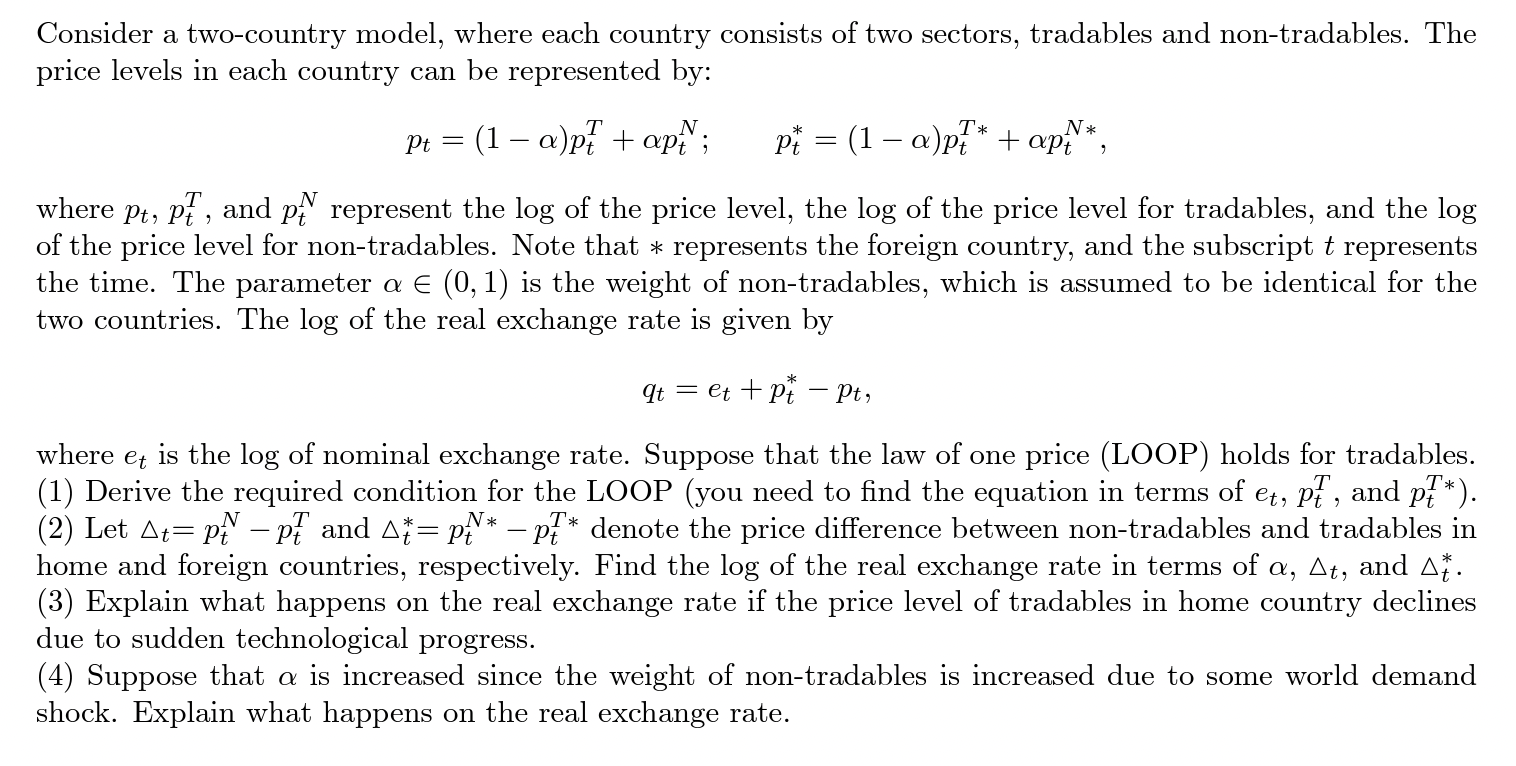

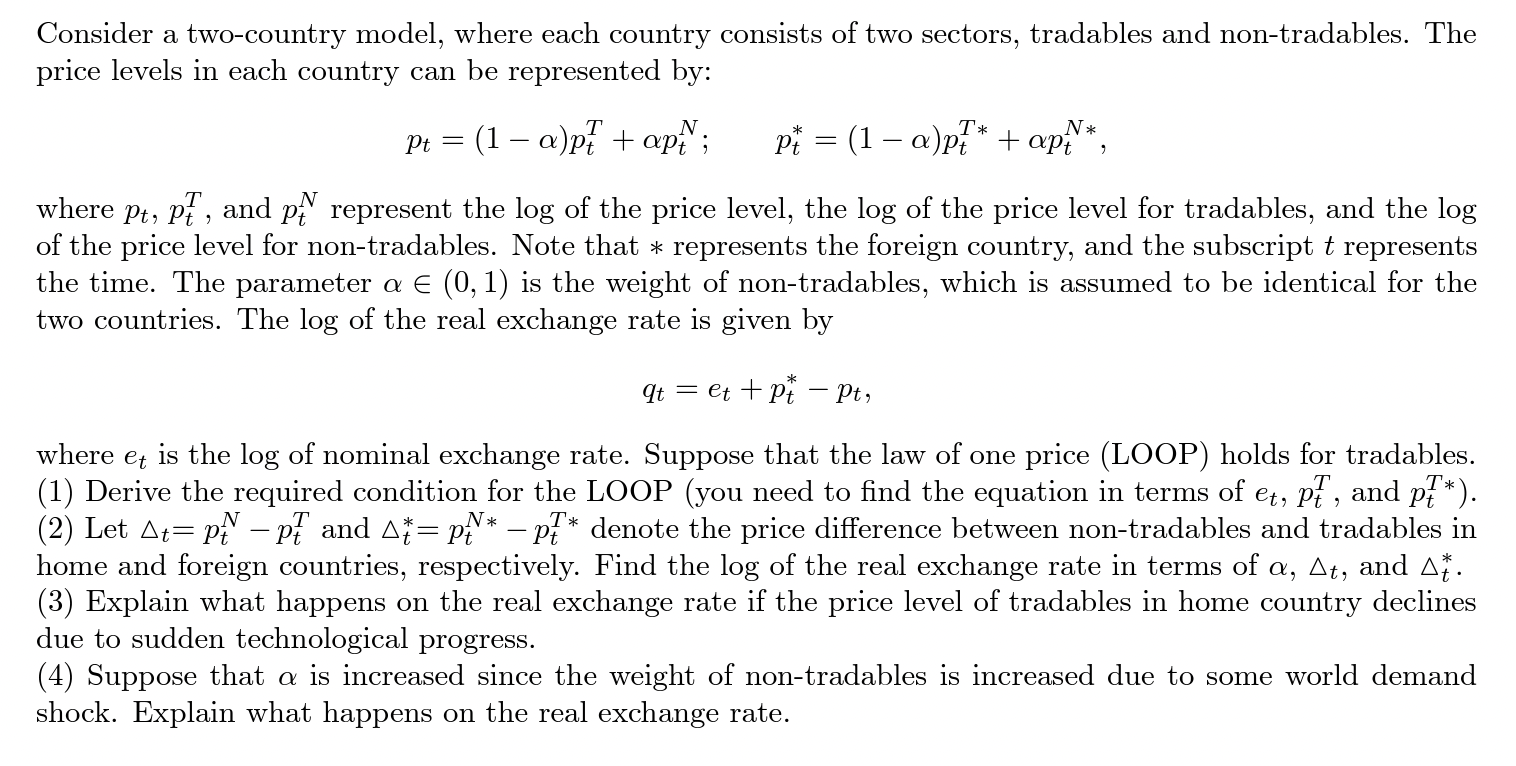

Consider a two-country model, where each country consists of two sectors, tradables and non-tradables. The price levels in each country can be represented by: N T N pt = (1 a)p# + ap; = pt = (1 - ap?* + app* where Pt, p, and p represent the log of the price level, the log of the price level for tradables, and the log of the price level for non-tradables. Note that * represents the foreign country, and the subscript t represents the time. The parameter a (0,1) is the weight of non-tradables, which is assumed to be identical for the two countries. The log of the real exchange rate is given by qt = et + P* - pt, - et Pt N * T* where is the log of nominal exchange rate. Suppose that the law of one price (LOOP) holds for tradables. (1) Derive the required condition for the LOOP (you need to find the equation in terms of et, p, and p*). (2) Let At=p# - p7 and PN* p* denote the price difference between non-tradables and tradables in home and foreign countries, respectively. Find the log of the real exchange rate in terms of a, At, and Am. (3) Explain what happens on the real exchange rate if the price level of tradables in home country declines due to sudden technological progress. (4) Suppose that a is increased since the weight of non-tradables is increased due to some world demand shock. Explain what happens on the real exchange rate. Consider a two-country model, where each country consists of two sectors, tradables and non-tradables. The price levels in each country can be represented by: N T N pt = (1 a)p# + ap; = pt = (1 - ap?* + app* where Pt, p, and p represent the log of the price level, the log of the price level for tradables, and the log of the price level for non-tradables. Note that * represents the foreign country, and the subscript t represents the time. The parameter a (0,1) is the weight of non-tradables, which is assumed to be identical for the two countries. The log of the real exchange rate is given by qt = et + P* - pt, - et Pt N * T* where is the log of nominal exchange rate. Suppose that the law of one price (LOOP) holds for tradables. (1) Derive the required condition for the LOOP (you need to find the equation in terms of et, p, and p*). (2) Let At=p# - p7 and PN* p* denote the price difference between non-tradables and tradables in home and foreign countries, respectively. Find the log of the real exchange rate in terms of a, At, and Am. (3) Explain what happens on the real exchange rate if the price level of tradables in home country declines due to sudden technological progress. (4) Suppose that a is increased since the weight of non-tradables is increased due to some world demand shock. Explain what happens on the real exchange rate