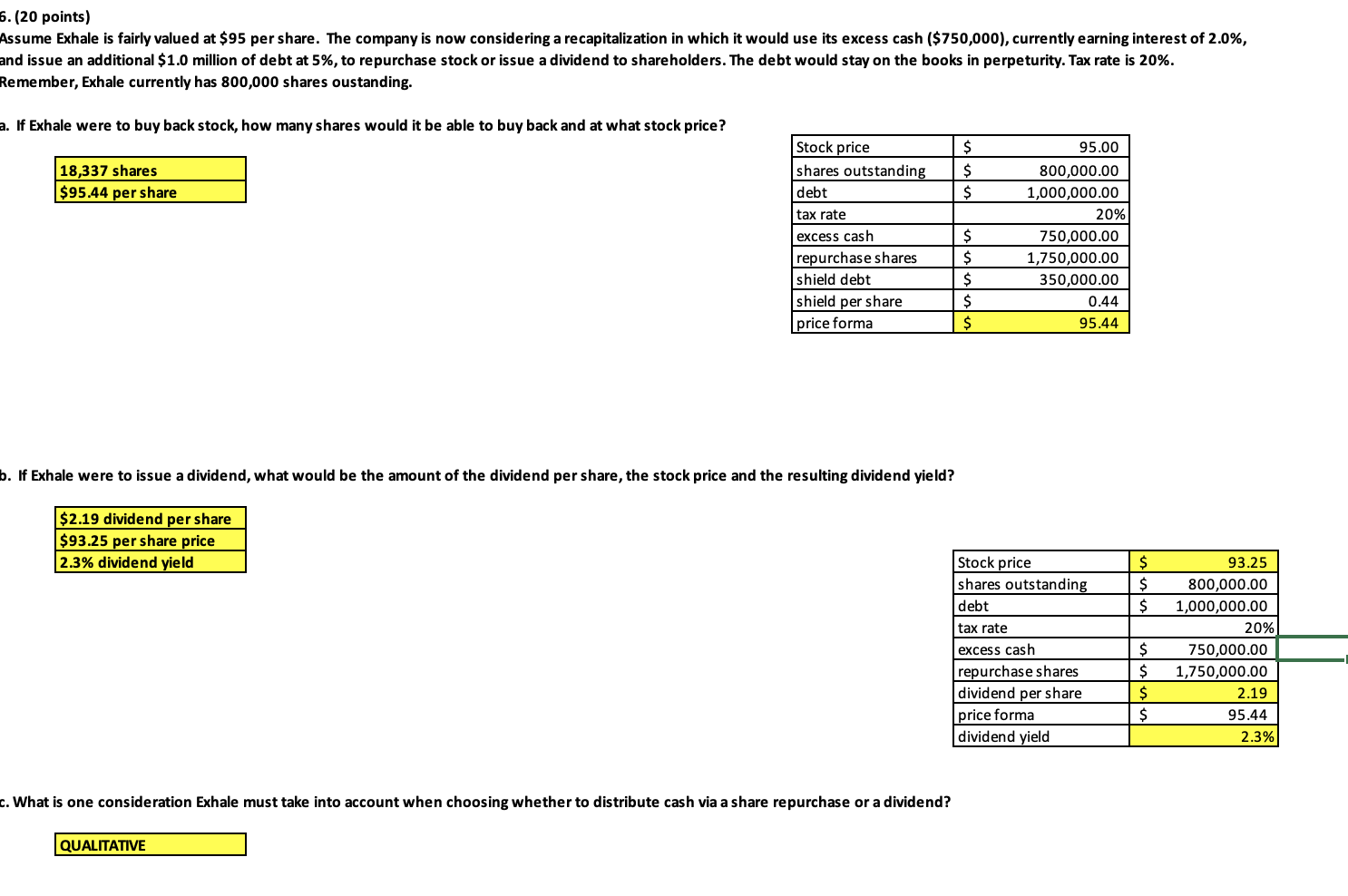

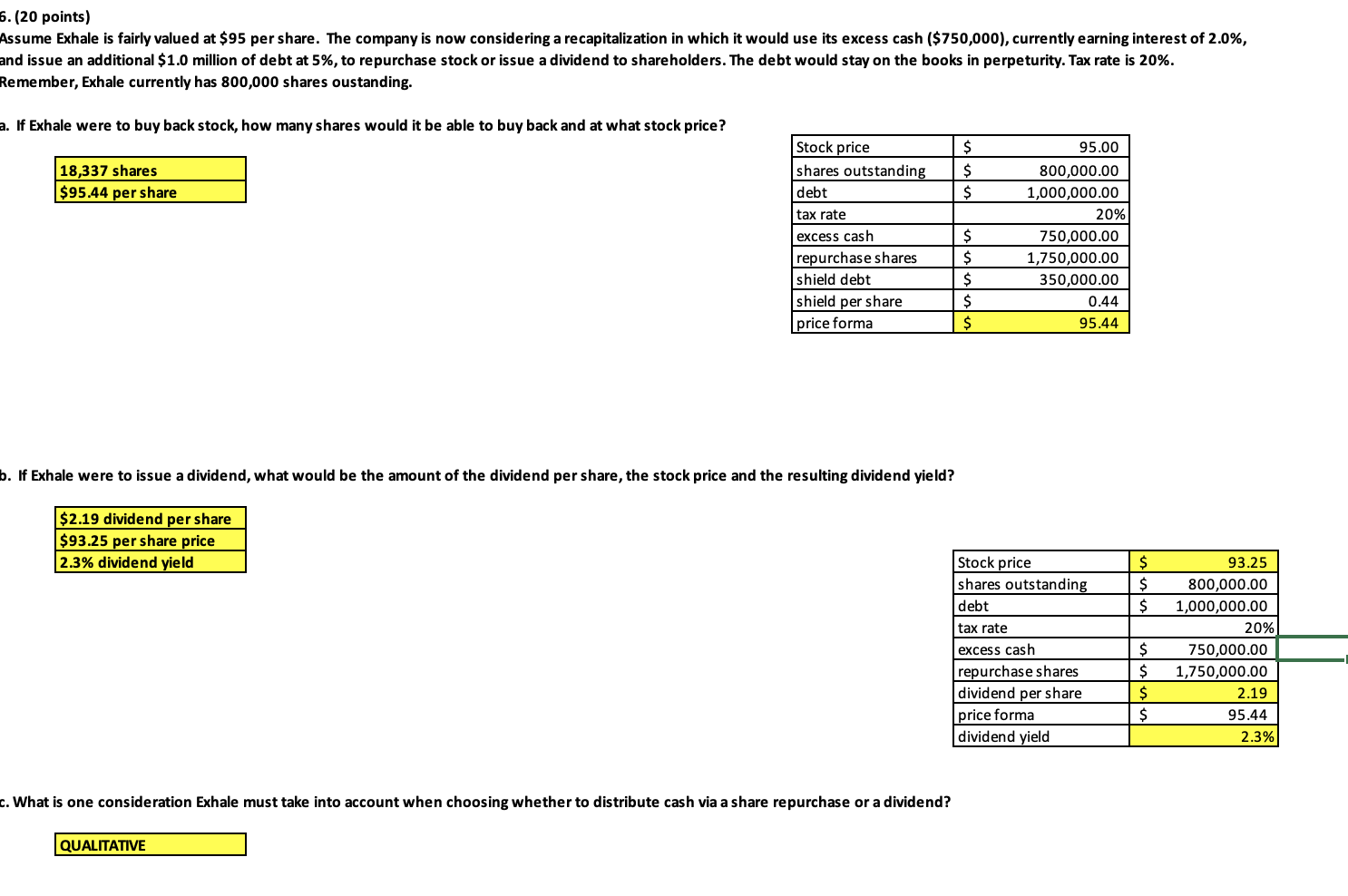

6.(20 points) Assume Exhale is fairly valued at $95 per share. The company is now considering a recapitalization in which it would use its excess cash ($750,000), currently earning interest of 2.0%, and issue an additional $1.0 million of debt at 5%, to repurchase stock or issue a dividend to shareholders. The debt would stay on the books in perpeturity. Tax rate is 20%. Remember, Exhale currently has 800,000 shares oustanding. a. If Exhale were to buy back stock, how many shares would it be able to buy back and at what stock price? $ 18,337 shares $95.44 per share Stock price shares outstanding debt $ $ tax rate $ $ excess cash repurchase shares shield debt shield per share price forma 95.00 800,000.00 1,000,000.00 20% 750,000.00 1,750,000.00 350,000.00 0.44 95.44 $ $ $ b. If Exhale were to issue a dividend, what would be the amount of the dividend per share, the stock price and the resulting dividend yield? $2.19 dividend per share $93.25 per share price 2.3% dividend yield $ $ $ Stock price shares outstanding debt tax rate excess cash repurchase shares dividend per share price forma dividend yield $ $ $ $ 93.25 800,000.00 1,000,000.00 20% 750,000.00 1,750,000.00 2.19 95.44 2.3% c. What is one consideration Exhale must take into account when choosing whether to distribute cash via a share repurchase or a dividend? QUALITATIVE 6.(20 points) Assume Exhale is fairly valued at $95 per share. The company is now considering a recapitalization in which it would use its excess cash ($750,000), currently earning interest of 2.0%, and issue an additional $1.0 million of debt at 5%, to repurchase stock or issue a dividend to shareholders. The debt would stay on the books in perpeturity. Tax rate is 20%. Remember, Exhale currently has 800,000 shares oustanding. a. If Exhale were to buy back stock, how many shares would it be able to buy back and at what stock price? $ 18,337 shares $95.44 per share Stock price shares outstanding debt $ $ tax rate $ $ excess cash repurchase shares shield debt shield per share price forma 95.00 800,000.00 1,000,000.00 20% 750,000.00 1,750,000.00 350,000.00 0.44 95.44 $ $ $ b. If Exhale were to issue a dividend, what would be the amount of the dividend per share, the stock price and the resulting dividend yield? $2.19 dividend per share $93.25 per share price 2.3% dividend yield $ $ $ Stock price shares outstanding debt tax rate excess cash repurchase shares dividend per share price forma dividend yield $ $ $ $ 93.25 800,000.00 1,000,000.00 20% 750,000.00 1,750,000.00 2.19 95.44 2.3% c. What is one consideration Exhale must take into account when choosing whether to distribute cash via a share repurchase or a dividend? QUALITATIVE