Answered step by step

Verified Expert Solution

Question

1 Approved Answer

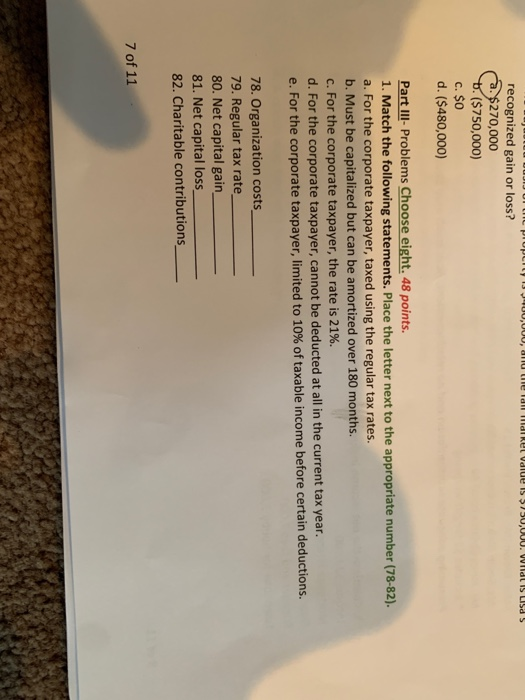

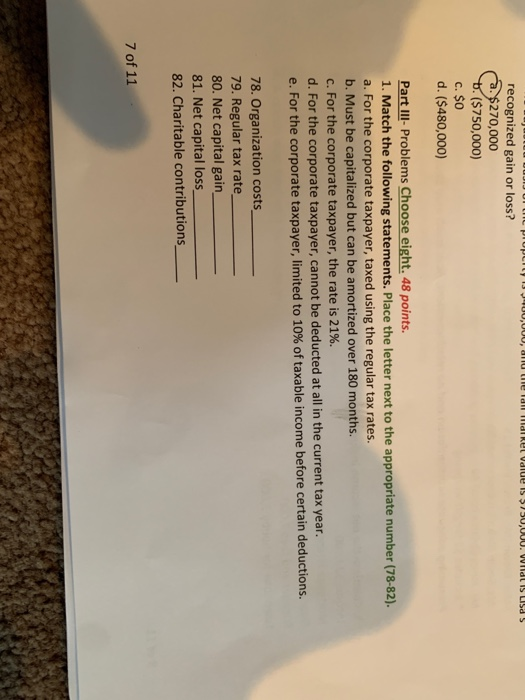

61801215847__A9EEEAD3-98CF-49E4-A389-A178F0ED276F.jpeg - properly IJ MUUUUU, nu te la maire Value is $750,000. WildL IS LISAS recognized gain or loss? $270,000 ($750,000) c. $0 d. ($480,000)

61801215847__A9EEEAD3-98CF-49E4-A389-A178F0ED276F.jpeg

- properly IJ MUUUUU, nu te la maire Value is $750,000. WildL IS LISAS recognized gain or loss? $270,000 ($750,000) c. $0 d. ($480,000) Part III- Problems Choose eight. 48 points. 1. Match the following statements. Place the letter next to the appropriate number (78-82). a. For the corporate taxpayer, taxed using the regular tax rates. b. Must be capitalized but can be amortized over 180 months. c. For the corporate taxpayer, the rate is 21%. d. For the corporate taxpayer, cannot be deducted at all in the current tax year. e. For the corporate taxpayer, limited to 10% of taxable income before certain deductions. 78. Organization costs 79. Regular tax rate 80. Net capital gain 81. Net capital loss 82. Charitable contributions 7 of 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started