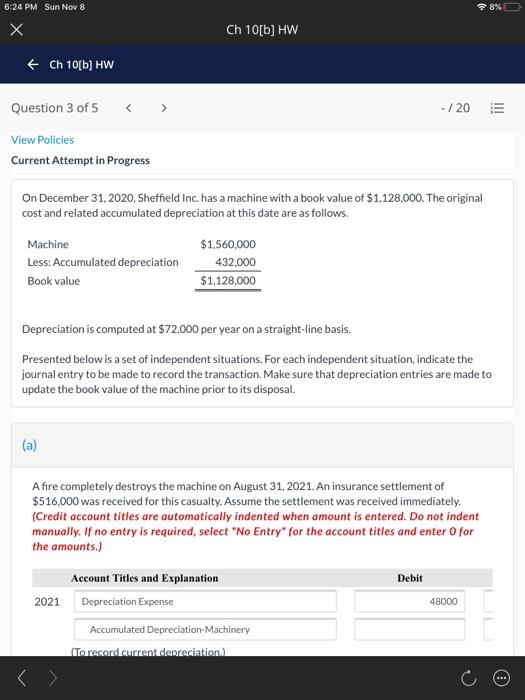

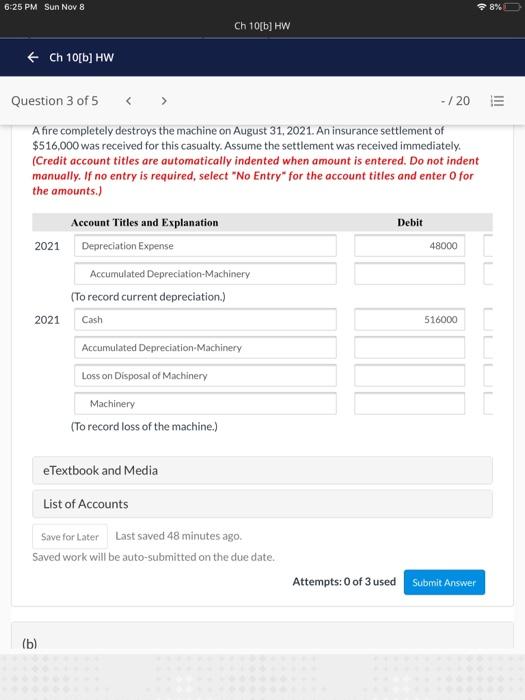

6:24 PM Sun Nov 8 98% Ch 10[b] HW + Ch 10[b] HW Question 3 of 5 - /20 View Policies Current Attempt in Progress On December 31, 2020, Sheffield Inc. has a machine with a book value of $1,128,000. The original cost and related accumulated depreciation at this date are as follows. Machine Less: Accumulated depreciation Book value $1,560,000 432,000 $1.128,000 Depreciation is computed at $72,000 per year on a straight-line basis. Presented below is a set of independent situations. For each independent situation, indicate the journal entry to be made to record the transaction. Make sure that depreciation entries are made to update the book value of the machine prior to its disposal. (a) Afire completely destroys the machine on August 31, 2021. An insurance settlement of $516,000 was received for this casualty. Assume the settlement was received immediately. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts.) Debit 2021 48000 Account Titles and Explanation Depreciation Expense Accumulated Depreciation Machinery To record current depreciation) 6:25 PM Sun Nov 8 98% Ch 10[b] HW + Ch 10[b] HW Question 3 of 5 - /20 A fire completely destroys the machine on August 31, 2021. An insurance settlement of $516,000 was received for this casualty. Assume the settlement was received immediately. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter o for the amounts.) Debit 2021 48000 Account Titles and Explanation Depreciation Expense Accumulated Depreciation-Machinery (To record current depreciation.) Cash 2021 516000 Accumulated Depreciation Machinery Loss on Disposal of Machinery Machinery (To record loss of the machine.) eTextbook and Media List of Accounts Save for Later Last saved 48 minutes ago. Saved work will be auto-submitted on the due date. Attempts: 0 of 3 used Submit Answer (b)