ONLY SOLVE A & B . Follow the special instructions , & please show excel formulas used. Double check work before uploading.. This is my 3rd time posting Chegg does not take excel pdf files must upload by screenshot or picture .

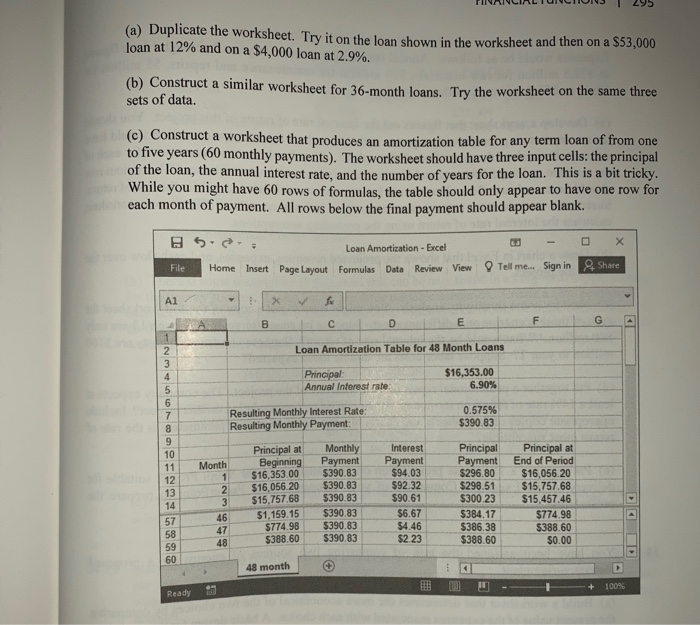

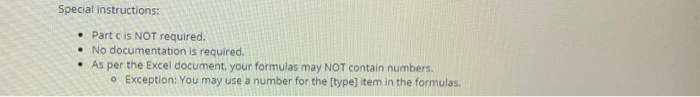

14-12. A loan amortization table shows the effect of each payment on the amount of principal still owed. A worksheet for constructing loan amortization tables for 48-month loans is shown below. The worksheet has two input cells: (1) the principal of the loan (the original amount borrowed) and (2) the annual interest rate. All other numbers in the worksheet are calculated. Changing either or both of these input numbers will create a new amortization table. Note that in the table, the amount of interest owed each month is the monthly interest rate times the amount of the principal still owed at the beginning of the month. The amount of the payment that goes to reducing the principal is the amount of the payment that is left over. If all of the calculations are correct, then the principal owed at the end of the forty-eighth month should be 0. (a) Duplicate the worksheet. Try it on the loan shown in the worksheet and then on a $53,000 loan at 12% and on a $4,000 loan at 2.9%. (b) Construct a similar worksheet for 36-month loans. Try the worksheet on the same three sets of data. (c) Construct a worksheet that produces an amortization table for any term loan of from one to five years (60 monthly payments). The worksheet should have three input cells: the principal of the loan, the annual interest rate, and the number of years for the loan. This is a bit tricky. While you might have 60 rows of formulas, the table should only appear to have one row for each month of payment. All rows below the final payment should appear blank. 5 Loan Amortization - Excel Home Insert Page Layout Formulas Data Review View Tell me.. Sign in 8. Share File > A1 > B D G E F 1 Loan Amortization Table for 48 Month Loans Principal Annual Interest rate $16,353.00 6.90% 2 3 4 5 6 7 8 9 10 11 12 13 14 0.575% $390.83 Resulting Monthly Interest Rate: Resulting Monthly Payment: Month 1 Principal at Beginning $16,353.00 $16,056 20 $15,757.68 $1,159.15 $774.98 $388.60 2 3 46 47 48 Monthly Payment $390.83 $390.83 $390.83 $390.83 $390.83 $390.83 Interest Payment $94.03 $92.32 $90.61 $6.67 $4.46 $2.23 Principal Payment $296.80 $298.51 $300.23 $384.17 $386.38 $388.60 Principal at End of Period $16,056.20 $15,757.68 $15,457,46 $774.98 $388.60 $0.00 57 58 59 60 . 48 month + HIE + 100% Ready Special instructions: Partc is NOT required. No documentation is required. As per the Excel document, your formulas may NOT contain numbers. Exception: You may use a number for the [type] item in the formulas