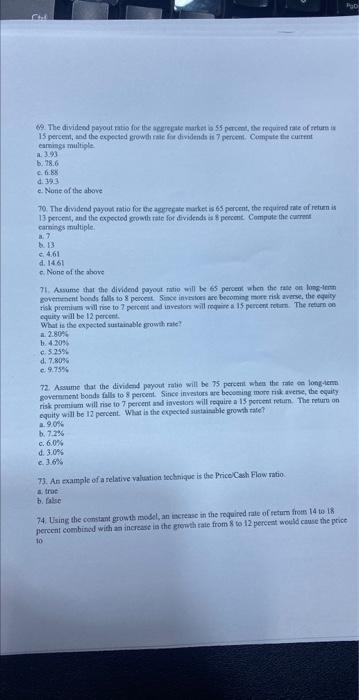

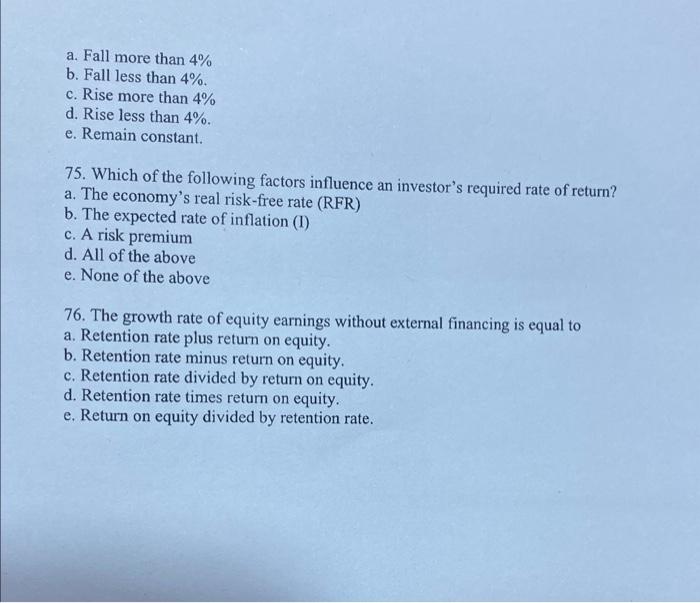

69. The divided poyout ratio for the aceregate makket is 55 percent, the requand rate of scturn is 15 percent, and the expectsd growthrale fint dividends is 7 percem. Compate fle cuirrnt earmints multicle a. 3.93 b. 78.6 c. 6.88 d. 393. e. None of the above 70. The divadend payodl ratio for the agyefare market is 65 percent, the sequired rate of retien is 13 percent, and the expectod eroath raie for tividendi a 5 percent. Compute the current camiegs multiple. a. 3 b. 13 \&. 4.61 d. 146 ! c. None of the ahove 71. Asunee that the dividend payout natio will be &5 percent ahen the tate ont lasg-irrin govennaent boeds falls to 8 pervent- Since inveloes are becoming murt risk averse, the oquity risk premiums will rise to ? portent and investon will redaice a 15 percent retirn. The ream os equiry will be 12 perest. What is the expeted autainable growth raic? a. 2.80% b. 4208 c. 525% d. 7.8085 c. 9.75% 72. Assume that the divilend pryout rabo will be 75 percent nhes the rale en longuent government boods falls to 5 percent. Since inveators are becoeting mote risk averne, the equity. risk permium will rise to 7 percent and investon will rpquire a 15 poreent retam. The return on equity will be 12 percent. What is the copected rustaisable growth tate? a. 9.8ck b. 7.226 c. 6.025 d. 3.08 c. 3.6% 73. An example of a relative yaluation techinique is the PricolCash Flow ratio a trat b. False 74. Using the constant grow1b mobel, an iscreasc in the required rale of setum fross 14 to 18 jercent coenbincd with aa increase is the gromth rate from 8 to 12 percent would cause the prise 10 a. Fall more than 4% b. Fall less than 4%. c. Rise more than 4% d. Rise less than 4%. e. Remain constant. 75. Which of the following factors influence an investor's required rate of return? a. The economy's real risk-free rate (RFR) b. The expected rate of inflation (I) c. A risk premium d. All of the above e. None of the above 76. The growth rate of equity earnings without external financing is equal to a. Retention rate plus return on equity. b. Retention rate minus return on equity. c. Retention rate divided by return on equity. d. Retention rate times return on equity. e. Return on equity divided by retention rate