Question

6.When working capital is positive, the current ratio is: a.Less than 1 b.1 c.Greater than 1 d.Zero e.None of the above 7.A weakness of the

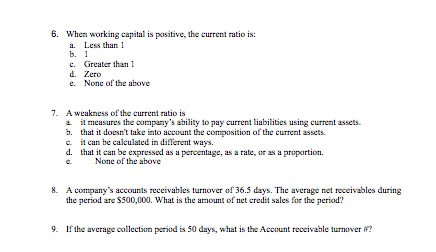

6.When working capital is positive, the current ratio is: a.Less than 1 b.1 c.Greater than 1 d.Zero e.None of the above

7.A weakness of the current ratio is a. it measures the companys ability to pay current liabilities using current assets. b. that it doesn't take into account the composition of the current assets. c. it can be calculated in different ways. d. that it can be expressed as a percentage, as a rate, or as a proportion. e.None of the above

8.A companys accounts receivables turnover of 36.5 days. The average net receivables during the period are $500,000. What is the amount of net credit sales for the period?

9.If the average collection period is 50 days, what is the Account receivable turnover #?

6. When working capital is positive, the current ratio is: a. Less than 1 e. Greater than ! d. Zero e. None of the above 7. A weakness of the current ratio is a it measures the company's ability to pay current liabilities using current assets b. that it doesn't take into account the composition of the current assets. c. it can be calculated in different ways. d. that it can be expressed as a percentage, as a rate, or as a proportion. None of the above 8. A company's accounts receivables turnover of 36,5 days. The average not receivables during the period are $500,000. What is the amount of net credit sales for the period? 9. If the average collection period is 50 days, what is the Account receivable turnoverStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started