Answered step by step

Verified Expert Solution

Question

1 Approved Answer

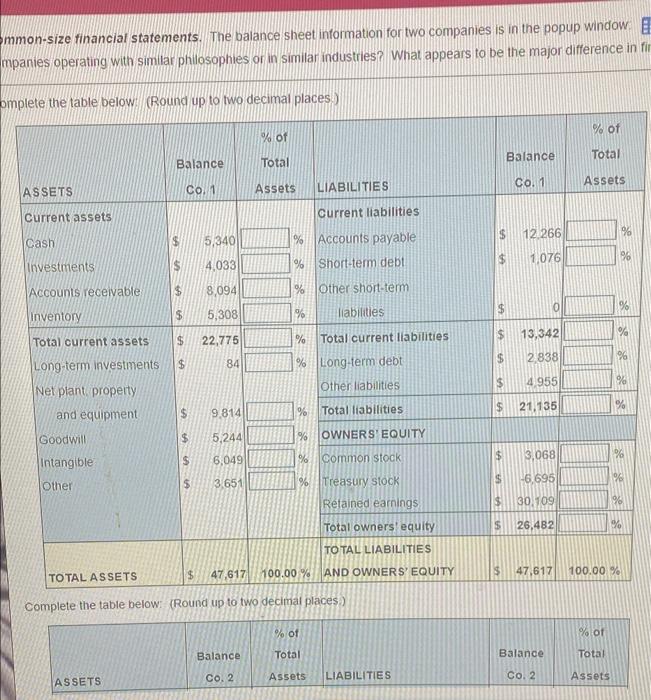

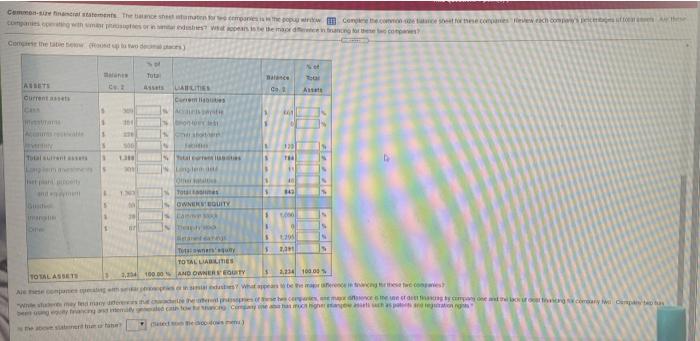

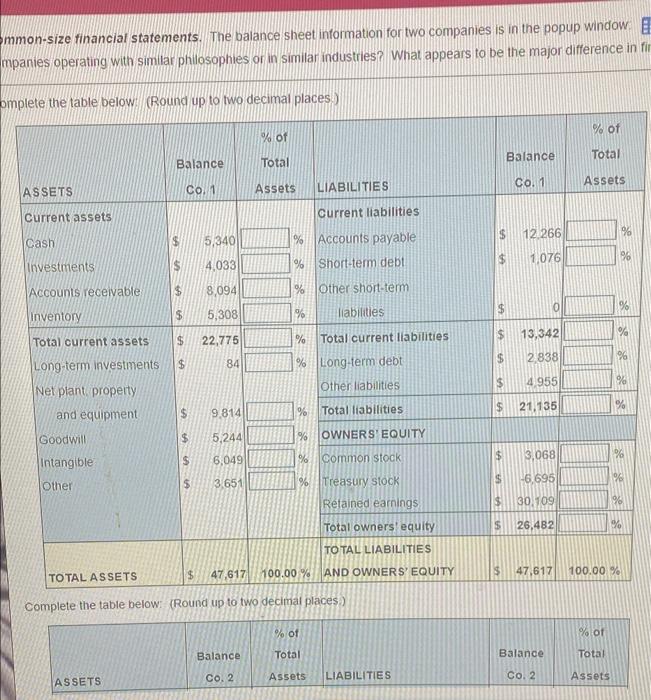

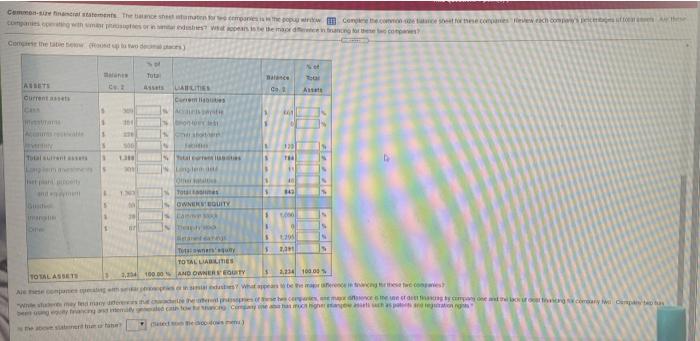

6-8 14 mmon-size financial statements. The balance sheet information for two companies is in the popup window mpanies operating with similar philosophies or in similar

6-8 14

mmon-size financial statements. The balance sheet information for two companies is in the popup window mpanies operating with similar philosophies or in similar industries? What appears to be the major difference in fir omplete the table below (Round up to two decimal places) % of % of Balance Total Balance Total Assets ASSETS CO, 1 Co 1 Assets LIABILITIES Current assets current liabilities 121266 10 S 5,340 % Accounts payable cash investments $ $ 90 4,033 1,076 % Short-term debt Accounts receivable $ 8,094 % other short-term $ 9 $ Inventory $ % 5,308 liabilities $ 13,342 Total current assets $ 22,775 $ 2 838 %6 Long-term investments % Total current liabilities % Long-term debt Other liabilities $ 84 $ 4955 Net plant property and equipment % h. 21.135 %% $ 9,814 Total liabilities Goodwill $ 5,244 % OWNERS' EQUITY % $ % 6,049 Intangible 3,068 common stock $ $ S Other 3.651 % Treasury Stock -6.695 Retained earnings 30.109 90 % $ $ Total owners' equity 26.482 % TOTAL LIABILITIES $ 47,617 TOTAL ASSETS 100.00% AND OWNERS' EQUITY VA 47,617 100,00 % Complete the table below (Round up to two decimal places % of % of Balance Total Balance Total Co. 2 Assets LIABILITIES CO. 2 ASSETS Assets Gemma hicient. The beach other companies in the companie tecnico nese come even each cow Cowhow is the morning for Come theaters WE Tota sas LILITIES Cat ARTI Current A 1 BE 1 1 00 13 Tutti 1 S . 10 Tot 111 OWNERSULITY DE 1 $ To 5 TOTAL LIABILITIES TOTAL ASSETS 1,400.00 AND OWNERVEOTY 1,234 100.00 Alencontres de pan with these two We meeste waarom one back on the way I Campo med

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started