64.Using only freeze k score for the year ended 31 dec 20x7, assess whether Freeze is at risk of corporate failur. Solve PART B

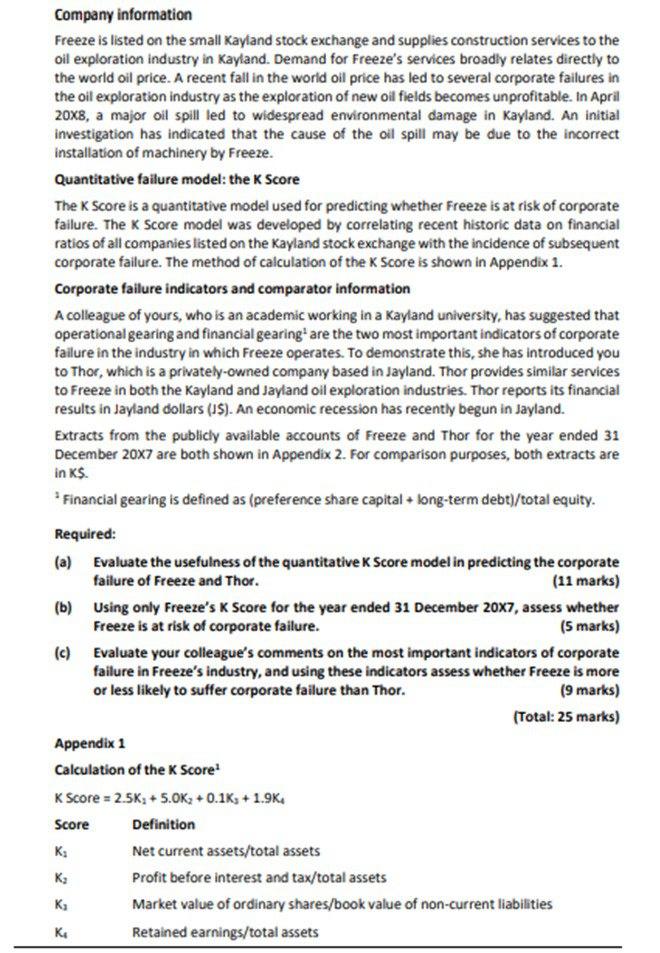

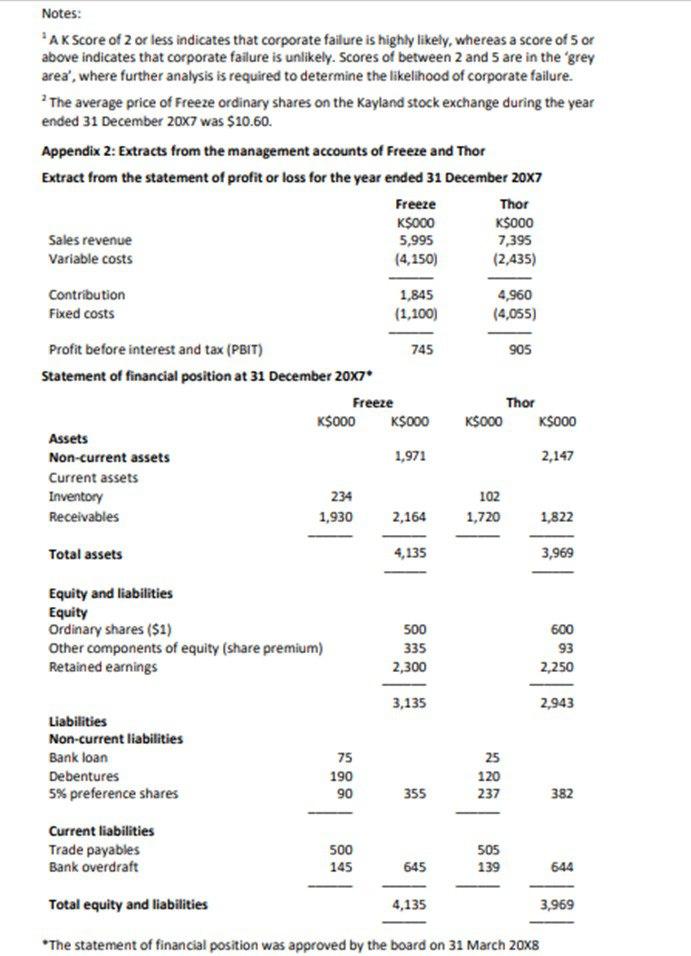

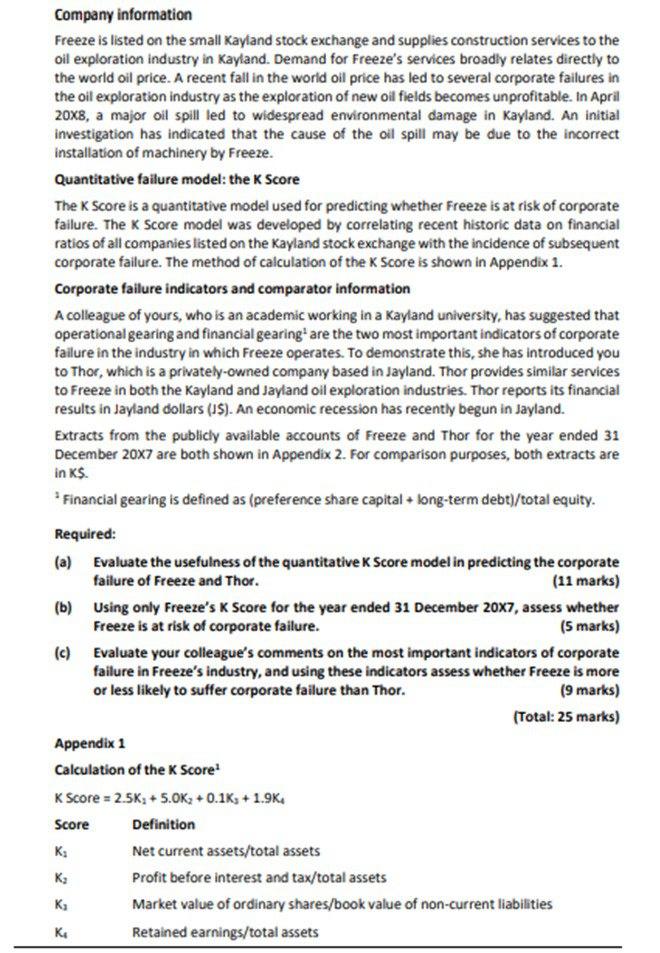

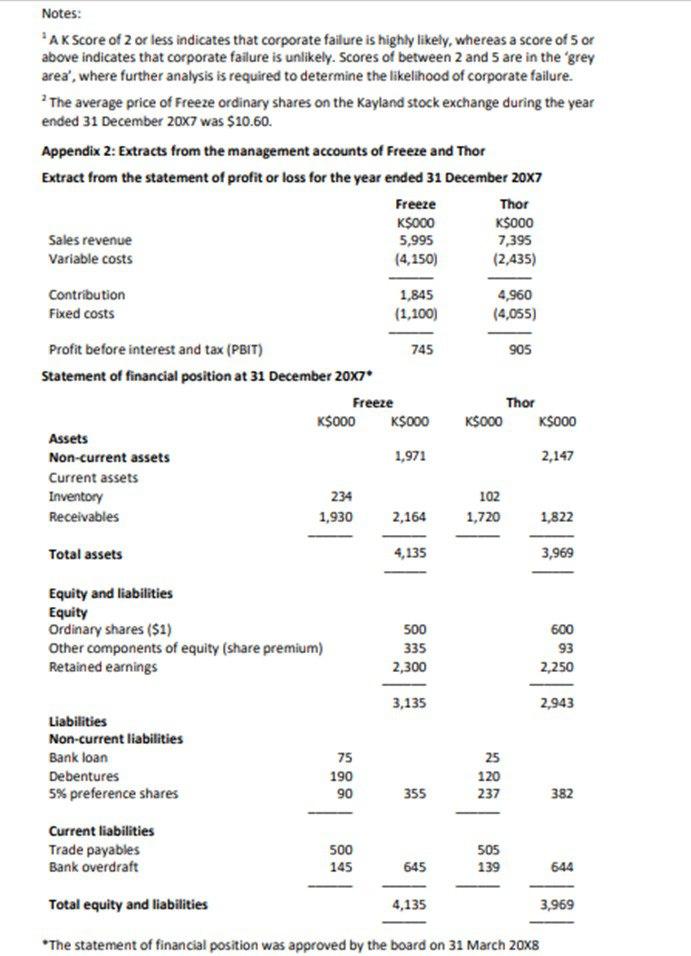

Freeze is listed on the small Kayland stock exchange and supplies construction services to the oil exploration industry in Kayland. Demand for Freeze's services broadly relates directly to the world oil price. A recent fall in the world oil price has led to several corporate failures in the oil exploration industry as the exploration of new oil fields becomes unprofitable. In April 20x8, a major oil spill led to widespread environmental damage in Kayland. An initial investigation has indicated that the cause of the oil spill may be due to the incorrect installation of machinery by Freeze. Quantitative failure model: the K Score The K Score is a quantitative model used for predicting whether Freeze is at risk of corporate failure. The K Score model was developed by correlating recent historic data on financial ratios of all companies listed on the Kayland stock exchange with the incidence of subsequent corporate failure. The method of calculation of the K Score is shown in Appendix 1. Corporate failure indicators and comparator information A colleague of yours, who is an academic working in a Kayland university, has suggested that operational gearing and financial gearing 1 are the two most important indicators of corporate failure in the industry in which Freeze operates. To demonstrate this, she has introduced you to Thor, which is a privately-owned company based in Jayland. Thor provides similar services to Freeze in both the Kayland and Jayland oil exploration industries. Thor reports its financial results in Jayland dollars (J\$). An economic recession has recently begun in Jayland. Extracts from the publicly available accounts of Freeze and Thor for the year ended 31 December 20x7 are both shown in Appendix 2. For comparison purposes, both extracts are in KS. 2 Financial gearing is defined as (preference share capital + long-term debt)/total equity. Required: (a) Evaluate the usefulness of the quantitative K Score model in predicting the corporate failure of Freeze and Thor. (11 marks) (b) Using only Freeze's K Score for the year ended 31 December 20X7, assess whether Freeze is at risk of corporate failure. (5 marks) (c) Evaluate your colleague's comments on the most important indicators of corporate failure in Freeze's industry, and using these indicators assess whether Freeze is more or less likely to suffer corporate failure than Thor. (9 marks) (Total: 25 marks) Appendix 1 Calculation of the K Score 2 KScore=2.5K1+5.0K2+0.1Ks+1.9Ka Notes: 2AK Score of 2 or less indicates that corporate failure is highly likely, whereas a score of 5 or above indicates that corporate failure is unlikely. Scores of between 2 and 5 are in the 'grey area', where further analysis is required to determine the likelihood of corporate failure. 2 The average price of Freeze ordinary shares on the Kayland stock exchange during the year ended 31 December 207 was $10.60. Appendix 2: Extracts from the management accounts of Freeze and Thor Extract from the statement of profit or loss for the year ended 31 December 20X7 Statement of financial position at 31 December 207 'The statement of financial position was approved by the baard on 31 March 208