Answered step by step

Verified Expert Solution

Question

1 Approved Answer

66 ts eBook Print eferences DATE TRANSACTIONS October 1 Shonna Pumphrey invested $59,000 cash in the business. October 2 Paid October office rent of $2,950;

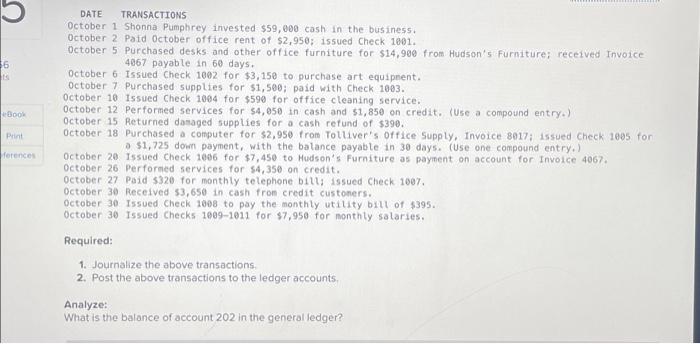

66 ts eBook Print eferences DATE TRANSACTIONS October 1 Shonna Pumphrey invested $59,000 cash in the business. October 2 Paid October office rent of $2,950; issued Check 1001. October 5 Purchased desks and other office furniture for $14,900 from Hudson's Furniture; received Invoice 4067 payable in 60 days. October 6 Issued Check 1002 for $3,150 to purchase art equipment. October 7 Purchased supplies for $1,500; paid with Check 1003. October 10 Issued Check 1004 for $590 for office cleaning service. October 12 Performed services for $4,050 in cash and $1,850 on credit. (Use a compound entry.) October 15 Returned damaged supplies for a cash refund of $390. October 18 Purchased a computer for $2,950 from Tolliver's Office Supply, Invoice 8017; issued Check 1005 for a $1,725 down payment, with the balance payable in 30 days. (Use one compound entry.) October 20 Issued Check 1006 for $7,450 to Hudson's Furniture as payment on account for Invoice 4067. October 26 Performed services for $4,350 on credit. October 27 Paid $320 for monthly telephone bill; issued Check 1007. October 30 Received $3,650 in cash from credit customers. October 30 Issued Check 1008 to pay the monthly utility bill of $395. October 30 Issued Checks 1009-1011 for $7,950 for monthly salaries. Required: 1. Journalize the above transactions. 2. Post the above transactions to the ledger accounts. Analyze: What is the balance of account 202 in the general ledger?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started