Answered step by step

Verified Expert Solution

Question

1 Approved Answer

67 & 68 practice test inventory is 500 units, the beginning inventory is 300 units, the number of units set forth in the production budget,

67 & 68 practice test

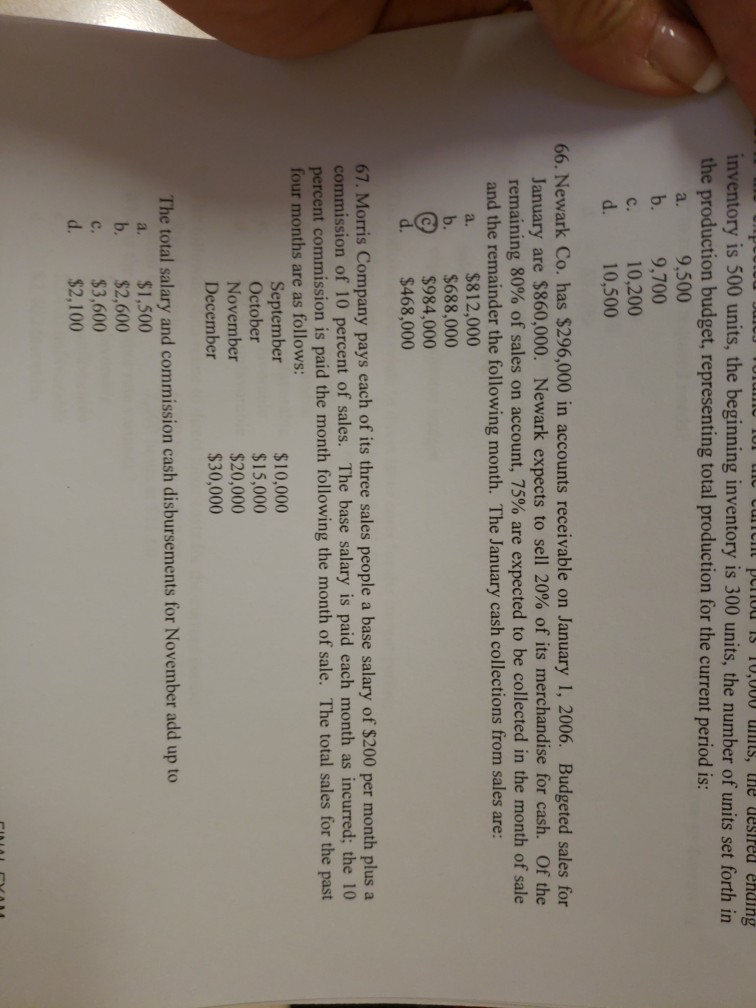

inventory is 500 units, the beginning inventory is 300 units, the number of units set forth in the production budget, representing total production for the current period is a. 9,500 b. 9,700 c. 10,200 d. 10,500 66. Newark Co. has $296,000 in accounts receivable on January 1, 2006. Budgeted sales for January are $860,000. Newark expects to sell 20% of its merchandise for cash. Of the remaining 80% of sales on account, 75% are expected to be collected in the month of sale and the remainder the following month. The January cash collections from sales are: a. $812,000 b. $688,000 $984,000 d. $468,000 67. Morris Company pays each of its three sales people a base salary of $200 per month plus a commission of 10 percent of sales. The base salary is paid each month as incurred; the 10 percent commission is paid the month following the month of sale. The total sales for the past four months are as follows September October November December $10,000 $15,000 $20,000 $30,000 The total salary and commission cash disbursements for November add up to a. $1,500 b. $2,600 c. $3,600 d. $2,100Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started