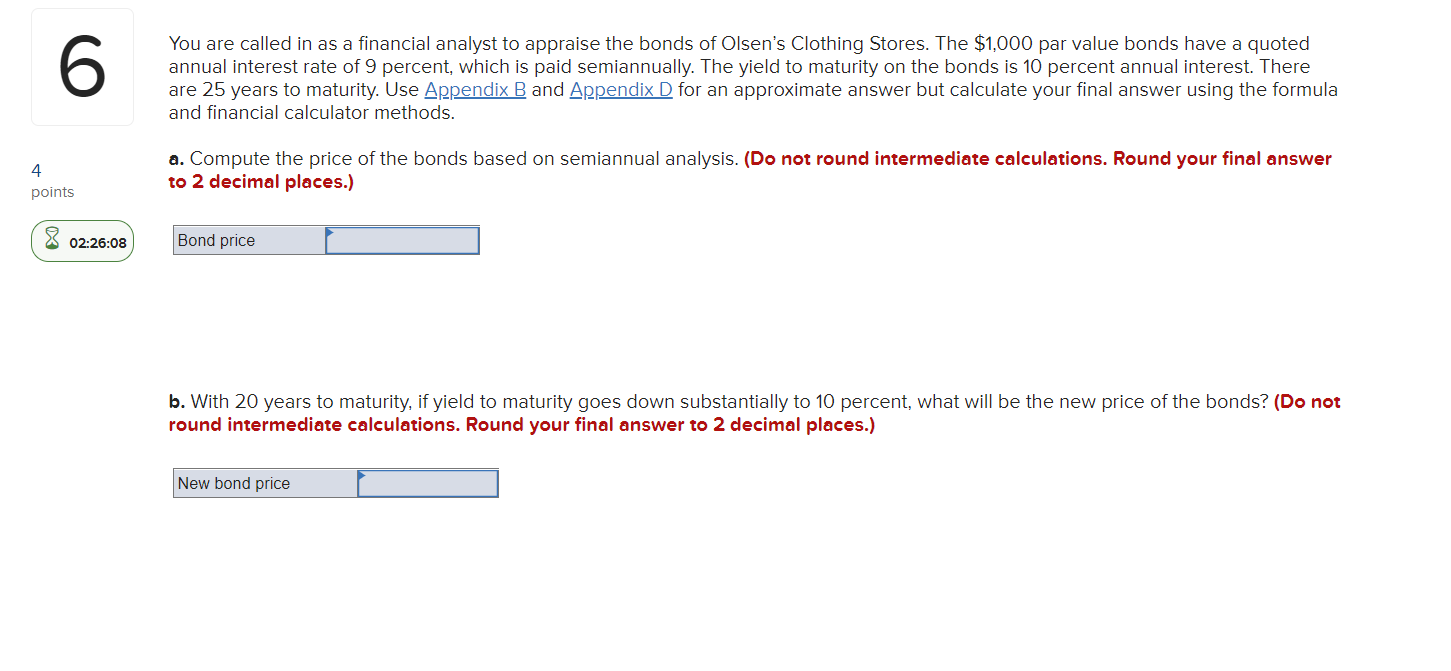

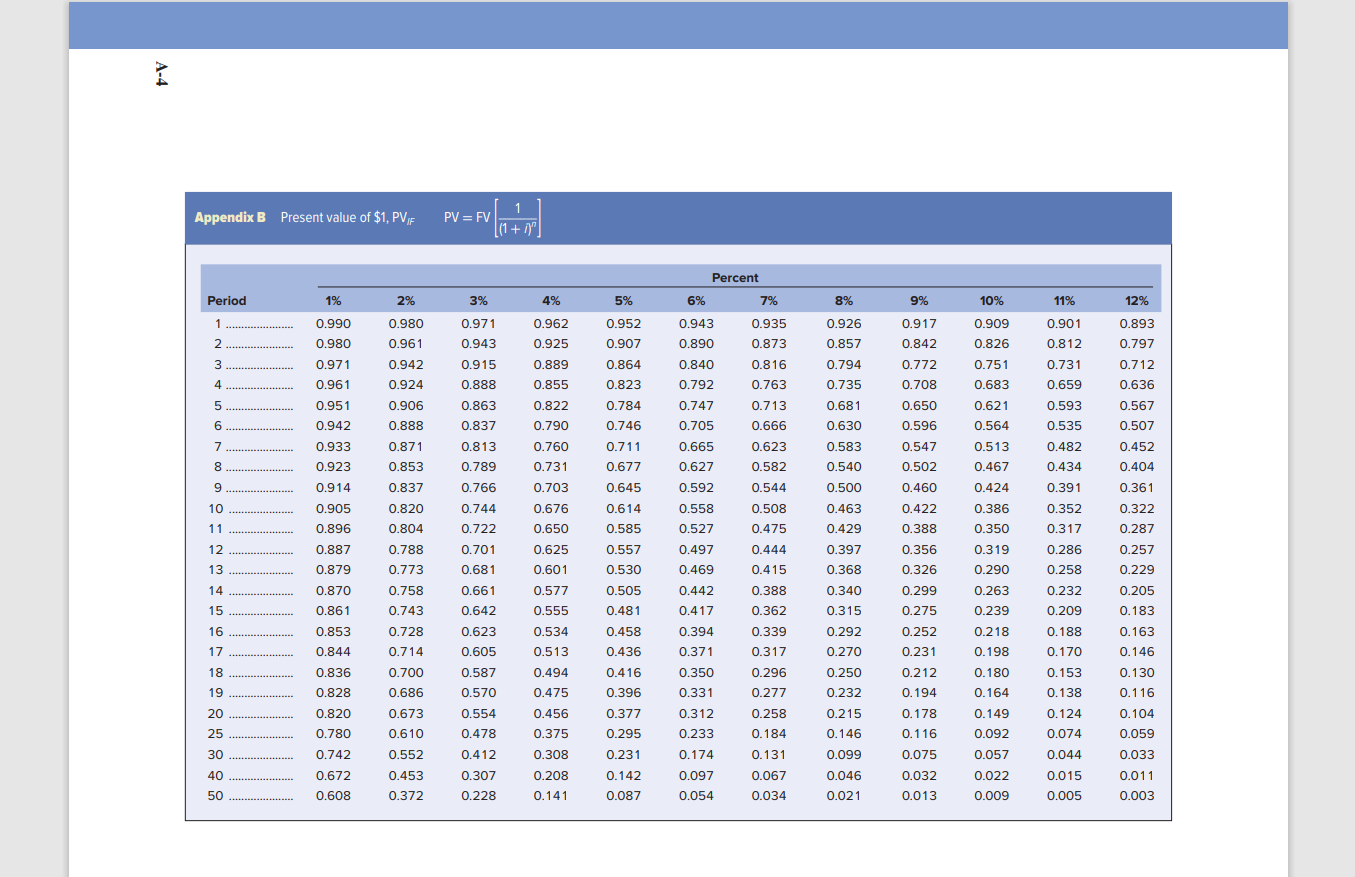

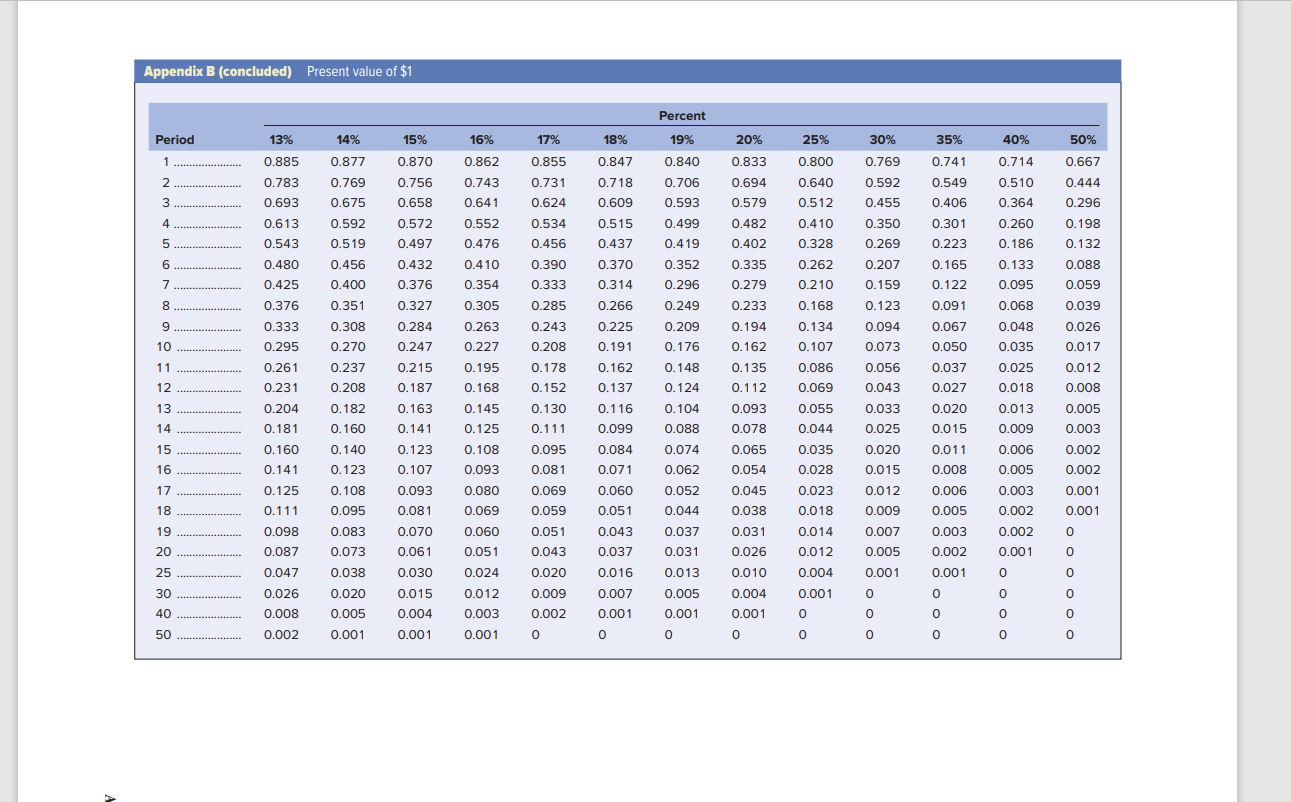

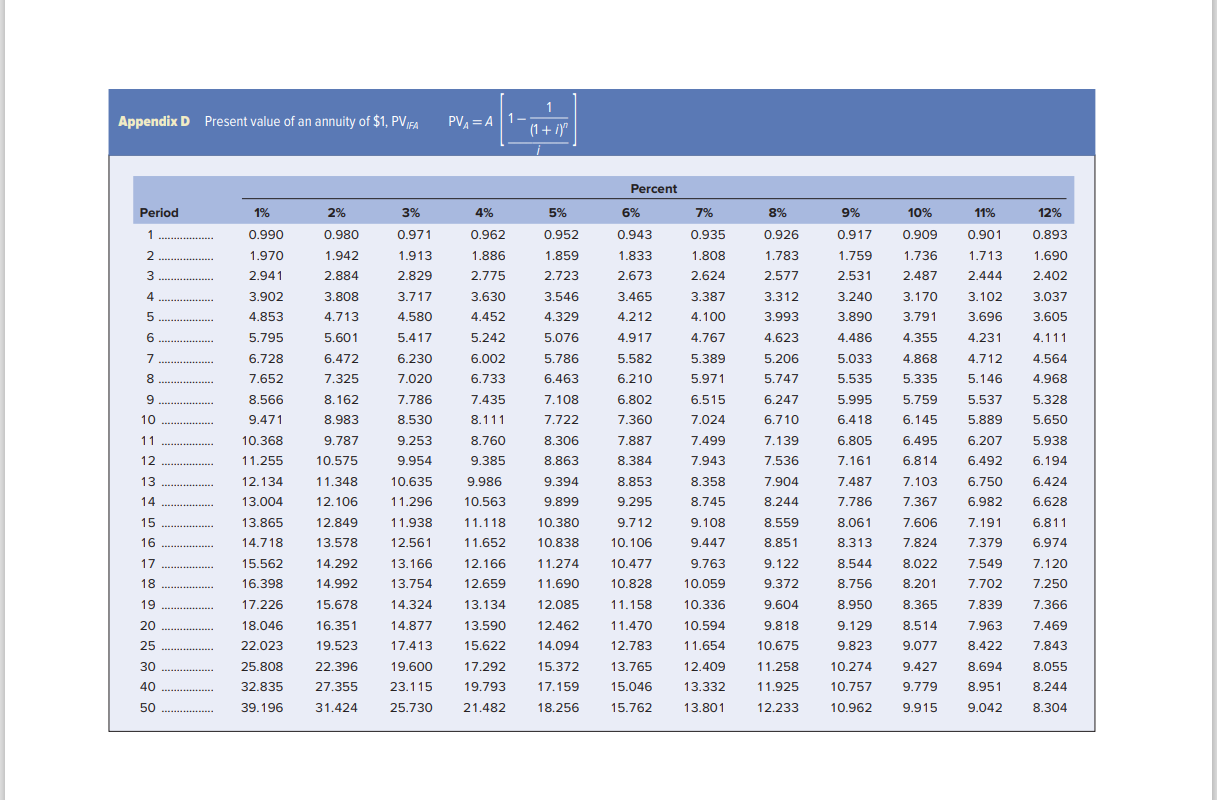

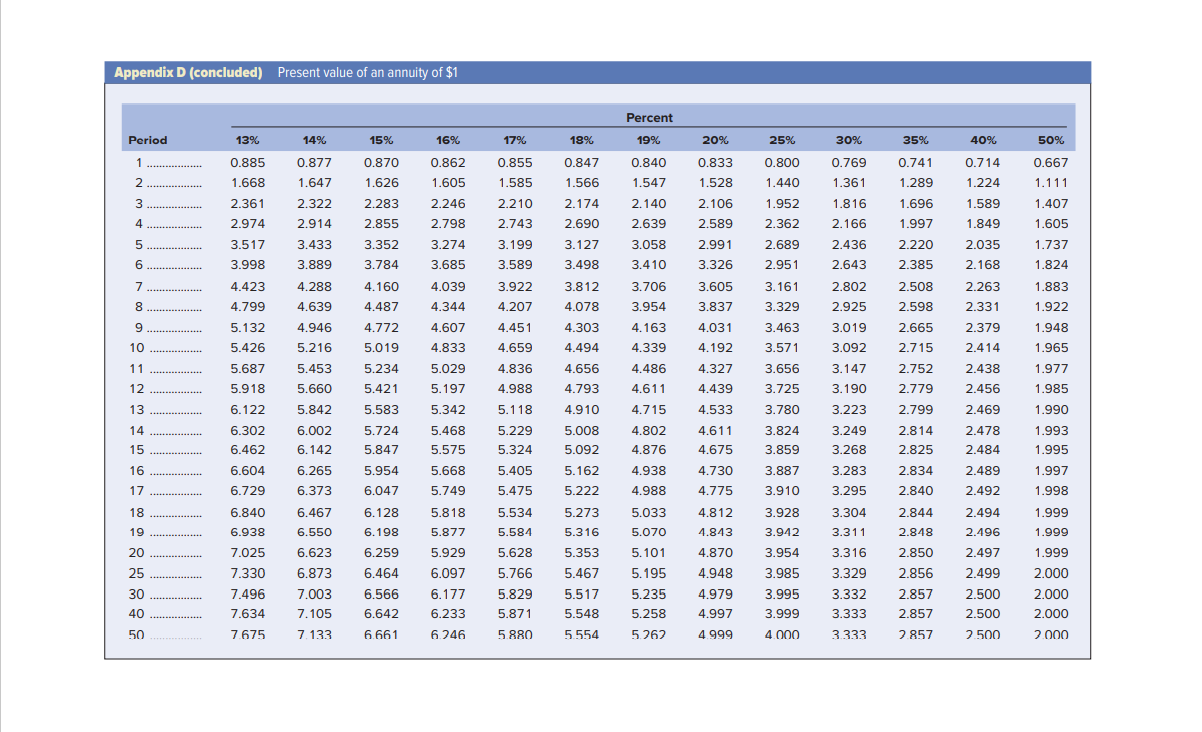

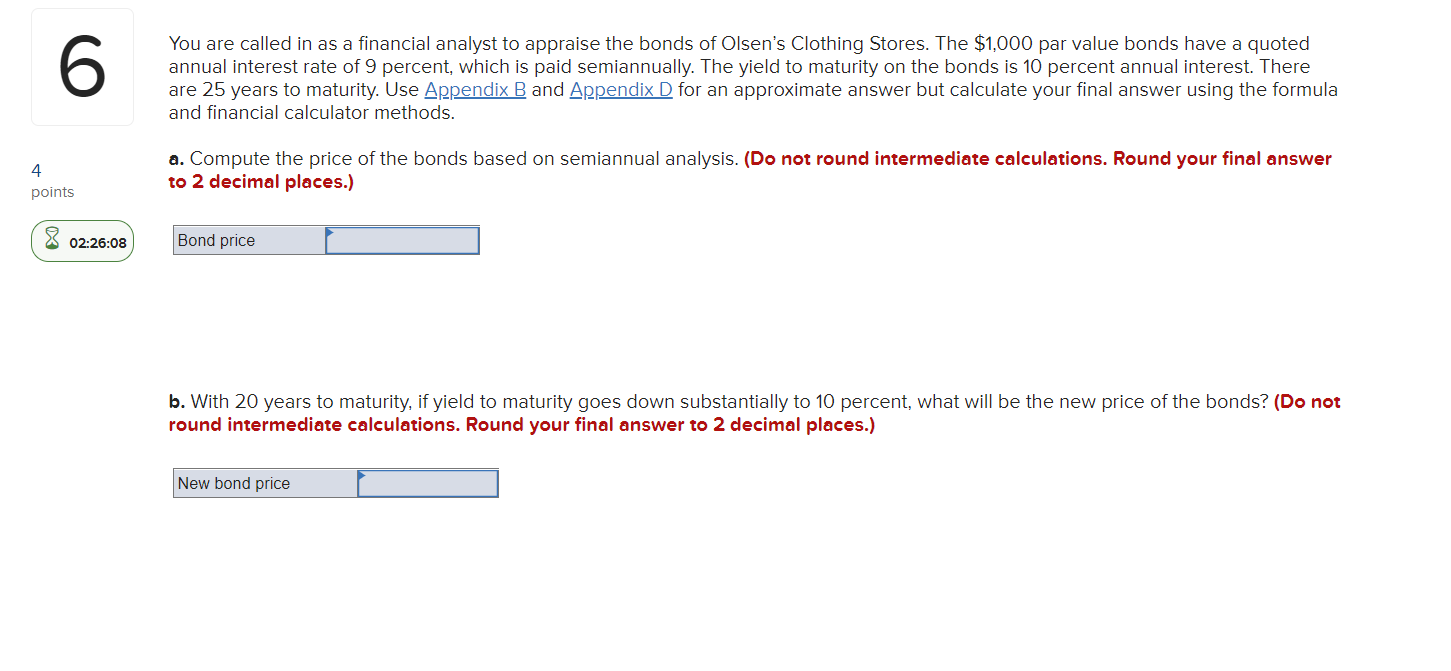

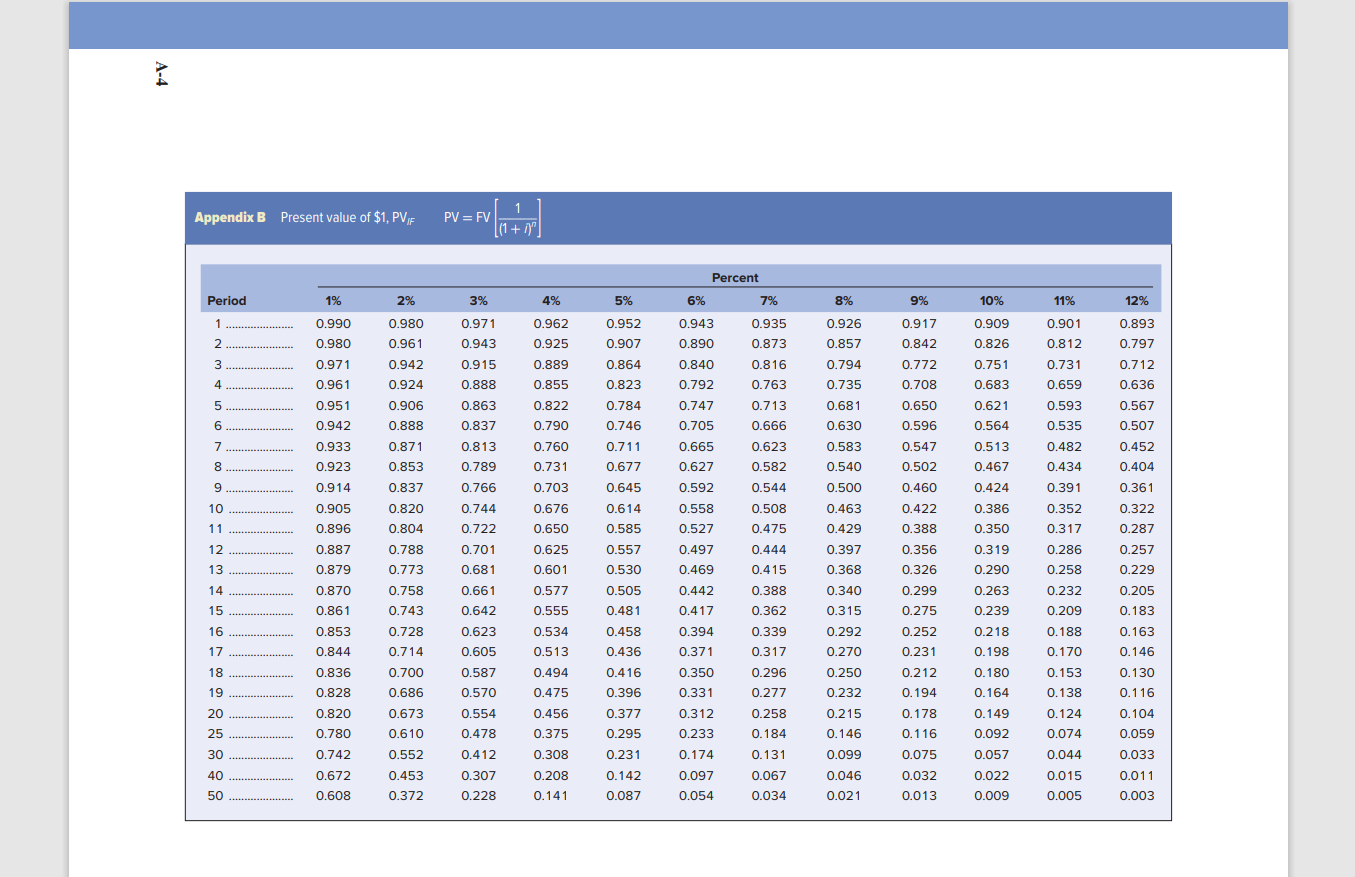

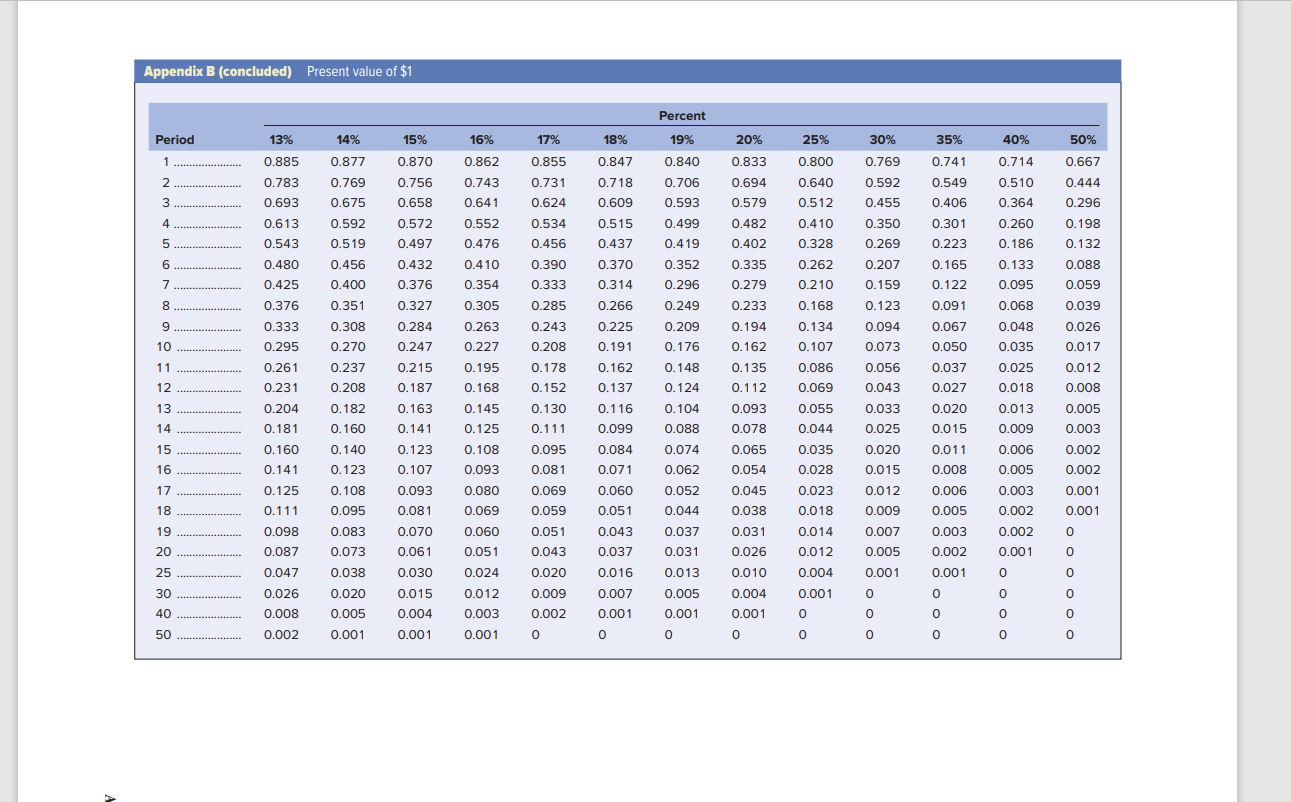

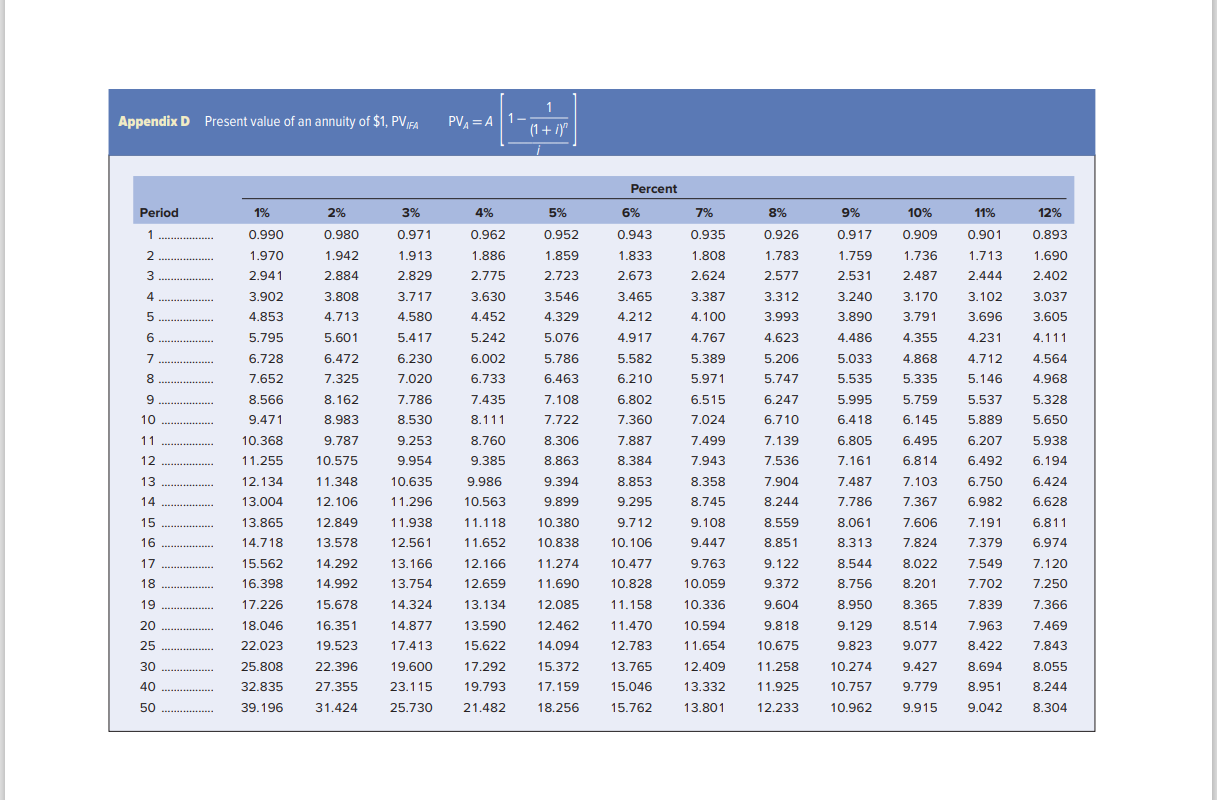

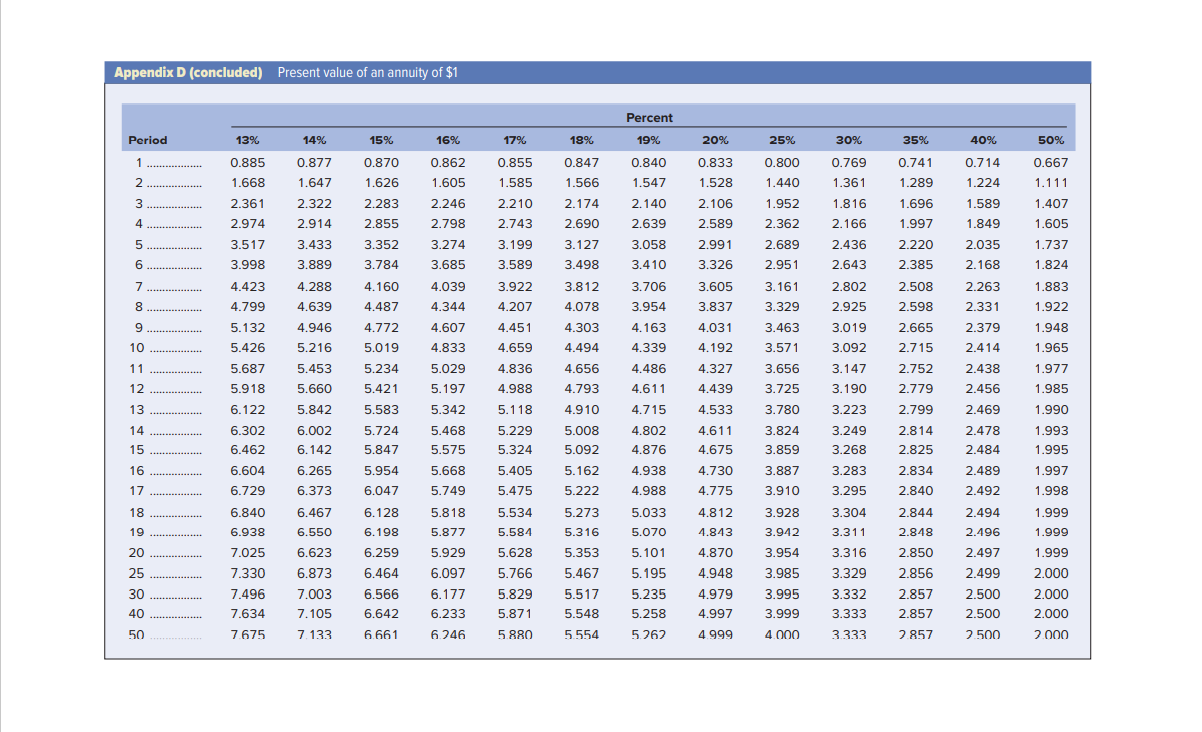

6 You are called in as a financial analyst to appraise the bonds of Olsen's Clothing Stores. The $1,000 par value bonds have a quoted annual interest rate of 9 percent, which is paid semiannually. The yield to maturity on the bonds is 10 percent annual interest. There are 25 years to maturity. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. 4 points a. Compute the price of the bonds based on semiannual analysis. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) 02:26:08 Bond price b. With 20 years to maturity, if yield to maturity goes down substantially to 10 percent, what will be the new price of the bonds? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) New bond price A-4 Appendix B Present value of $1, PVE 1 PV = FV 1 (1 + 7)" Percent Period 1% 3% 4% 6% 7% 8% 9% 11% 12% 0.971 1 2 0.990 0.980 0.962 0.925 0.889 0.943 0.890 10% 0.909 0.826 0.943 3 0.971 0.840 0.915 0.888 % 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.935 0.873 0.816 0.763 0.713 0.666 0.917 0.842 0.772 0.708 0.650 0.893 0.797 0.712 0.636 0.567 4 0.792 0.747 5 0.961 0.951 0.942 0.933 0.923 0.914 0.855 0.822 0.790 0.760 0.863 0.837 0.813 6 0.751 0.683 0.621 0.564 0.513 0.467 0.705 0.507 0.596 0.547 7 0.665 0.627 0.623 0.582 0.452 0.404 8 0.789 0.731 0.502 0.460 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 9 0.766 0.592 0.544 10 0.744 0.722 0.701 0.558 0.527 0.422 0.388 11 0.905 0.896 0.887 0.879 0.870 0.861 0.508 0.475 0.444 0.415 5% 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.295 0.231 0.142 0.087 12 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.146 0.099 0.361 0.322 0.287 0.257 0.229 0.497 0.469 0.356 0.326 13 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.681 0.661 0.642 14 0.388 0.442 0.417 0.394 0.205 0.183 15 0.362 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.610 0.552 0.453 0.372 16 0.853 0.188 0.623 0.605 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.092 0.057 0.022 0.009 0.163 0.146 17 0.339 0.317 0.296 0.844 0.371 0.170 18 0.836 0.587 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.116 0.075 0.032 0.350 19 0.828 0.570 0.475 0.277 20 0.130 0.116 0.104 0.059 0.554 0.258 0.820 0.780 0.331 0.312 0.233 0.174 25 0.184 0.153 0.138 0.124 0.074 0.044 0.015 0.005 30 0.456 0.375 0.308 0.208 0.141 0.478 0.412 0.307 0.742 0.131 0.033 40 0.672 0.067 0.046 0.097 0.054 0.011 0.003 50 0.608 0.228 0.034 0.021 0.013 Appendix B (concluded) Present value of $1 Percent 14% 15% 16% 17% 18% 19% 20% 25% 30% 35% 40% 50% 13% 0.885 0.783 0.877 0.870 0.855 0.847 0.840 0.833 Period 1 2 3 0.769 0.862 0.743 0.741 0.549 0.714 0.510 0.667 0.444 0.769 0.731 0.718 0.800 0.640 0.512 0.706 0.756 0.658 0.592 0.694 0.579 0.675 0.641 0.624 0.609 0.455 0.406 0.364 0.296 0.693 0.613 4 0.592 0.534 0.515 0.593 0.499 0.419 0.552 0.476 0.198 0.482 0.402 0.410 0.328 0.350 0.269 0.301 0.223 0.260 0.186 5 0.543 0.519 0.456 0.437 0.132 6 0.480 0.262 0.088 0.456 0.400 0.410 0.354 0.390 0.333 0.352 0.296 0.335 0.279 0.207 0.159 0.165 0.122 7 0.425 0.059 0.210 0.168 8 0.351 0.249 0.233 0.091 9 0.376 0.333 0.295 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 0.305 0.263 0.227 0.370 0.314 0.266 0.225 0.191 0.162 0.137 0.209 0.176 0.194 0.162 0.134 0.107 0.123 0.094 0.073 0.133 0.095 0.068 0.048 0.035 0.025 0.018 0.039 0.026 0.017 10 0.308 0.270 0.237 0.208 0.182 0.160 11 0.261 0.012 0.195 0.168 0.148 0.124 0.086 0.069 0.056 0.043 12 0.231 0.008 0.135 0.112 0.093 0.078 13 0.104 0.005 0.204 0.181 0.145 0.125 0.055 0.044 0.033 0.025 0.013 0.009 0.067 0.050 0.037 0.027 0.020 0.015 0.011 0.008 0.006 0.005 14 0.088 0.003 15 0.074 0.035 0.116 0.099 0.084 0.071 0.060 0.002 0.160 0.141 0.125 0.140 0.123 0.108 0.093 0.080 16 0.285 0.243 0.208 0.178 0.152 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.043 0.020 0.009 0.002 o 0 0.020 0.015 0.062 0.002 17 0.108 0.052 0.012 0.001 0.065 0.054 0.045 0.038 0.031 0.026 0.006 0.005 0.003 0.002 0.002 0.028 0.023 0.018 0.014 18 0.051 0.044 0.009 0.001 0.111 0.098 19 0.123 0.107 0.093 0.081 0.070 0.061 0.030 0.015 0.004 0.001 0.069 0.060 0.051 0.003 0 0.037 0.031 0.007 0.005 20 0.087 0.002 0 0.095 0.083 0.073 0.038 0.020 0.005 0.001 0.043 0.037 0.016 0.007 0.047 0.024 0.013 0.001 0.012 0.004 0.001 25 30 40 0.001 0 0.010 0.004 0.001 o 0 o 0.026 0.012 0.005 0 0 0.003 0.001 0.001 0.001 0 o 0.008 0.002 0 50 0.001 0 0 0 0 0 0 0 1 Appendix D Present value of an annuity of $1, PVIFA PVA = A 1- (1 + i)" Percent Period 1% 3% 6% 7% 8% 9% 12% 4% 0.962 10% 0.909 11% 0.901 1 0.990 2% 0.980 1.942 2.884 0.917 1.759 2 1.970 1.736 1.886 2.775 5% 0.952 1.859 2.723 3.546 4.329 0.971 1.913 2.829 3.717 4.580 0.935 1.808 2.624 3 0.943 1.833 2.673 3.465 4.212 2.941 1.713 2.444 0.926 1.783 2.577 3.312 3.993 2.531 2.487 0.893 1.690 2.402 3.037 3.605 4 3.630 3.902 4.853 3.808 4.713 3.387 4.100 3.240 3.890 3.170 3.791 3.102 3.696 5 4.452 6 5.795 5.076 4.917 4.486 4.231 7 6.728 7.652 5.417 6.230 7.020 5.242 6.002 6.733 5.786 6.463 7.108 5.582 6.210 4.767 5.389 5.971 6.515 7.024 5.033 5.535 4.355 4.868 5.335 8 4.712 5.146 4.111 4.564 4.968 5.328 5.650 9 5.995 5.759 4.623 5.206 5.747 6.247 6.710 7.139 7.536 6.802 7.360 5.537 10 7.722 6.418 6.145 8.566 9.471 10.368 11.255 5.889 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 12.849 7.435 8.111 8.760 9.385 11 12 8.306 8.863 7.887 8.384 7.499 7.943 6.805 7.161 6.495 6.814 6.207 6.492 7.786 8.530 9.253 9.954 10.635 11.296 11.938 12.561 13 9.986 9.394 8.358 7.904 7.487 7.103 6.750 12.134 13.004 14 10.563 8.745 8.244 7.786 7.367 6.982 15 13.865 11.118 9.108 8.559 8.061 9.899 10.380 10.838 11.274 16 14.718 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 13.578 11.652 8.851 8.853 9.295 9.712 10.106 10.477 10.828 11.158 11.470 8.313 7.606 7.824 8.022 8.201 9.447 9.763 7.191 7.379 7.549 17 12.166 15.562 16.398 17.226 14.292 14.992 18 12.659 11.690 7.702 13.166 13.754 14.324 14.877 10.059 10.336 9.122 9.372 9.604 9.818 8.544 8.756 8.950 9.129 19 12.085 15.678 16.351 8.365 8.514 7.839 7.963 20 18.046 12.462 10.594 7.469 25 19.523 14.094 13.134 13.590 15.622 17.292 19.793 12.783 11.654 10.675 9.823 9.077 8.422 22.023 25.808 32.835 39.196 30 17.413 19.600 23.115 25.730 22.396 27.355 15.372 17.159 13.765 15.046 12.409 13.332 11.258 11.925 12.233 10.274 10.757 9.427 9.779 9.915 8.694 8.951 40 7.843 8.055 8.244 8.304 50 31.424 21.482 18.256 15.762 13.801 10.962 9.042 Appendix D (concluded) Present value of an annuity of $1 Percent 13% 15% 16% 17% 1996 19% 2096 30% 3596 4096 Period 1 .................. 1. 2 14% 0.877 % 50% 0.667 0.885 0.862 0.847 0.870 1.626 0.855 1.585 0.840 1.547 0.833 1.528 25% 0.800 1.440 1.952 0.769 1.361 0.741 1.289 0.714 1.224 1.668 1.647 1.605 1.566 1.111 3 2.322 2.246 2.210 2.140 2.106 1.696 1.407 2.361 2.974 3.517 2.283 2.855 2.174 2.690 4 1.589 1.849 2.914 2.798 2.743 2.639 2.589 1.816 2.166 2.436 2.362 1.997 1.605 5 3.433 3.274 3.127 3.058 2.689 2.220 2.035 1.737 2.991 3.326 6 3.998 3.889 3.410 2.643 2.385 2.168 1.824 3.352 3.784 4.160 4.487 3.199 3.589 3.922 4.207 7 4.288 3.685 4.039 4.344 4.423 4.799 3.498 3.812 4.078 8 3.706 3.954 4.163 2.508 2.598 4.639 4.946 2.951 3.161 3.329 3.463 3.571 3.605 3.837 4.031 4.192 2.263 2.331 2.379 2.414 1.883 1.922 1.948 1.965 9 9 5.132 4.772 4.451 4.303 2.665 4.607 4.833 10 5.426 5.216 5.019 4.659 4.494 4.339 2.715 2.802 2.925 3.019 3.092 3.147 3.190 3.223 3.249 11 5.234 4.486 2.752 2.438 5.687 5.918 5.453 5.660 5.029 5.197 4.836 4.988 4.656 4.793 4.327 4.439 3.656 3.725 1.977 1.985 12 5.421 4.611 2.779 2.456 13 6.122 4.715 4.533 2.469 5.583 5.724 3.780 3.824 2.799 2.814 14 6.302 5.118 5.229 5.324 5.342 5.468 5.575 5.668 5.842 6.002 6.142 6.265 6.373 4.802 4.876 4.611 4.675 4.910 5.008 5.092 5.162 5.222 2.478 2.484 15 1.990 1.993 1.995 6.462 5.847 3.859 3.268 2.825 16 4.730 2.834 6.604 6.729 5.954 6.047 5.405 5.475 4.938 4.988 3.887 3.910 3.283 3.295 1.997 1.998 5.749 4.775 2.840 17 18 19 6.840 5.534 6.467 6.550 6.623 6.873 7.003 20 6.128 6.198 6.259 6.464 6.566 5.273 5.316 5.353 5.818 5.877 5.929 6.097 6.177 6.938 7.025 7.330 7.496 7.634 7.675 3.304 3.311 3.316 5.033 5.070 5.101 5.195 5.235 5.581 5.628 5.766 5.829 5.871 5.880 3.928 3.942 3.954 3.985 3.995 25 30 40 4.812 4.813 4.870 4.948 4.979 4.997 4.999 2.844 2.848 2.850 2.856 2.857 2.489 2.492 2.494 2.496 2.497 2.499 2.500 2.500 2.500 5.467 5.517 5.548 5.554 3.329 3.332 3.333 3333 1.999 1.999 1.999 2.000 2.000 2.000 2000 7.105 6.233 5.258 6.642 6.661 3.999 4.000 2.857 2.857 50 7.133 6.246 5.262