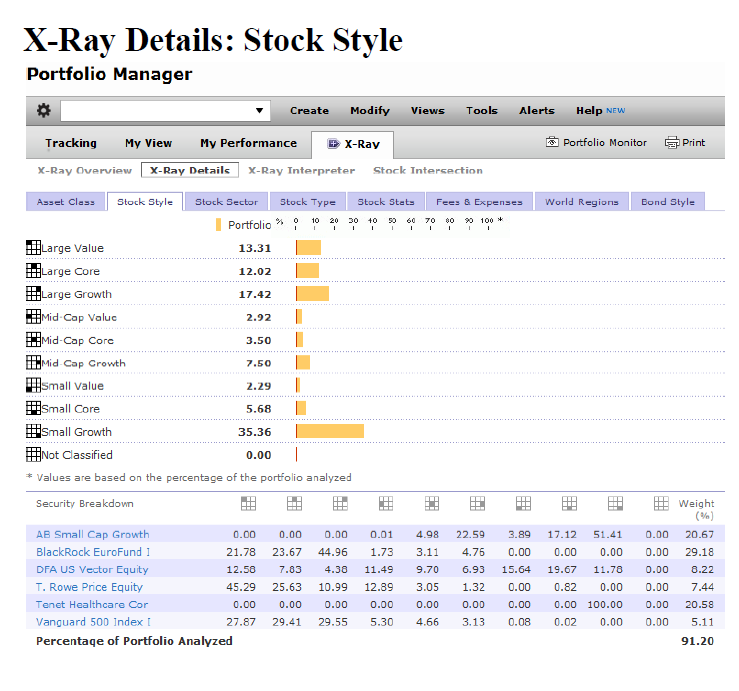

6.The last part of the analysis is the Stock Analysis.a.Based on information oftheX-Ray Interpreter section(located in the supplemental document titled: Documents for the Case Study, compare the current Stock Allocation with the Wilshire 5000 (an index fund of stocks).Looking at the StockStyleDiversification, which asset class is heavily overweighed? b.In the Stock Sectorareaof the X-Ray Overview Cont., you will find the information regarding the stock sectors that your friend investsin.What are the three main sectors that stocks are categorized in. In which sectors is the portfoliooverweighed and under-weighed?What are some implications of the current allocations? Remember to cite your sources.

X-Ray Details: Stock Style Portfolio Manager Create Modify Views Tools Alerts Help NEW Portfolio Monitor 9 Print Tracking My View My Performance X-Ray X-Ray Overview X-Ray Details X-Ray Interpreter Stock Intersection Asset Class Stock Style Stock Sector Stock Type Stock Stats Fees & Expenses World Regions Bond Style 10 1 20 Portfolio 30 40 50 60 70 1 80 90 100 Large Value 13.31 HPLarge Core 12.02 #Large Growth 17.42 Mid-Cap Value 2.92 1 Mid-Cap Core 3.50 H.Mid Cap Crowth 7.50 lismall value 2.29 Small Core 5.68 Small Growth 35.36 Not Classified 0.00 1 * Values are based on the percentage of the portfolio analyzed Security Breakdown BIE ! HH CE BB HH E HH 0.00 0.01 22.59 3.89 AB Small Cap Growth 0.00 BlackRock EuroFund 1 21.78 DFA US Vector Equity 12.58 T. Rowe Price Equity 45.29 Tenet Healthcare Cor 0.00 Vanguard 500 Index I 27.87 Percentage of Portfolio Analyzed 0.00 23.67 7.83 25.63 0.00 29.41 44.96 4.38 10.99 4.76 6.93 4.98 3.11 9.70 3.05 0.00 Weight (%) 20.67 29.18 8.22 7.44 1.73 11.49 12.89 0.00 5.30 17.12 51.41 0.00 0.00 19.67 11.78 0.82 0.00 0.00 100.00 0.02 0.00 0.00 15.64 0.00 0.00 0.00 0.00 0.00 0.00 0.00 29.55 1.32 0.00 3.13 0.00 0.08 20.58 5.11 4.66 0.00 91.20 X-Ray Details: Stock Style Portfolio Manager Create Modify Views Tools Alerts Help NEW Portfolio Monitor 9 Print Tracking My View My Performance X-Ray X-Ray Overview X-Ray Details X-Ray Interpreter Stock Intersection Asset Class Stock Style Stock Sector Stock Type Stock Stats Fees & Expenses World Regions Bond Style 10 1 20 Portfolio 30 40 50 60 70 1 80 90 100 Large Value 13.31 HPLarge Core 12.02 #Large Growth 17.42 Mid-Cap Value 2.92 1 Mid-Cap Core 3.50 H.Mid Cap Crowth 7.50 lismall value 2.29 Small Core 5.68 Small Growth 35.36 Not Classified 0.00 1 * Values are based on the percentage of the portfolio analyzed Security Breakdown BIE ! HH CE BB HH E HH 0.00 0.01 22.59 3.89 AB Small Cap Growth 0.00 BlackRock EuroFund 1 21.78 DFA US Vector Equity 12.58 T. Rowe Price Equity 45.29 Tenet Healthcare Cor 0.00 Vanguard 500 Index I 27.87 Percentage of Portfolio Analyzed 0.00 23.67 7.83 25.63 0.00 29.41 44.96 4.38 10.99 4.76 6.93 4.98 3.11 9.70 3.05 0.00 Weight (%) 20.67 29.18 8.22 7.44 1.73 11.49 12.89 0.00 5.30 17.12 51.41 0.00 0.00 19.67 11.78 0.82 0.00 0.00 100.00 0.02 0.00 0.00 15.64 0.00 0.00 0.00 0.00 0.00 0.00 0.00 29.55 1.32 0.00 3.13 0.00 0.08 20.58 5.11 4.66 0.00 91.20