64.3%.

61.3%.

68.9%.

70.7%.

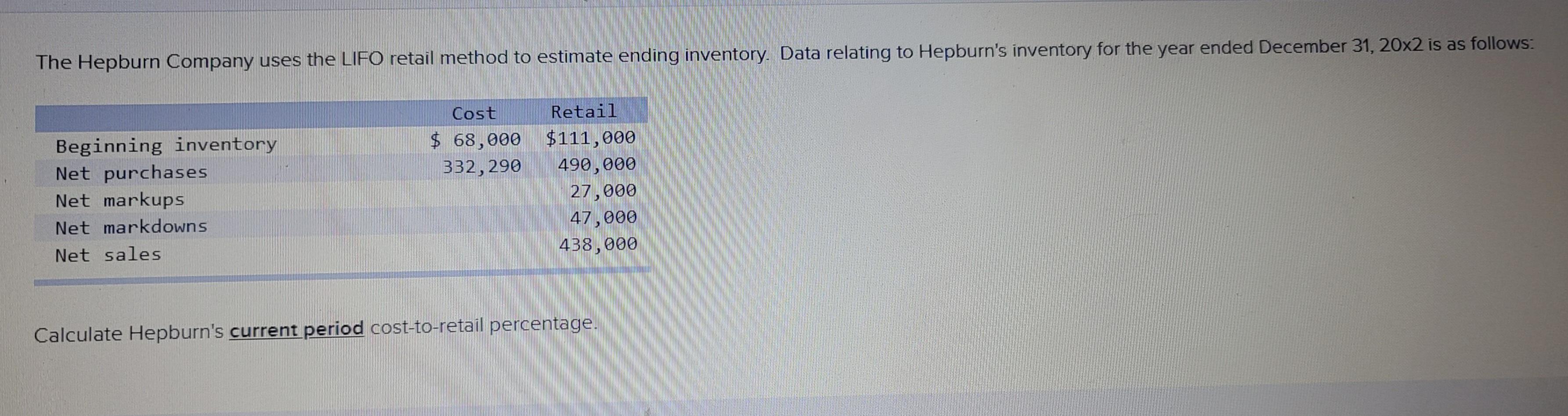

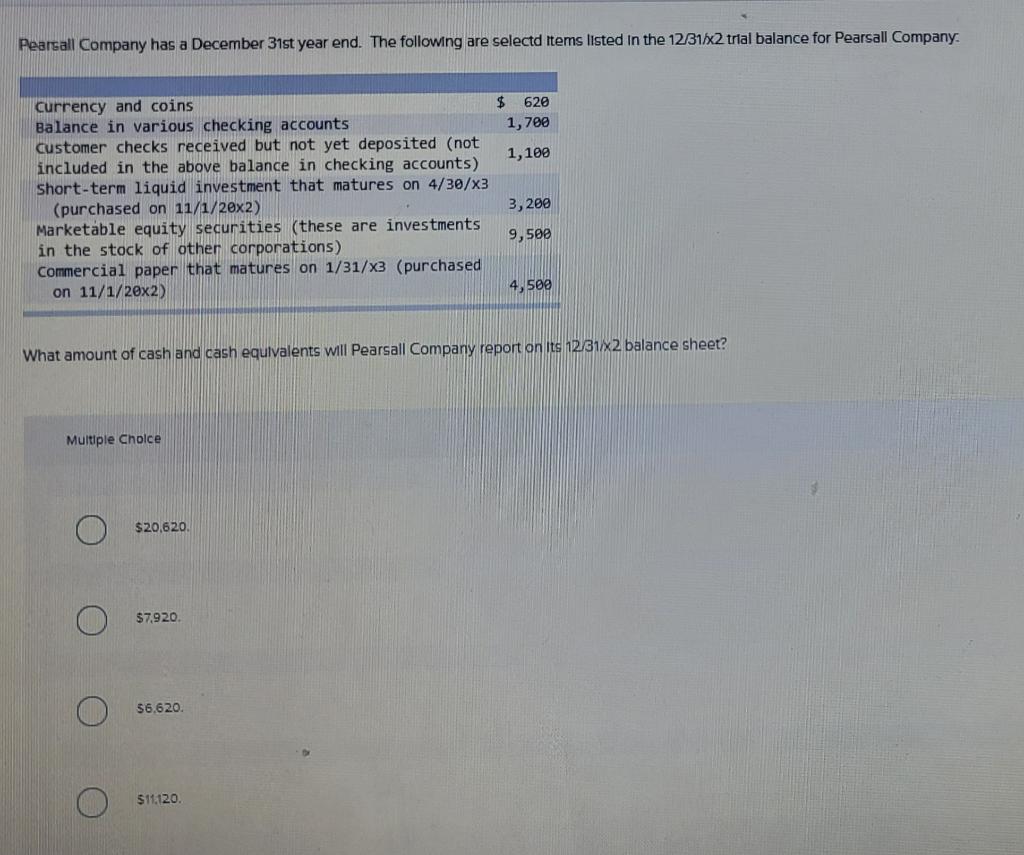

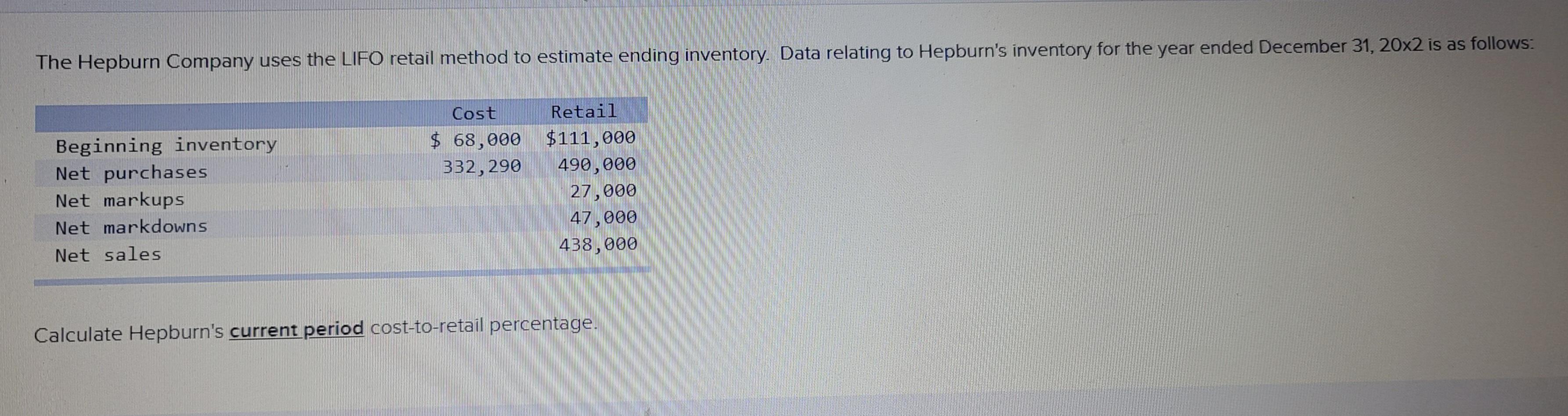

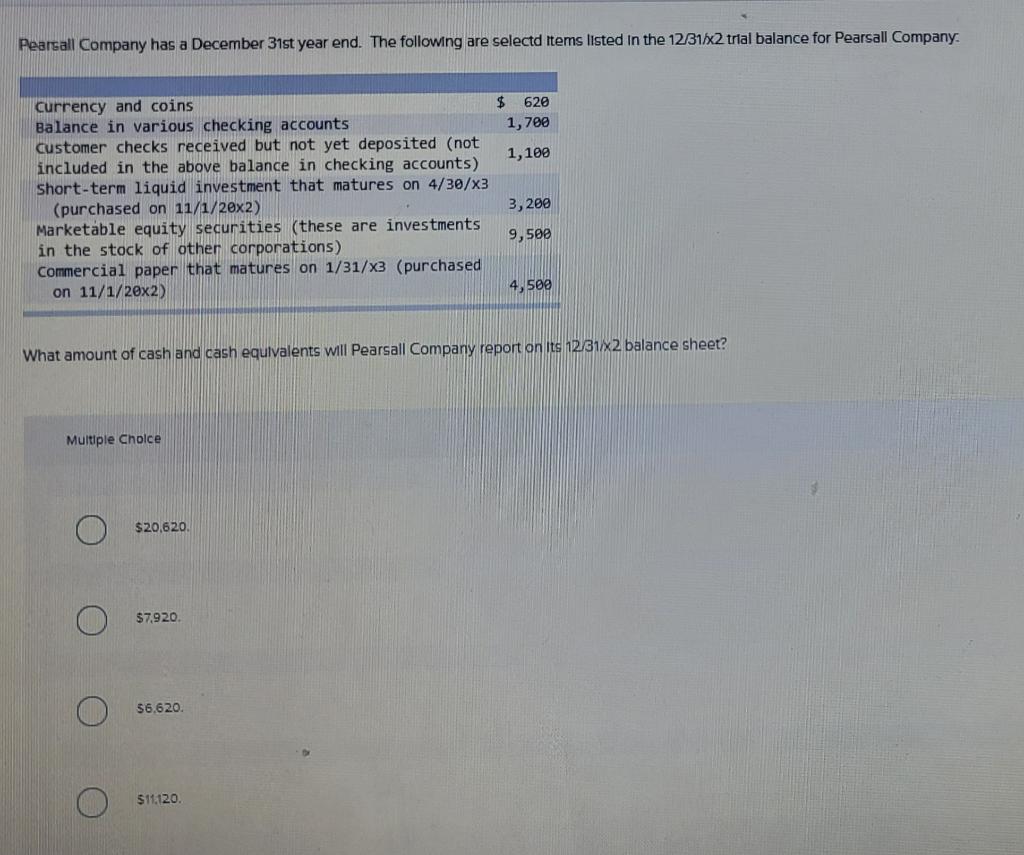

The Hepburn Company uses the LIFO retail method to estimate ending inventory. Data relating to Hepburn's inventory for the year ended December 31, 20x2 is as follows: Retail Cost $ 68,000 332,290 Beginning inventory Net purchases Net markups Net markdowns Net sales $111,000 490,000 27,000 47,000 438,000 Calculate Hepburn's current period cost-to-retail percentage. Pearsall Company has a December 31st year end. The following are selectd items listed in the 12/31/2 trial balance for Pearsall Company $ 620 1,700 1,100 Currency and coins Balance in various checking accounts customer checks received but not yet deposited (not included in the above balance in checking accounts) Short-term liquid investment that matures on 4/30/3 (purchased on 11/1/20x2) Marketable equity securities (these are investments in the stock of other corporations) Commercial paper that matures on 1/31/X3 (purchased on 11/1/20x2) 3,200 9,500 4,500 What amount of cash and cash equivalents will Pearsall Company report on its 12/31/X2 balance sheet? Multiple Choice $20,620 $7.920 $6,620 $11,120 The Hepburn Company uses the LIFO retail method to estimate ending inventory. Data relating to Hepburn's inventory for the year ended December 31, 20x2 is as follows: Retail Cost $ 68,000 332,290 Beginning inventory Net purchases Net markups Net markdowns Net sales $111,000 490,000 27,000 47,000 438,000 Calculate Hepburn's current period cost-to-retail percentage. Pearsall Company has a December 31st year end. The following are selectd items listed in the 12/31/2 trial balance for Pearsall Company $ 620 1,700 1,100 Currency and coins Balance in various checking accounts customer checks received but not yet deposited (not included in the above balance in checking accounts) Short-term liquid investment that matures on 4/30/3 (purchased on 11/1/20x2) Marketable equity securities (these are investments in the stock of other corporations) Commercial paper that matures on 1/31/X3 (purchased on 11/1/20x2) 3,200 9,500 4,500 What amount of cash and cash equivalents will Pearsall Company report on its 12/31/X2 balance sheet? Multiple Choice $20,620 $7.920 $6,620 $11,120